Atlas operates as a registered investment advisor and fees are charged on invested assets without the return-sharing typical of hedge funds or the layering of costs typical of fund of funds, investment brokerage firms and insurance companies.

There have been numerous academic studies quantifying how the layering of fees adversely affects client returns. Two of our favorites were produced by MIT professor Mark Kritzman and Vanguard Funds research group. Kritzman compared the hypothetical returns over a 20-year period of index equity funds, actively managed equity funds, and hedge funds – adjusting for fees, other costs, and taxes. He found that in order to break even with an index fund after expenses, actively managed funds would need to produce an annualized alpha of 4.3%, while a typical hedge fund would need to produce an annualized alpha of 10%.

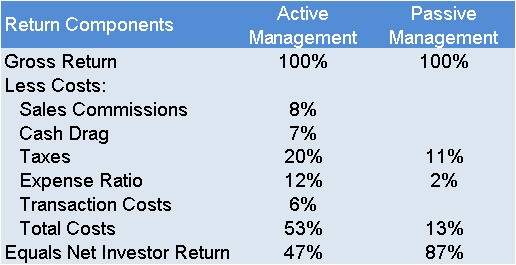

A 15-year study conducted by Vanguard Funds revealed the silent, but costly, impact of fees and expenses. Bogle concluded that the average equity fund investor only kept 47% of their cumulative returns while an index fund investor retained 87% of their cumulative returns.