What’s Discussed

Whether you invest on your own or have a professional advisor, you may seek a straightforward framework for making investment choices. The following three principles are based on academic research, industry data, and the best interest of investors.

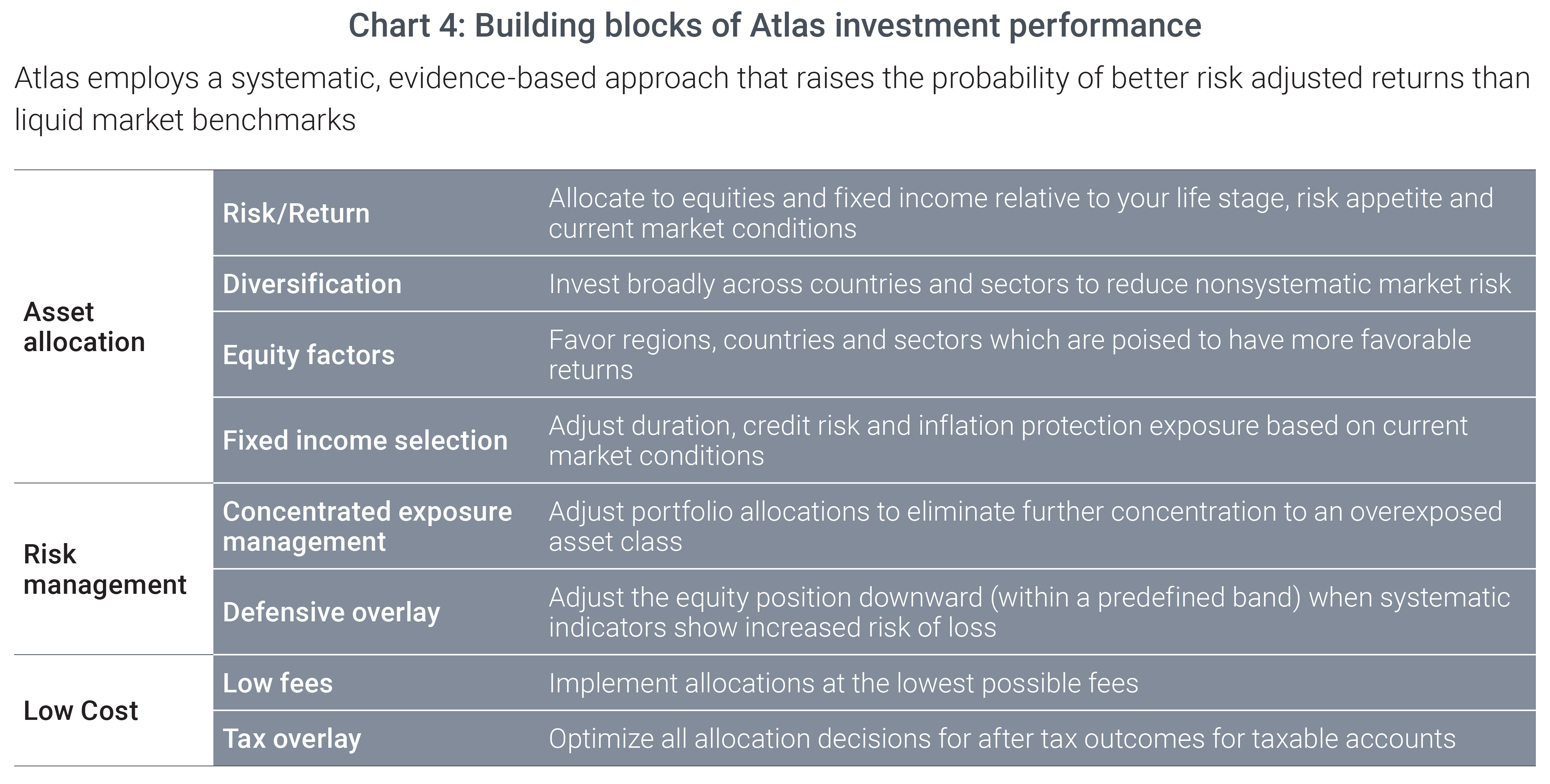

- Prioritize the asset allocation decision. For your total portfolio, what asset classes do you own? Within equities, what is your exposure to regions, countries and sectors? Within fixed income, what is the maturity, credit risk and inflation exposure?

- Manage Risk. Do you have holdings that are concentrated in a stock, industry or country? Is your risk level appropriate for current conditions and your desired return?

- Minimize cost. What are you paying for the mutual funds and alternatives you own? Will the performance of your investment managers cover their fees?

1. Prioritize the asset allocation decision in portfolio construction

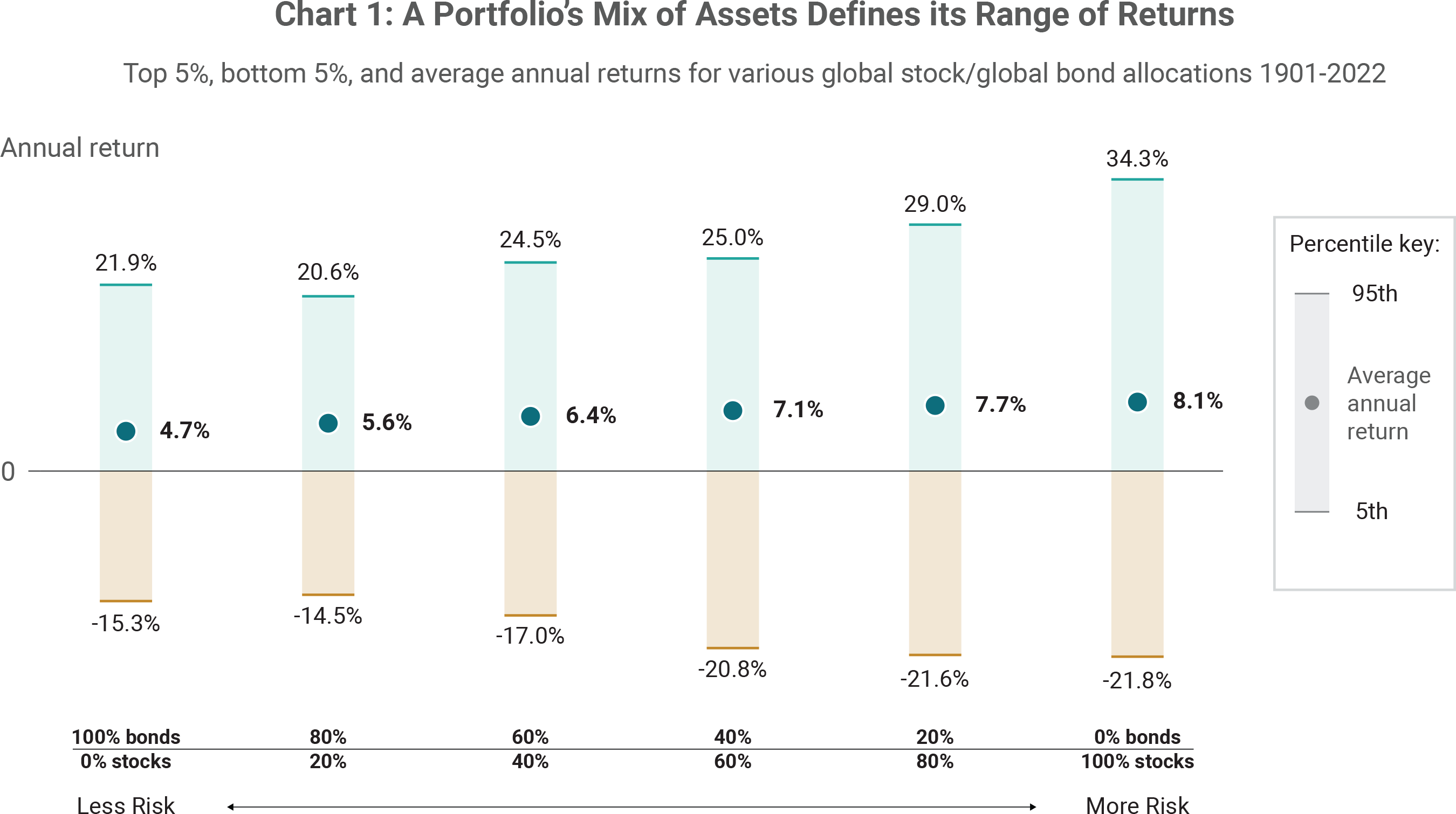

- Determine your goals and risk tolerance. Equities have higher historical performance than bonds and higher risk (see chart 1). Reconsider your equity and bond allocations periodically, as the investment return advantage of equities over bonds varies

- Diversify equities across sectors and countries to reduce the volatility of the equity allocation. Seek diversification as broad as a global equity index, such as the MSCI all country world index

- Apply “factor” weights to your diversified equity portfolio. Certain factors have been demonstrated to outperform traditional cap-weighted indexes over long periods of time. Read more at Factor Investing for Equities.

- Rebalance regularly to stay on your allocation targets as conditions change

- Buy high quality bonds with duration and inflation protection suitable to current market conditions

- Stay disciplined through market highs and lows. Long-term investment horizons have yielded positive results, given enough time

Notes: Data are from Dimson-Marsh-Staunton (DMS) dataset for 1901-2022. Annualized nominal geometric returns are in dark green. The 5th and 95th percentiles are plotted below and above asset mixes. Bar length indicates the range, from 5th to 95th percentile, of annual returns for each allocation; the longer the bar, the larger the variability. The numbers next to each bar represent the average nominal annual returns for that allocation for the 122 years covered.

Sources: Vanguard calculations, using DMS global returns data from Morningstar, Inc. (the DMS World Equity Index and the DMS World Bond Index, both in nominal and real terms).

The dataset includes returns from Australia, Austria, Belgium, Canada, China, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Russia, South Africa, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

2. Manage Risk

- Reduce concentrated holdings. Concentration reduces diversification and increases risk. Even relatively small increases in risk, if not accompanied by a sufficient increase in expected return, lead to surprisingly large decreases in the probability of long-term investment success

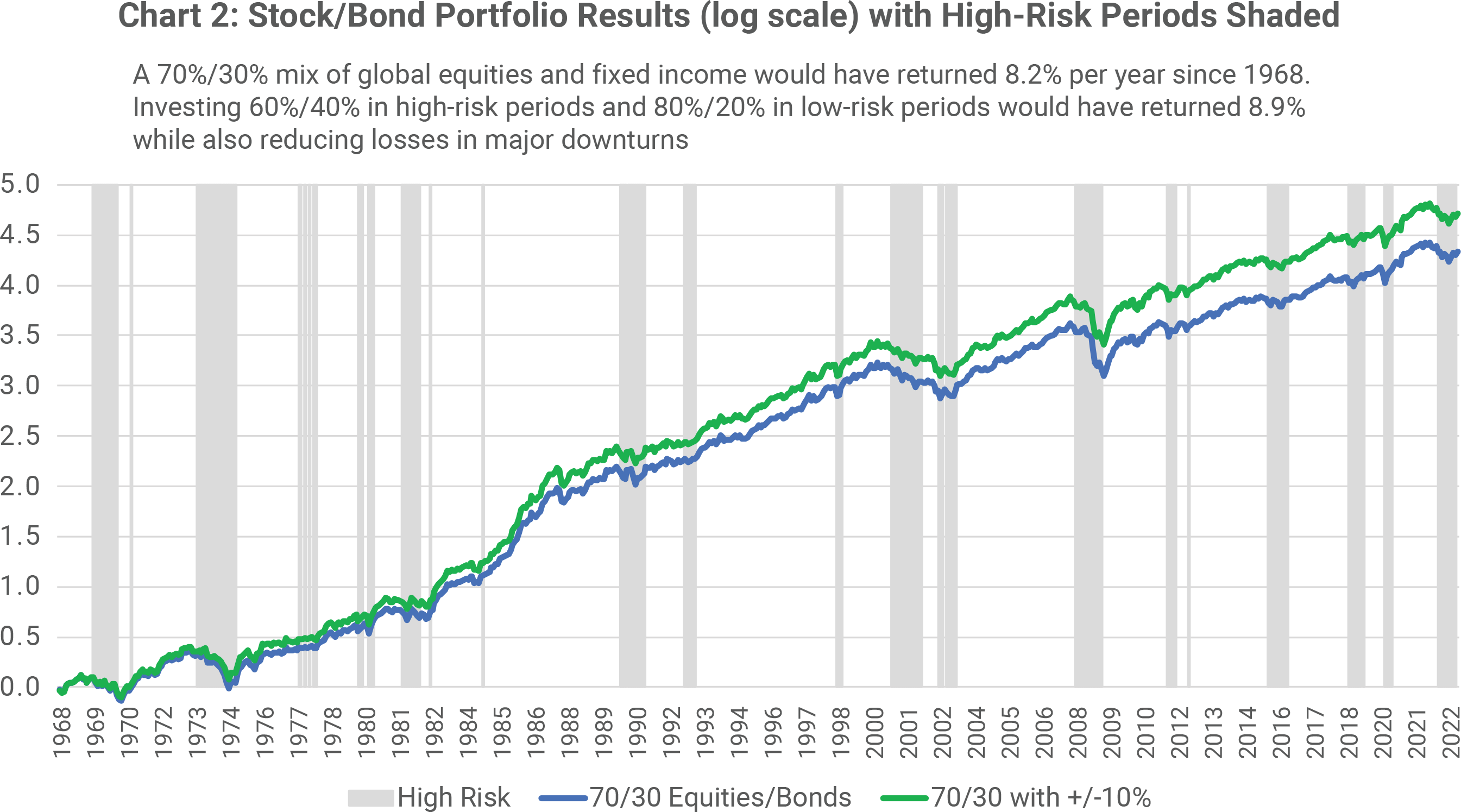

- Apply a defensive overlay when systematic indicators show elevated probability of a large general decline in stock prices. (see chart 2 and read more at Equity Downside Risk Dashboard.)

Source: Atlas Capital Advisors. Chart illustrates hypothetical backtest, please see disclaimer at end.

3. Minimize Cost

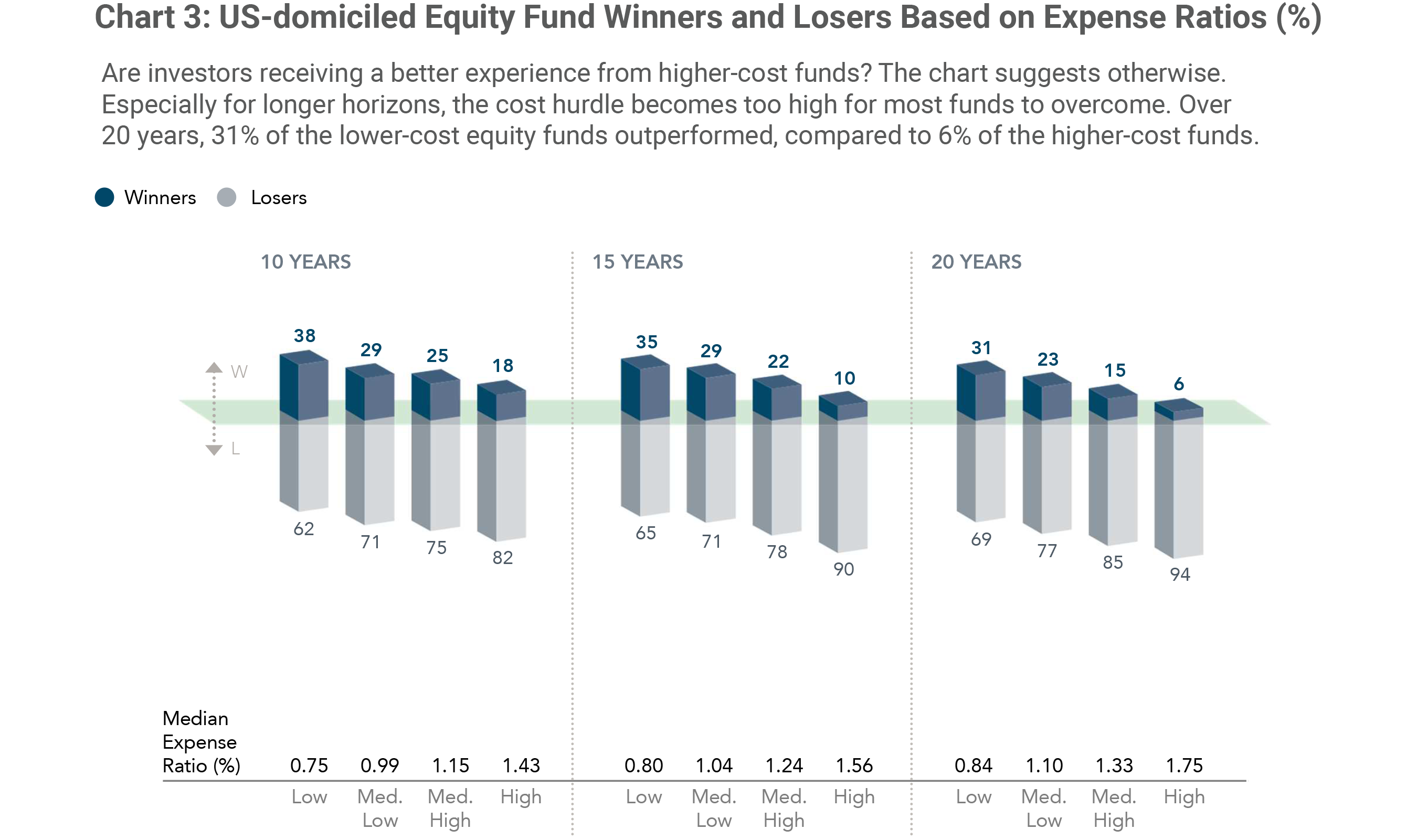

- Seek the lowest implementation cost across the board. Any reduction in implementation costs has a high probability of improving future returns (see chart 3)

- Avoid the high cost of active managers in liquid assets. The odds of any active manager consistently outperforming their relevant benchmark are quite low. Just 18% of U.S.-based active equity mutual funds outperformed their benchmarks between 2004-2023[1]

- Avoid the high fees charged by the alternatives industry. The risk and return profile of private equity and venture capital can be replicated in liquid markets at lower cost

- Seek the lowest cost passive implementation of each asset category. Implement equity allocations with single stocks and ETFs

- Optimize all allocation decisions for after tax outcomes in taxable accounts

Source: Dimensional Fund Advisors. Note: The sample includes funds at the beginning of the 10-, 15-, and 20-year periods ending December 31, 2021. Funds are sorted into quartiles within their category based on average expense ratio during the sample period. The chart shows the percentage of winner and loser funds by expense ratio quartile for each period. Winners are funds that survived and outperformed their benchmark over the period. Losers are funds that either did not survive or did not outperform their respective benchmark.

Atlas Capital in Summary

Atlas Capital was founded by Jono Tunney in 2003 to provide a service encompassing these traits. To provide this service at low cost, Atlas developed its own implementation technology. We do not need to pay an intermediary to aid our implementation. This is unique.

In addition to investment management, Atlas provides long-term solutions to a variety of planning and investment circumstances. We are a fee-only fiduciary who always prioritizes the best interests of our clients. Please contact us to discuss your financial situation.

Do you know someone needing the services of a financial advisor? We appreciate referrals. Thank you for helping us continue to grow.

[1] Dimensional Fund Advisors analysis

Disclaimer

The information and opinions contained in this presentation are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information or opinions contained herein. Atlas does not give any representation, warranty or undertaking, or accept any liability, as to the accuracy or the completeness of the information or opinions contained herein. This presentation does not constitute an offer or solicitation to any person in any jurisdiction. Any such offering will only be made in accordance with the terms and conditions set forth in a private placement memorandum or other offering document. Recipients should not rely on this material in making any future investment decision. We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Atlas and its affiliates do not assume any responsibility for the accuracy or completeness of such information. Atlas does not undertake any obligation to update the information contained herein as of any future date. Any views or opinions expressed may not reflect those of the firm as a whole. Any illustrative models or investments presented in this document are based on a number of assumptions and are presented only for the limited purpose of providing a sample illustration. The hypothetical performance information contained herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. Any sample illustration is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Atlas’s control. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. This document may include projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. Investments are subject to risk, including the possible loss of principal. There is no guarantee that projected returns or risk assumptions will be realized or that an investment strategy will be successful. No representation, warranty or undertaking is made as to the reasonableness of the assumptions made herein or that all assumptions made herein have been stated. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. The information contained in this document is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date and Atlas does not undertake any obligation to update the information contained herein as of any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for background purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make its own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her/its specific portfolio or situation, it is encouraged to consult with the professional advisor of his/her/its choosing. Investment advisory and management services are provided by Atlas Capital Advisors, Inc. Atlas is registered as an investment advisor with the Securities and Exchange Commission.