For nearly a decade, the yield on fixed income instruments was so meager that it seemed that the stock market offered the only hope of satisfactory long-term returns. By 2021 the yield on US high-yield bonds had fallen to 3.5%, the lowest ever recorded, while corporate bond yields were below 2%. For many institutional investors, the search for yield led them to myriad private equity, private credit and real estate investments that benefited from historically low borrowing costs. For others, the only asset class left was equities. Indeed, despite valuations rising to bubble territory, we often heard that the stock market would remain resilient due to TINA – “There Is No Alternative”.

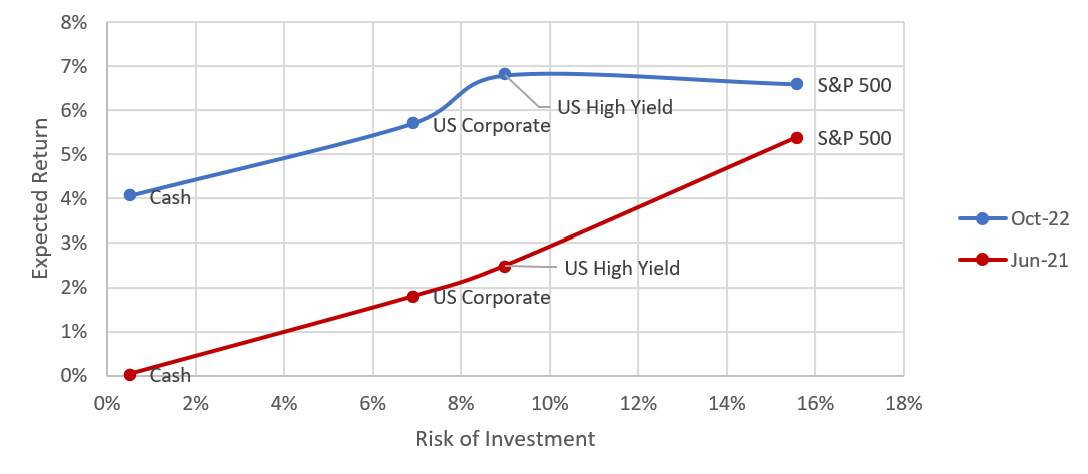

How things have changed! The surge in interest rates this year has made fixed income investments much more tempting, certainly more attractive than for a very long time. We can see this clearly in the chart below, which shows expected returns and risk in June 2021 relative to October 2022. Fixed income investments have become much more competitive to the stock market, offering comparable returns with less downside risk. It could be that we have attained TIARA – “There Is A Reasonable Alternative” – at last.

Many investors have an annual return target of 7%, which became very hard to achieve last year. But now, one doesn’t need to stretch too much to get there, and in a much less risky way. An investor who purchases the high yield bond index today would have a reasonably good chance to earn about 7% per year over the next 3 years – similar to the odds of earning 7% per year from the S&P 500.

However, even better opportunities to purchase high yield bonds may be on their way. When stocks are in a bear market, the best time to buy high-yield bonds is usually within a few months of the best time to buy stocks. Around the equity bear market bottom, there could be an opportunity to obtain exceptional returns from US high-yield bonds, which we intend to exploit for our clients.

High Yield is Usually a Good Deal

The yield on high-yield bonds is the sum of the US treasury rate (the “risk-free” rate) and the credit spread, the part of the yield which compensates investors for the risk of defaults and downgrades.

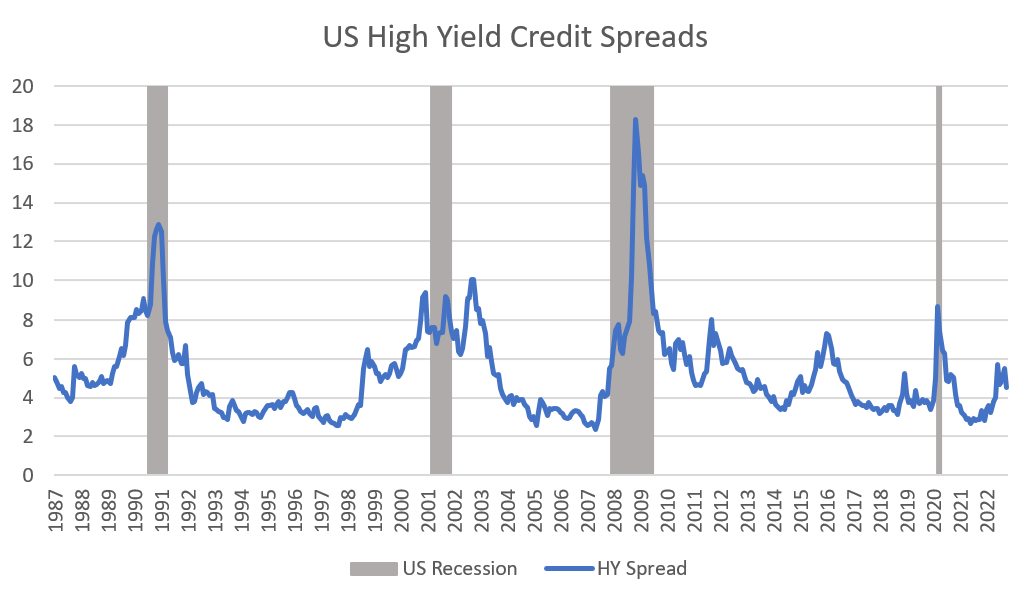

The chart[1] illustrates the credit spreads for US high yield since 1986. The median credit spread over that period was 4.6%, around where the credit spread is now. On average, the performance of the US high yield index has been 2.3% per year better than the performance of equivalent duration US Treasuries[2]. This mean that US high yield has usually been a good deal. The “spread capture,” the portion of the spread paid by borrowers that investors kept in their pockets, has been about 50%. Issuers paid 4.6% spreads, on average, and investors earned 2.3% over the return they could have obtained from the equivalent maturity US Treasury securities.

High Yield at 9.2% is Probably a Reasonable Deal

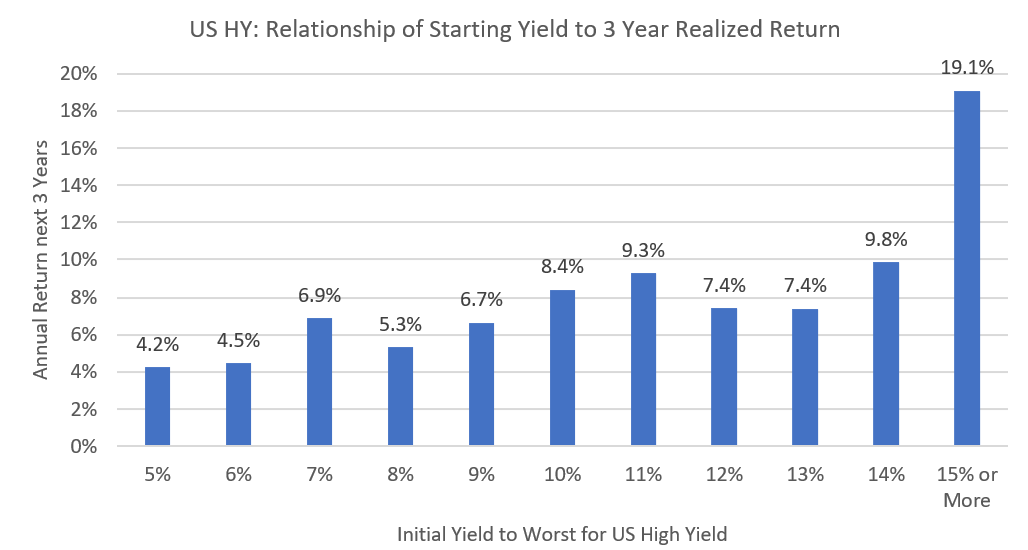

As of this writing, the yield on the US high-yield index is 9.2%. The 9.2% is the 4.4% yield on risk-free US Treasuries of the same duration plus a credit spread of 4.8%. A crude estimate of what we should expect to earn is 9.2% less half the credit spread, which would be 6.8%. That outcome would be consistent with the history, as the chart[3] below indicates.

An Even Better Deal Likely Lies Ahead

Credit spreads rise during recessions, as the probability of default by corporate borrowers rises. The economic information indicates that a US recession is likely in the coming quarters.[4] The median high yield credit spread during recessions (the shaded periods in the first chart) was 8.7%, or 3.9% higher than current spreads. High yield investors today have not yet adjusted prices for the recession risk. We are reluctant to purchase US high yield at the current yield of 9.2% if there is an imminent risk of the yield rising over 13%. A rise in rates from 9% to 13% would cost us about 16% of the value of our investment.

Equity Bear Market and HY Bottoms Coincide

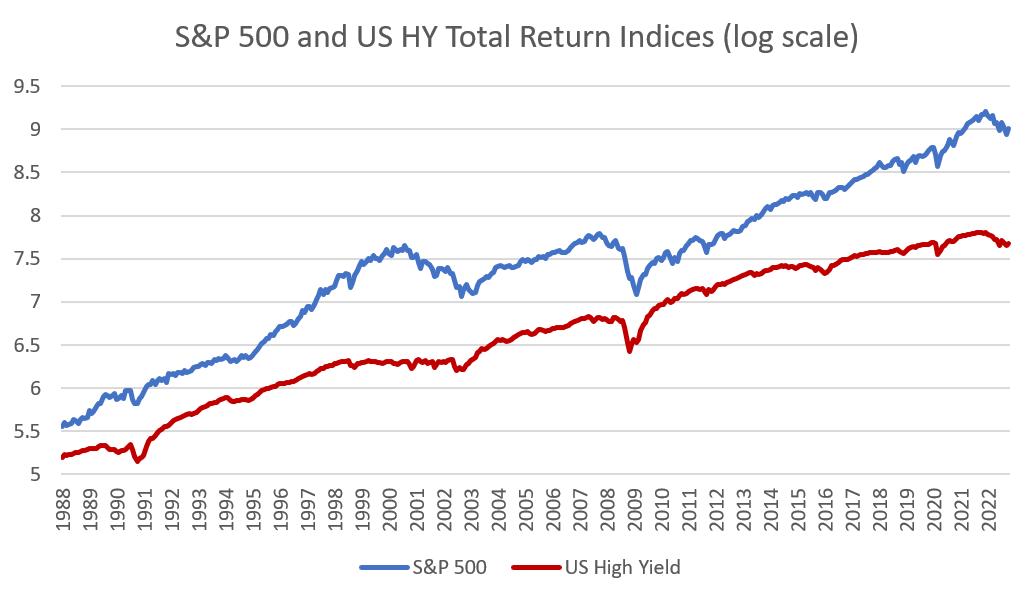

The current equity bear market is the fifth in the past twenty-five years. In the prior four bear markets, the low price (highest yield) for the high yield index happened around the same date as the low price for the stock market. In 1990 and 2020, stocks and HY bonds reached their low price in the same month. In 2002 and 2009, the low price for high yield bonds occurred 2 – 3 months before the low price for stocks. As we discussed in the prior quarterly letter, the bottom price for stocks likely awaits a Fed pivot, among other criteria[5]. The bottom price for high yield depends on the same considerations. Because the low in high yield prices can anticipate the low in stocks, Atlas will be observing the high yield market carefully for signs that the beginning of a high yield recovery is signaling an imminent stock market recovery as well.

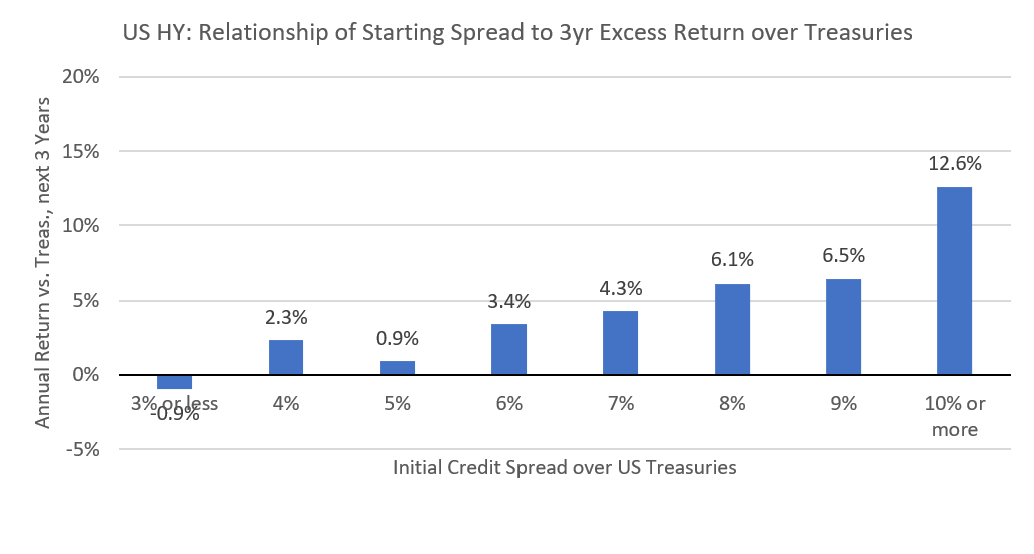

Higher Spreads Mean Higher Returns

Although the average spread capture has been 50%, it was less than 50% when spreads were low and more than 50% when spreads were high. As the chart below indicates, investors who bought high yield at credit spreads of 3% or less (the spreads which prevailed last year!) earned three-year returns 0.9% per year lower than they could have earned from much safer US Treasuries of the same maturity. The spread capture was negative. Whereas investors who bought high yield at recession-level spreads of 9% have obtained a return of 6.5% over Treasuries in the next three years, a capture of over 70%. When spreads reached 10% or more, it became exceptionally desirable to invest in high yield – the future three-year return was 12.6% more than the equivalent US Treasury return. The spread capture was over 100%! If spreads reach those levels, you can expect Atlas to add to high yield positions in client portfolios.

Conclusion

Conclusion

The rise in interest rates and credit spreads since last year has caused fixed income investments to become a reasonable alternative to the stock market. With a current yield of 9.2%, US high yield securities offer expected three-returns of about 7%. Since we believe the expected return on the S&P 500 is also in the 7% range, high yield offers a similar return with less investment risk. However, credit spreads have not yet reached the levels typical for US recession periods. Should the US economy go into a recession, there would likely be an opportunity for investors to earn even higher returns from high yield investments than are available today.

[1] Source: Bloomberg, LF98TRUU Index

[2] Source: Bloomberg, LF98TRUU Index

[3] Source: Bloomberg, LF98TRUU Index, Initial yield rounded to the closest whole percent. Data since 1988

[4] See: Markets and the Economy – Atlas Capital Advisors

[5] See Is it Time to Re-Enter the Market? – Atlas Capital Advisors

For nearly a decade, the yield on fixed income instruments was so meager that it seemed that the stock market offered the only hope of satisfactory long-term returns. By 2021 the yield on US high-yield bonds had fallen to 3.5%, the lowest ever recorded, while corporate bond yields were below 2%. For many institutional investors, the search for yield led them to myriad private equity, private credit and real estate investments that benefited from historically low borrowing costs. For others, the only asset class left was equities. Indeed, despite valuations rising to bubble territory, we often heard that the stock market would remain resilient due to TINA – “There Is No Alternative”.

How things have changed! The surge in interest rates this year has made fixed income investments much more tempting, certainly more attractive than for a very long time. We can see this clearly in the chart below, which shows expected returns and risk in June 2021 relative to October 2022. Fixed income investments have become much more competitive to the stock market, offering comparable returns with less downside risk. It could be that we have attained TIARA – “There Is A Reasonable Alternative” – at last.

Many investors have an annual return target of 7%, which became very hard to achieve last year. But now, one doesn’t need to stretch too much to get there, and in a much less risky way. An investor who purchases the high yield bond index today would have a reasonably good chance to earn about 7% per year over the next 3 years – similar to the odds of earning 7% per year from the S&P 500.

However, even better opportunities to purchase high yield bonds may be on their way. When stocks are in a bear market, the best time to buy high-yield bonds is usually within a few months of the best time to buy stocks. Around the equity bear market bottom, there could be an opportunity to obtain exceptional returns from US high-yield bonds, which we intend to exploit for our clients.

High Yield is Usually a Good Deal

The yield on high-yield bonds is the sum of the US treasury rate (the “risk-free” rate) and the credit spread, the part of the yield which compensates investors for the risk of defaults and downgrades.

The chart[1] illustrates the credit spreads for US high yield since 1986. The median credit spread over that period was 4.6%, around where the credit spread is now. On average, the performance of the US high yield index has been 2.3% per year better than the performance of equivalent duration US Treasuries[2]. This mean that US high yield has usually been a good deal. The “spread capture,” the portion of the spread paid by borrowers that investors kept in their pockets, has been about 50%. Issuers paid 4.6% spreads, on average, and investors earned 2.3% over the return they could have obtained from the equivalent maturity US Treasury securities.

High Yield at 9.2% is Probably a Reasonable Deal

As of this writing, the yield on the US high-yield index is 9.2%. The 9.2% is the 4.4% yield on risk-free US Treasuries of the same duration plus a credit spread of 4.8%. A crude estimate of what we should expect to earn is 9.2% less half the credit spread, which would be 6.8%. That outcome would be consistent with the history, as the chart[3] below indicates.

An Even Better Deal Likely Lies Ahead

Credit spreads rise during recessions, as the probability of default by corporate borrowers rises. The economic information indicates that a US recession is likely in the coming quarters.[4] The median high yield credit spread during recessions (the shaded periods in the first chart) was 8.7%, or 3.9% higher than current spreads. High yield investors today have not yet adjusted prices for the recession risk. We are reluctant to purchase US high yield at the current yield of 9.2% if there is an imminent risk of the yield rising over 13%. A rise in rates from 9% to 13% would cost us about 16% of the value of our investment.

Equity Bear Market and HY Bottoms Coincide

The current equity bear market is the fifth in the past twenty-five years. In the prior four bear markets, the low price (highest yield) for the high yield index happened around the same date as the low price for the stock market. In 1990 and 2020, stocks and HY bonds reached their low price in the same month. In 2002 and 2009, the low price for high yield bonds occurred 2 – 3 months before the low price for stocks. As we discussed in the prior quarterly letter, the bottom price for stocks likely awaits a Fed pivot, among other criteria[5]. The bottom price for high yield depends on the same considerations. Because the low in high yield prices can anticipate the low in stocks, Atlas will be observing the high yield market carefully for signs that the beginning of a high yield recovery is signaling an imminent stock market recovery as well.

Higher Spreads Mean Higher Returns

Although the average spread capture has been 50%, it was less than 50% when spreads were low and more than 50% when spreads were high. As the chart below indicates, investors who bought high yield at credit spreads of 3% or less (the spreads which prevailed last year!) earned three-year returns 0.9% per year lower than they could have earned from much safer US Treasuries of the same maturity. The spread capture was negative. Whereas investors who bought high yield at recession-level spreads of 9% have obtained a return of 6.5% over Treasuries in the next three years, a capture of over 70%. When spreads reached 10% or more, it became exceptionally desirable to invest in high yield – the future three-year return was 12.6% more than the equivalent US Treasury return. The spread capture was over 100%! If spreads reach those levels, you can expect Atlas to add to high yield positions in client portfolios.

The rise in interest rates and credit spreads since last year has caused fixed income investments to become a reasonable alternative to the stock market. With a current yield of 9.2%, US high yield securities offer expected three-returns of about 7%. Since we believe the expected return on the S&P 500 is also in the 7% range, high yield offers a similar return with less investment risk. However, credit spreads have not yet reached the levels typical for US recession periods. Should the US economy go into a recession, there would likely be an opportunity for investors to earn even higher returns from high yield investments than are available today.

[1] Source: Bloomberg, LF98TRUU Index

[2] Source: Bloomberg, LF98TRUU Index

[3] Source: Bloomberg, LF98TRUU Index, Initial yield rounded to the closest whole percent. Data since 1988

[4] See: Markets and the Economy – Atlas Capital Advisors

[5] See Is it Time to Re-Enter the Market? – Atlas Capital Advisors

Share with a friend!

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

What are credit spreads telling us about the U.S. stock market?

October 2024 Recap

September 2024 Recap

August 2024 Recap