What’s Discussed

- An excellent new book observes that most family fortunes of the past faded away within a few generations, leading to numerous “missing billionaires” today

- The book explains how to determine optimal rules for investing and spending, such that wealth lasts through time

- The authors assert that the main shortcoming in the investment choices of wealthy families has been to have undiversified portfolios with more investment risk than necessary

- While concentrated investment positions have often been a way to become wealthy, they also can be quite detrimental to staying wealthy

- Many of our clients have concentrated positions. We work with them to manage risk and increase the likelihood of sustaining wealth

Why aren’t there more billionaires today? That’s the provocative question posed by the new book “The Missing Billionaires” by my friend Victor Haghani and his co-writer James White. According to the book, there were enough US millionaires in the year 1900 to have generated as many as 16,000 billionaires today.[1] In reality, it is hard to identify any billionaire today whose fortune traces back to before the 20th century.

This book immediately piqued my interest, in part because the authors’ question hits rather close to home. My great-grandfather was one of those millionaires of 1900 whose wealth went missing. The topic is also an important question for our clients: what is the best formula for making wealth last?

The Billionaires book provides a well-reasoned logical framework for optimizing investment and spending choices. Other than spending too much (the failing of my great-grandfather, who loved his yachts), the book asserts that the main way that fortunes have been lost is by taking more investment risk than optimal. While concentrated investment positions, such as in the stock of one’s employer, can be a way to become wealthy, they also can be quite detrimental to staying wealthy.

The lessons in the book can resonate with every investor. The primary lesson is to be very careful about investment risk. Even relatively small increases in risk, if not accompanied by a sufficient increase in expected return, lead to surprisingly large decreases in the probability of long-term investment success.

Lessons from Long-Term Capital Management

One of the motivations for the Billionaires book was author Victor Haghani’s experience at the hedge fund Long Term Capital Management (LTCM), where he was one of the founding Partners. The value of his positions in the hedge fund and management company went well over $100 million, only to fall back to zero when LTCM collapsed in 1998.

This is not a unique story; here in Silicon Valley, many of us have witnessed and participated in boom/bust cycles during our careers. Once wealthy, individuals here often continue to favor the category of investment which created wealth in the first place. It is quite understandable that this happens, due to the specific insights and access that the individual has, but we would note that the importance of investment diversification is often underestimated, and lack of diversification can become extremely painful.

What would have been the right proportion of Victor’s net worth to have tied up in LTCM? The book answers that question using the framework presented there. Not surprisingly, the answer is “Less than he actually did.” Having personally experienced the agony of losing a life-changing amount of wealth quickly, he sets out in this book to help others avoid a similar fate.

Adjusting for changes in expected investment return

The most important investment choice is how much to allocate to “safe” assets such as government bonds versus “risky” assets such as the stock market. Optimizing this choice requires estimating the future return of both types of investment. The book shows the assumptions for expected return and risk under which common allocation choices such as 60/40 stocks/bonds would be optimal. The authors also urge readers to recognize that those assumptions do not always hold.

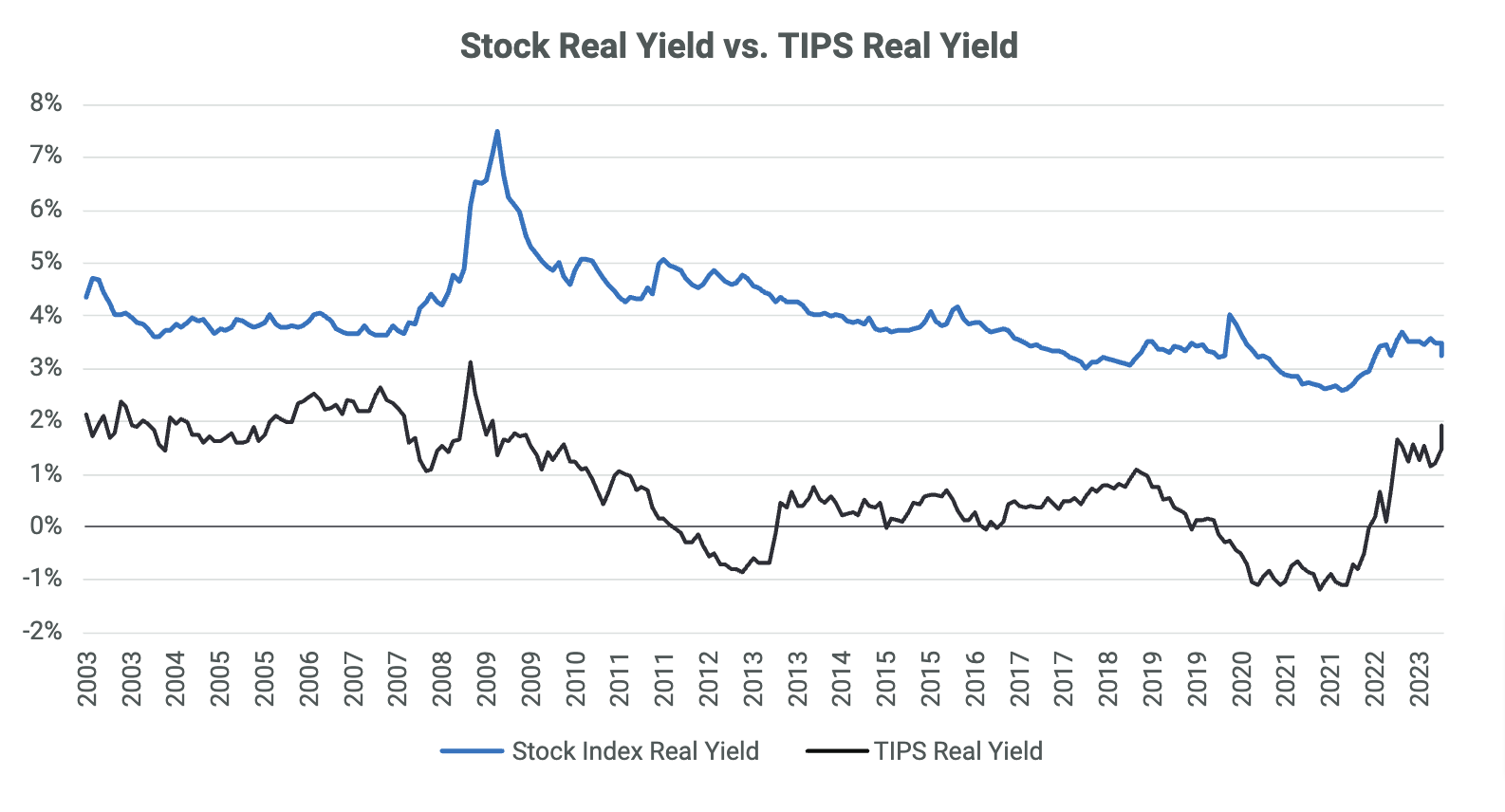

To estimate the real return (return over inflation) of the risk-free asset, the authors prefer to use the real yield of US Treasury Inflation Protected Securities (TIPS). That’s the black line in the chart below. For the real yield of the stock market, the authors use the trailing ten-year real earnings of the S&P 500 index divided by the current index price (the blue line). The gap between the lines is the expected excess return of US stocks over bonds.

Using these assumptions, the current excess return of stocks over bonds is very low – only 1.3%, the lowest of the past 15 years. The excess return was 4% just three years ago. By the logic presented in the Billionaires book, optimal investors should have more in bonds and less in stocks now than they would have had in 2020. In practice, few investors re-optimize their portfolios when conditions change. The authors would like to change this mindset and we agree: a willingness to adapt asset allocation reasonably to changes in expected returns can improve lifetime expected welfare significantly.

Impact of investment risk

In developing investment strategies, risk assumptions tend to receive less attention than the return assumptions. The emphasis is backwards: lifetime investment outcomes are more sensitive to risk than to return. The problem is that it is harder to understand, predict or optimize investment risk. Let’s look at an example:

Suppose one of our readers is a senior executive of a fast-growing company. The executive has reached the point where half of their net worth is in the stock of the employer. How good of an investment does the company stock need to be in order for investing half of one’s net worth in it to be an optimal choice? If the price of the stock is highly volatile, it needs to be an exceptionally good investment. The book stresses that too much exposure, even to the stock of a great company, is detrimental to sustaining wealth over the long term.

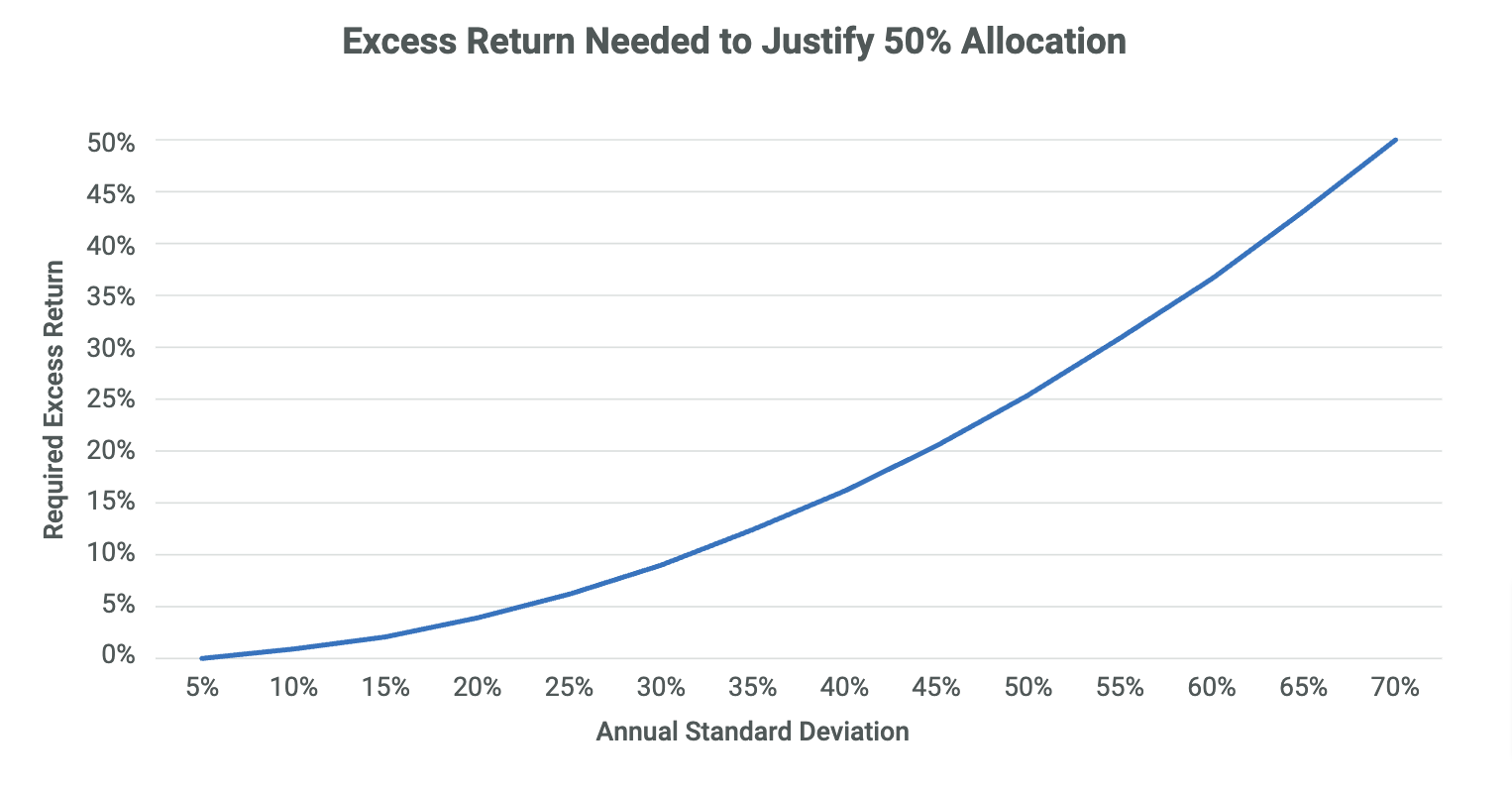

This chart shows how much expected excess return over government bonds is required for it to be optimal to hold half of one’s net worth in an investment, as a function of the annual standard deviation of the market price of the investment. It is an exponential function – twice the risk requires four times the return. If you work for Tesla, whose stock has a 50% standard deviation, the required excess return would be 25%. A Sofi employee with half her net worth in Sofi stock (which has a 70% standard deviation), needs 50% per year above the risk-free rate, a practically impossible rate of return to sustain.

At the other end of the spectrum, if we assume a standard deviation of 15% for the broad US stock market, the required excess return over bonds is just 2.3%, well within the range of possible outcomes. It is vastly more likely that an investor would obtain a reasonably good long-term outcome with 50% of her money in the S&P 500 index than with 50% in the stock of a single company. Fifty percent in global equities rather than US-only equities is an even better choice due to improved diversification.

For many individuals, it is difficult or impossible to diversify away from holdings in the stock of one’s current employer. Even when reductions in holdings of company stock are permitted, the “optics” of a current company leader selling out of company stock holdings are not good. But what about a retired technology executive? Should that individual continue to concentrate the investment portfolio in technology companies? Such a choice is quite unlikely to be optimal – the excess return required to justify taking more investment risk than necessary is just too daunting.

Summary

“The Missing Billionaires” is a fascinating and deeply researched book which translates insights from academic finance and the authors’ own experience into practical advice for investors. In most books about asset allocation, the expected return of the possible choices takes center stage. The book argues powerfully and persuasively that risk management is even more important – the key is to maximize investment diversification and avoid concentrated positions in higher risk assets. The good news is that while it may not be easy to do, it is possible to control and optimize investment risk as conditions and individual circumstances change. We find that this lesson is a critical one for our client base – we often help clients analyze and manage concentrated investment positions and thereby enhance the probability that their wealth will last through the years.

[1] The authors’ analysis assumes 100% investment in the US stock market index, a spend rate of 2% of assets and typical numbers of children in each generation.