Short-term cash investments are a safe choice for investors. But the safety comes at a cost. Investors can maintain safety while having a very high probability of higher investment returns through investing at a fixed rate for two years instead of investing in three-month cash. This is because fixed income investors routinely overestimate what short-term cash rates will be in the future.

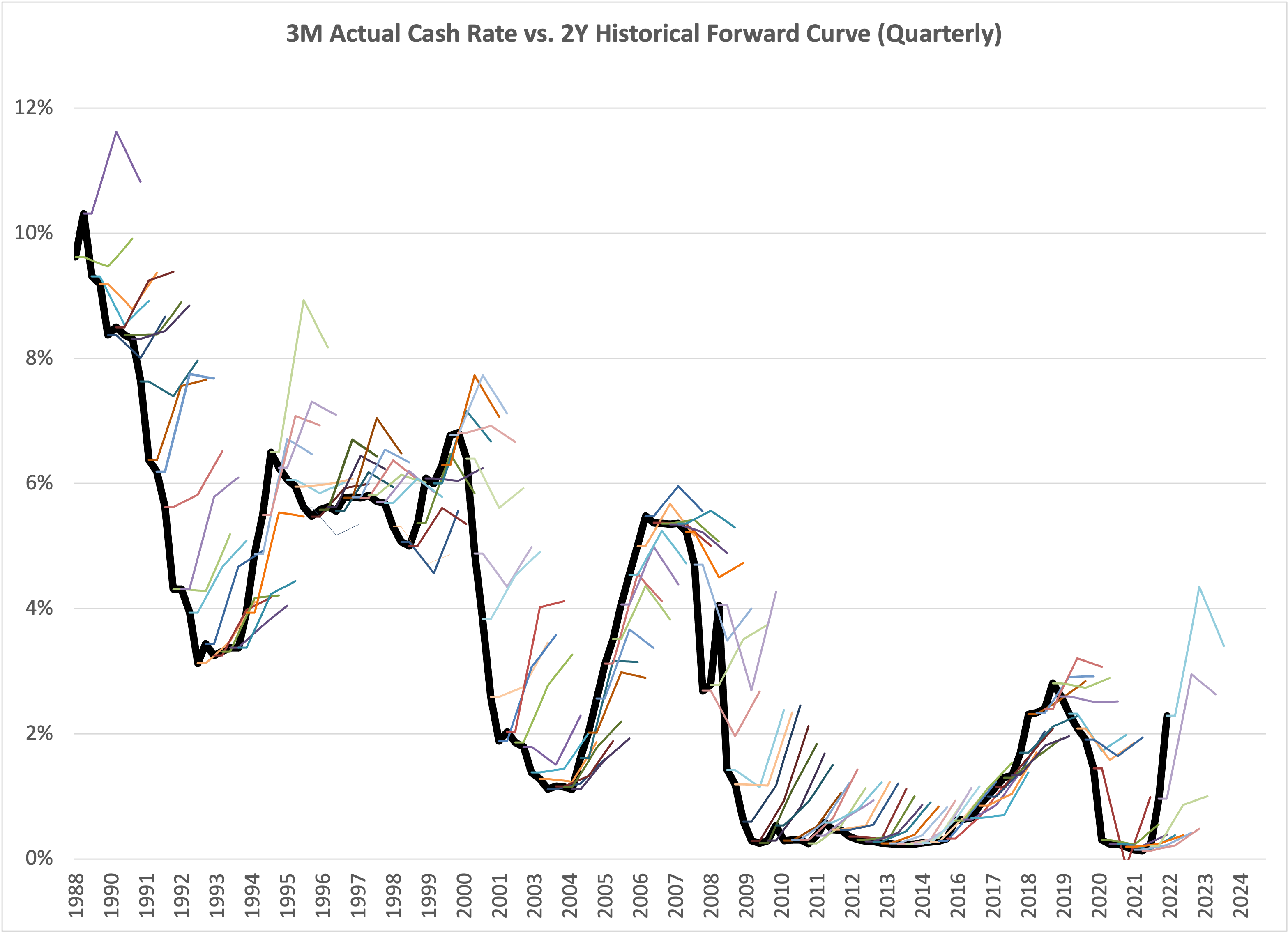

The solid black line in the chart above[1] shows three-month cash rates from 1988 through June 2022, as represented by LIBOR[2]. The many “hairs” to the right of the solid black line represent the forward rates – investor expectations for what three-month rates would be over the following two years from that date. For instance, the last date for the solid black line is June 2022, when the three-month rate was 2.29%. At that time, fixed income investors expected that three-month rates would be rising to about 4% in the future and then fall, as indicated by the light blue hair on the right of the chart.

When investors guessed correctly, the hairs and the solid black lines were on top of one another, but that rarely happened. The chart indicates that investors usually expected higher rates than occurred – the hairs generally lie above the solid black line in the chart.

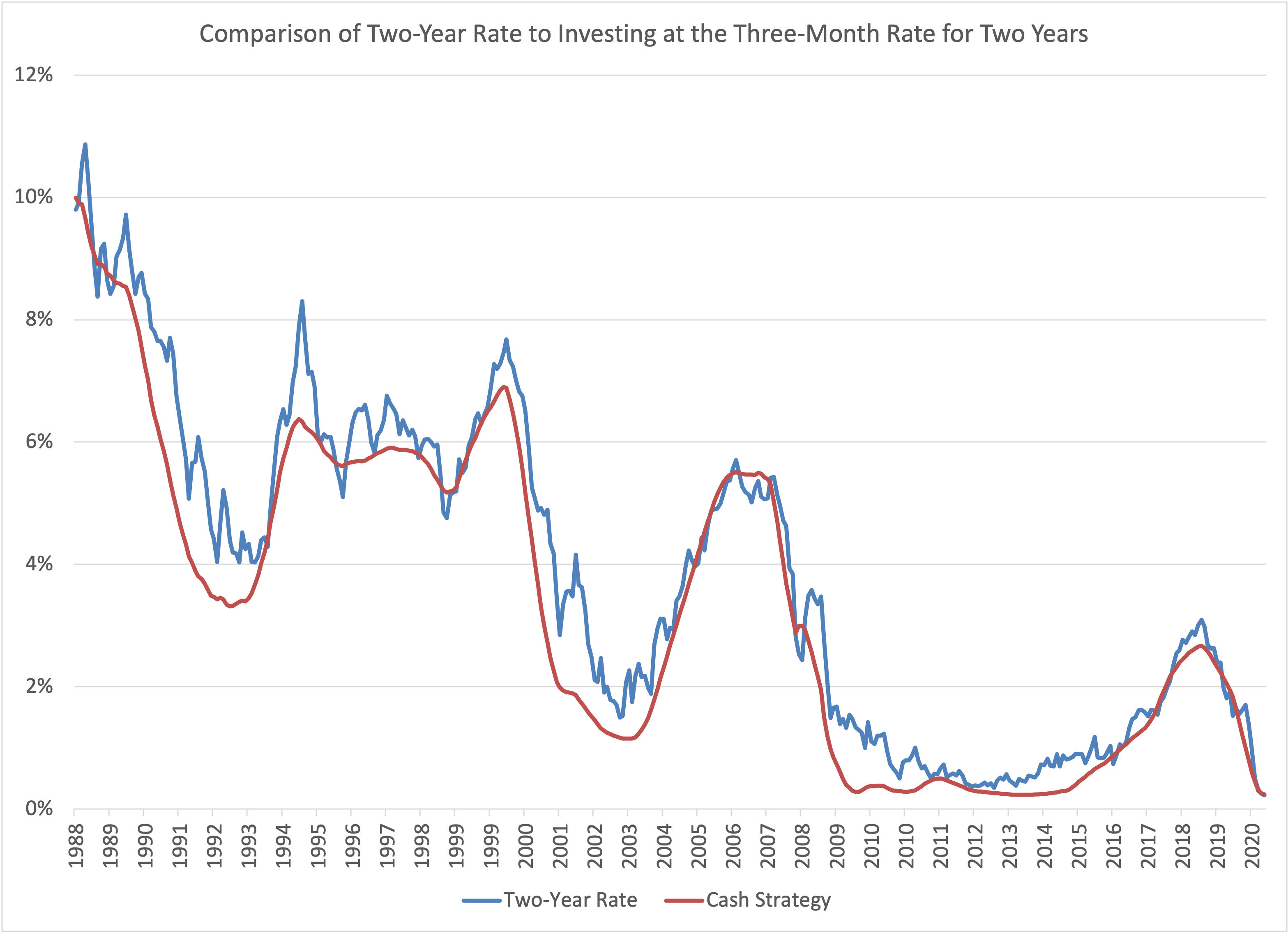

Because expectations for future interest rates typically err on the high side, a fixed-income investor can benefit from capturing these high expectations. Since 1988, investors who invested for two years at a fixed rate generally had higher returns than investors who chose a series of three-month investments. The blue line in the chart below is the two-year interest rate. The red line is the outcome that could have been obtained from investing in three-month cash every three months for two years.

It is evident that the two-year strategy would usually have come out ahead of the cash strategy (blue line above red line). In fact, the two-year strategy had a better outcome than the cash strategy more than 80% of the time. On average, the two-year strategy generated 0.5% per year of additional interest income relative to the cash strategy.

Inflation in the US and elsewhere is quite high now – higher than at any other time since the early 1980’s. This has led the Federal Reserve to increase short-term US interest rates in each meeting since March 2022. Because short-term rates are moving up rapidly and the inflation outlook is quite uncertain, this could be one of the rare occasions in which investors are underestimating future three-month interest rates rather than overestimating. The odds are probably lower than usual that a two-year strategy would have a higher return than cash investing over the next two years. But, once the Federal Reserve indicates it is finished raising rates, we expect the pattern illustrated here would resume. Two-year investments would again be highly likely to have a better outcome than investing in three-month cash, as has been the case for the past thirty years.

[1] Source: Bloomberg

[2] LIBOR means the London Interbank Offer Rate, the rate at which banks in London will loan US dollars to one another. LIBOR has recently been replaced by SOFR, the Secured Overnight Financing Rate.