What’s Discussed

What’s Discussed

- AQR’s Antti Ilmanen is one of the luminaries in the investment world, known globally for his mastery of the investment research and his insights about investment portfolio construction. Mr. Ilmanen is the author of Expected Returns, a masterful review of market returns of various asset classes and strategies, and a new book: Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least.

- In reviewing Investing Amid Low Expected Returns to prepare for my upcoming interview of Antti Ilmanen, it struck me that there are three insights which seem especially relevant for our readers to consider at present:

- Stocks and related assets are priced to generate relatively low returns going forward.

- Illiquid private assets may not be the answer – there may no longer be an “illiquidity premium.”

- This could be a good time for equity investors to tilt toward stocks and markets with more favorable valuation metrics.

Potential Future US Stock Market Return Low

The Low Returns book asserts that because past returns have been much better than expected, returns have been “borrowed from the future,” setting up investors for disappointment down the road. This is the case not only for the US stock market, but also the other higher-risk asset classes whose prices move with equities.

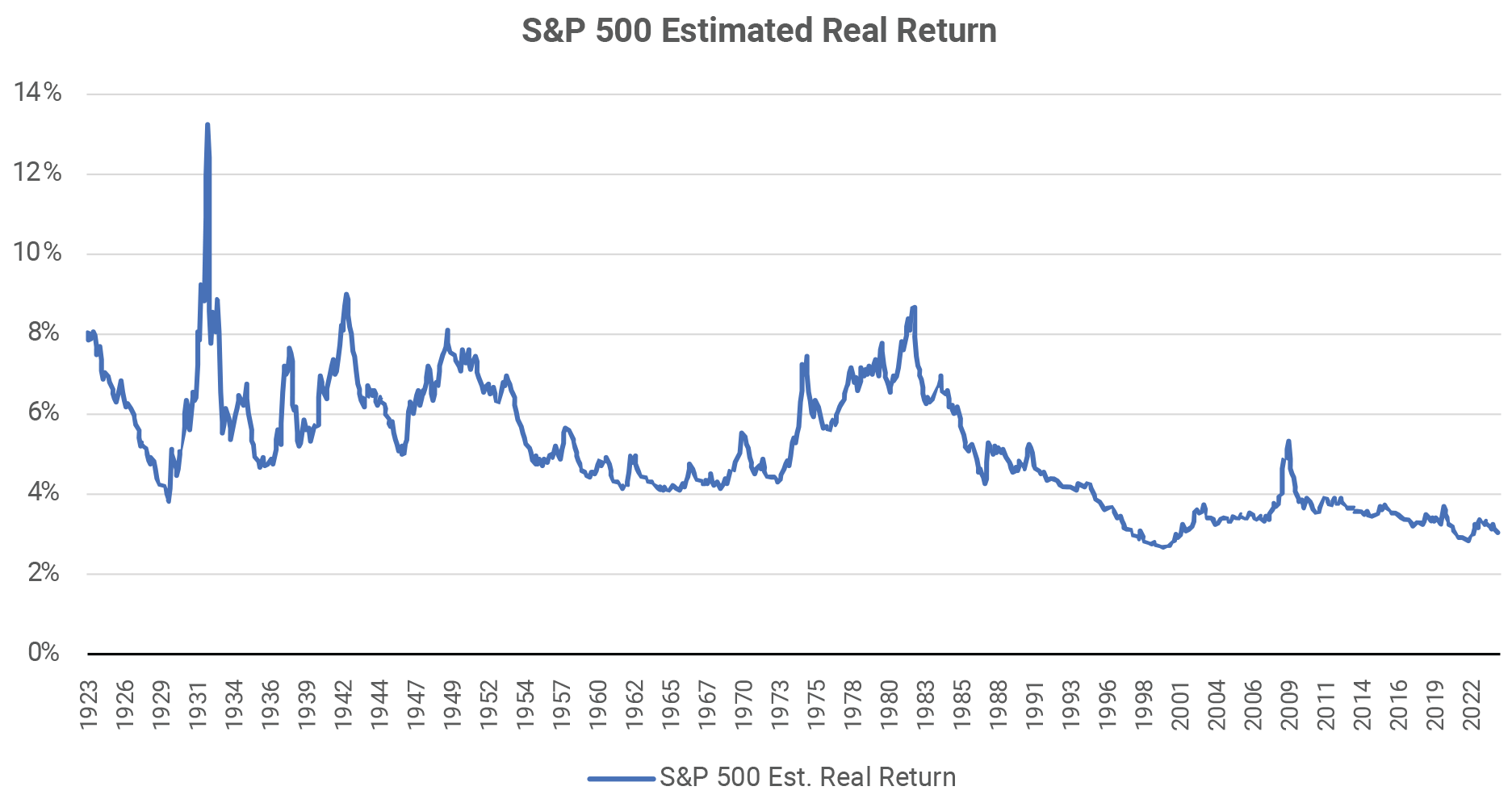

The book provides a methodology for estimating the future real return (return in excess of inflation) of the S&P 500. The current estimate is just 3.0%[1], which is in the bottom 4% of all observations over the past century. The only other times the expected real return was so low was around the end of 2021 and around the top of the technology stock bubble in 1998 – 2000. If the 3.0% real return estimate is correct and inflation is 2.1%[2] that would be a 5.1% nominal return for the S&P 500 – not very exciting when one can obtain a 5.4% return from investment grade US corporate bonds.

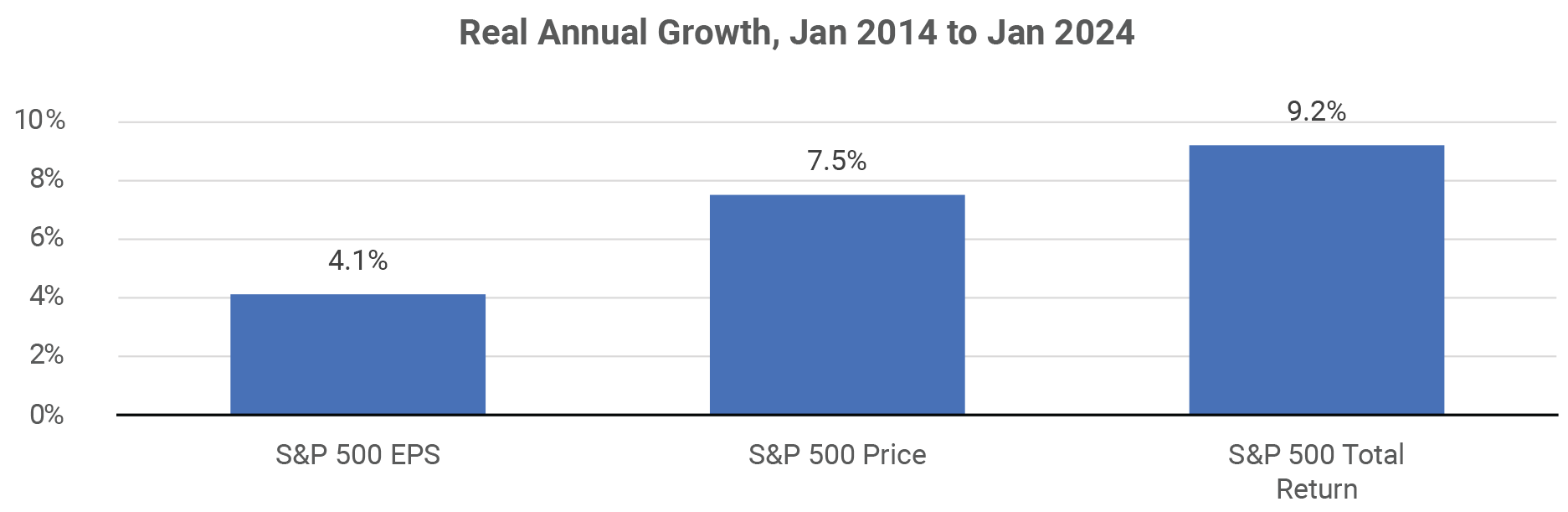

Although these estimates have been accurate on average, any given estimate can turn out to be significantly high or low. For instance, ten years ago, in January 2014, the methodology used in the book would have forecast a 3.6% annual real return for the S&P 500. In fact, the average real return (including dividends) in the last decade was 9.2% per year, vastly better than predicted. How did such a large difference happen?

The book’s methodology assumes that the earnings per share of the S&P 500 grow 1.5% per year faster than inflation, which has been the historical norm. But in the past ten years, earnings per share of the S&P 500 rose 4.1%/year faster than inflation. The escalation of deficit spending by the US government was an important reason why earnings growth was high, in addition to corporate tax cuts and the stellar performance of the US technology giants. The estimation methodology also assumes that the price to earnings ratios will be stable. In fact, the P/E ratio of the S&P 500 rose enormously from 13.8 to 23.3 between January 2014 and January 2024. That is why the real index price could rise 7.5% per year when real earnings rose only 4.1% per year.

As the book indicates, periods in which earnings have grown faster than the norm tend to be followed by periods of earnings growth below the norm. Periods in which price/earnings ratios escalate well above historical averages have typically been followed by periods in which P/E ratios revert back. If that should happen, the return of US stocks and related assets would become much lower than investors have enjoyed to this point.

It is not possible to predict exactly when the reversal of favorable trends might begin. As an example, the first time there was an estimate of US stock market real returns of 3.0% or lower was in 1998, but it was two more years before a major bear market began. The book argues that investors ought to prepare for that possibility by lowering their long-term expectations of investment income from the stock market and exploring other sources of investment return.

Illiquid Assets Less Beneficial than Believed

Most investors believe that there is an “illiquidity premium” whereby illiquid investments are likely to deliver a return premium over liquid equivalents. This is generally true and easily observable in the corporate bond market. In recent decades, most illiquid investing has been via private limited partnerships, a class of “alternative investment.”

The long-term success of the alternatives-heavy “endowment model” of investing has reinforced the belief in the illiquidity premium. The world’s largest investors and many high-net-worth individuals have steadily increased their allocations to private equity and other private assets over the past two decades. A report from Bain indicates that global private assets more than tripled in the past ten years[3].

In the Low Returns book, Mr. Ilmanen examines the evidence for an illiquidity premium and concludes that investors may be too optimistic. For instance, the books states that most of the historical outperformance of private equity over public equity occurred before the early 2000’s. On average, (after making appropriate adjustments for factor and sector exposures) there is no outperformance of private equity over public equity in vintage years since 2006.

Since 2006, prices paid for private companies have been similar to the prices of comparable companies in the liquid stock market. With a slim starting discount, it has been challenging for private equity partnerships to generate enough value-added to offset a fee burden of 5 – 6% per year. The ongoing preference by investors for private equity is attributed to the difficulty of deriving and understanding valid comparisons between private and public returns and the lack of mark-to-market accounting for private investments, which smooths reported returns.

Mr. Ilmanen’s analysis indicates there could be a challenge for asset allocators in the next decade. Since these private assets are illiquid, an allocator who concludes that private investing is no longer advantageous will find it difficult and expensive to make portfolio changes.

Possible Advantage for Value Investors Ahead

Antti Ilmanen is one of the leading proponents of style premia. A “style” (or “factor”) is a systematically rewarded attribute of an investment. For the “value” style, stocks are ranked based upon their fundamental attributes such as the ratio of price to earnings, cash flow, sales, book value or other metrics. The long-term historical evidence shows that stocks with better value attributes (e.g., low P/E ratios) tend to have better future performance over a full market cycle.

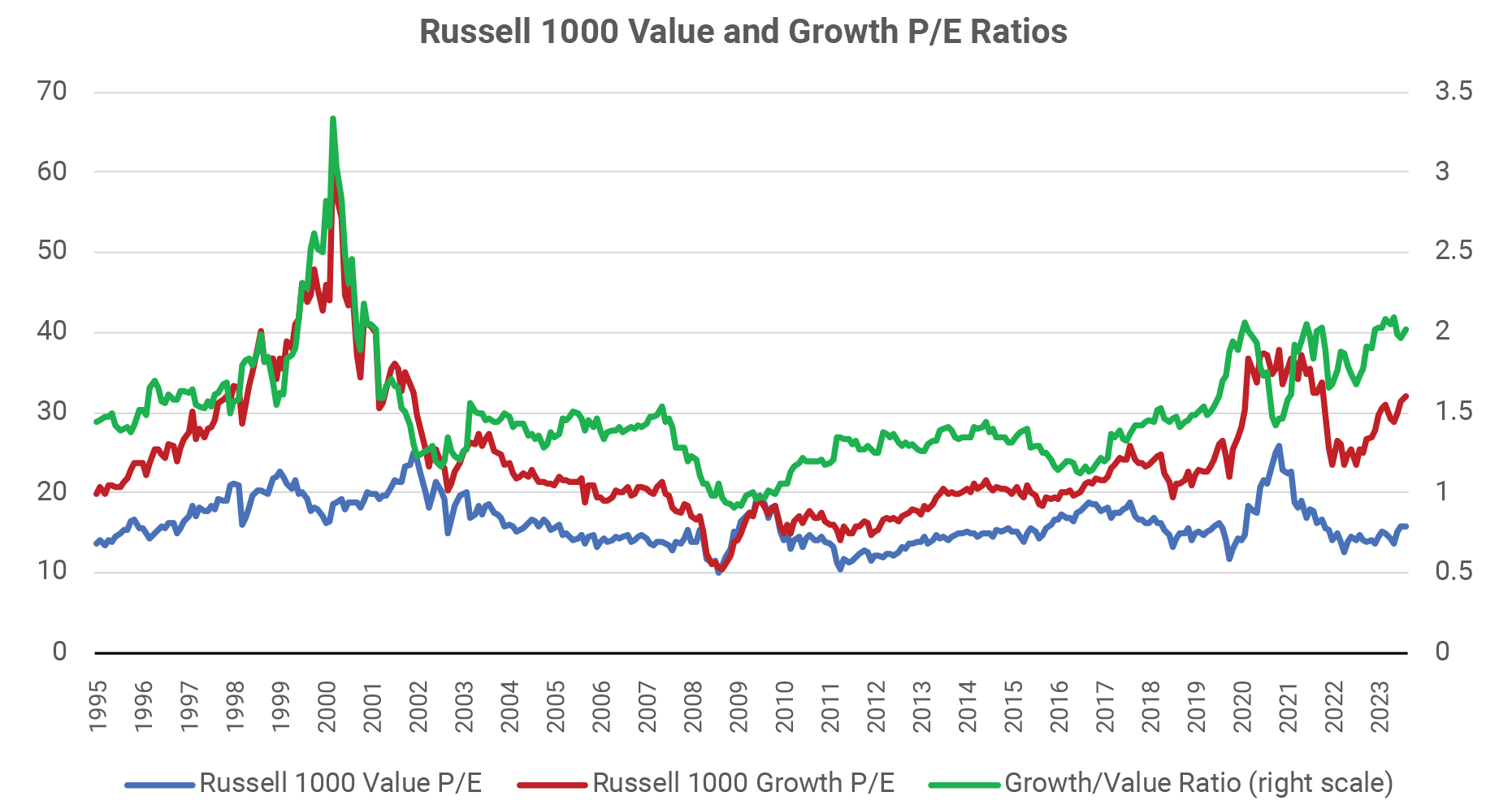

Nonetheless, it has been challenging for value investors to keep the faith in the last decade. Value investors were on the wrong side of the growth stock bubble in 2018 – 2020, and again in 2023 when the Magnificent Seven dominated stock market index gains. The ongoing surge in growth stocks has elevated the gap between the price/earnings ratios of growth stocks vs. value stocks. At present, the Russell 1000 Growth Index of the largest 1000 US public companies trades at a P/E of 34.1, which is more than double the 16.2 P/E of the Russell 1000 Value Index.

For small cap stocks the difference is even more elevated. The Russell 2000 Growth Index trades at a 108.4 P/E, which is 6.6 times the 16.4 P/E for the Russell 2000 Value Index. The Low Returns book argues that valuation gaps this large tend to be unsustainable, to the benefit of value investors.

As the chart indicates, a growth/value ratio of 2x or more does not necessarily mean that the boom in value investing is imminent. The ratio also reached 2x at the end of 2020 and 2021 and was as high as 3x at the crest of the tech bubble. But eventually, the book suggests, there will likely be a reward for value investing, and therefore it is sensible to position investment portfolios accordingly.

Conclusion

Atlas Capital Advisors, and many others, owe a debt to Antti Ilmanen, who is exceptional at synthesizing the investment research and using it to offer suggestions for better investment portfolios. In this paper, we cannot do justice to the wealth of valuable information in his books and articles. The three insights we have chosen to discuss here are fully in line with our current views and our positioning for clients. We are cautious about the long-term outlook for equities, we urge our clients to stick with liquid investments and our client equity portfolios are tilted toward better value.

If you are interested in hearing Mr. Ilmanen’s views directly, you may register for the upcoming Chartered Financial Analyst Society of San Francisco event [4], which will be on April 2. It is sure to be illuminating.

[1] Methodology from Ilmanen, Investing Amid Low Expected Returns, © 2022

[2] Estimate from Federal Reserve Bank of Cleveland (https://fred.stlouisfed.org/series/EXPINF10YR/)

[3] https://www.bain.com/globalassets/noindex/2023/bain_report_global-private-equity-report-2023.pdf

[4] Visit https://cfa-sf.org/ to register

Disclaimer

The information provided in this article by Atlas Capital Advisors Inc., a registered investment advisor (RIA), is intended for general informational purposes only and should not be considered as professional tax advice. While we strive to ensure the accuracy and timeliness of the content, tax laws are complex and subject to change. This article does not establish a client-advisor relationship, and individuals are encouraged to consult with qualified tax professionals for personalized advice tailored to their specific situations. Atlas Capital Advisors Inc. disclaims any responsibility for actions taken or not taken based on the information provided herein and makes no warranties regarding the accuracy or completeness of the content. The use of this information is at the reader’s own risk, and Atlas Capital Advisors Inc. is not liable for any direct or indirect damages arising from the use of this article.