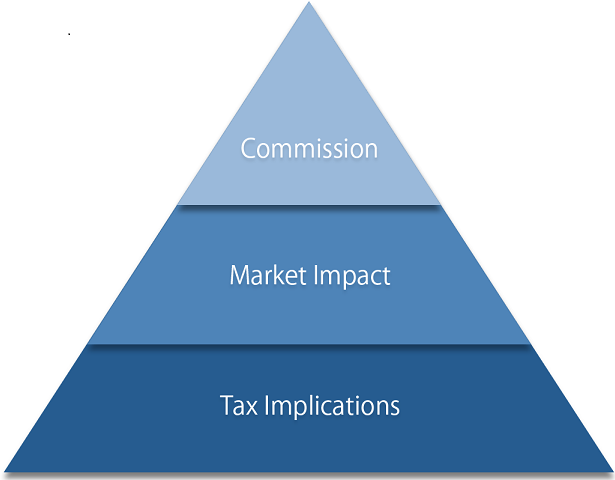

Transaction cost analysis can have a large impact of portfolio performance.

Our proprietary software incorporates all three levels of the transactional cost pyramid when making our trading decisions.

Most people tend to focus on commissions when they think about transaction cost, but commissions turn out to have a small impact relative to other costs.

1) Tax Impact

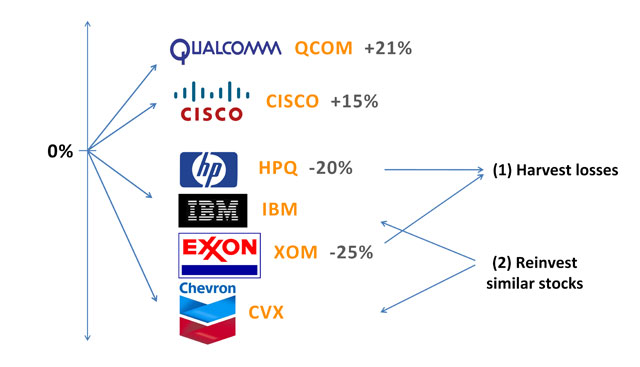

In order to offset capital gains and/or up to $3000 of ordinary income, Atlas Capital will overlay a tax loss harvesting strategy on each account depending on client circumstance. This is the unique benefit of utilizing separately managed accounts over commingled investment structures (ETFs or mutual funds). Separately managed accounts allow us to sell an individual security once it falls below a certain threshold and replace it with a similar security with a new cost basis. While the loss is realized for tax purposes, the performance of the portfolio is not dramatically affected.

Transaction cost analysis strategy is most effective in the first few years of a portfolio’s existence. As the portfolio ages, the potential for tax loss harvesting is decreased as the cost basis for the existing positions becomes lower and lower as compared to market prices.

2) Market Impact

This is merely a function of how wide the ‘bid/offer’ is on a particular security and how large of a position one needs to trade relative the volume offered at the bid or offer. Our relatively small asset size combined with the utilization of algorithmic trading techniques can significantly reduce the overall amount of market impact costs. Nonetheless, market impact cost are incorporated in every trading decision.

3) Commissions

Atlas will utilize a variety of custodians and brokers on behalf of our clients. For clients who invest in strategies with higher turnover, we can 1) utilize discount brokers who are the cutting edge of reduced commissions or 2) enter into asset-based pricing agreements with popular custodians like Schwab and Fidelity in which clients are charged an annual fee for unlimited transactions instead of per trade commissions.