Retirees must estimate how much of their retirement savings may be spent each year without leading to an uncomfortably high probability of running out of money. Traditional advice is that a retiree can safely withdraw 4% of retirement savings at age 65 and increase the annual withdrawal amount by the rate of inflation in the years thereafter. However, that is not good advice for current conditions. Assuming current high inflation is transitory, 3% is the new feasible starting withdraw rate. The main reason that 3% is the new 4% is that the expected future returns of stocks and bond are lower than past returns have been.

The Retirement Spending Goal

Most of the studies of sustainable spending in retirement have these assumptions:

- Retirement at age 65

- An intent to maintain an equivalent standard of living for the rest of life – the amount withdrawn each year increases at the inflation rate

- No more than 10% probability of running out of money during the retiree’s lifetime

- Life expectancy of 30 years (to age 95)

These assumptions are a bit conservative. A couple who are both age 65 would expect the longest-lived person to reach age 89, based on current actuarial tables. Also, some retirees might be comfortable with a higher than 10% probability of running out of money. In the analysis here we use the traditional assumptions, to be consistent with the rest of the literature.

Atlas Simulation Assumptions

Atlas Capital Advisors has simulated future sustainable spending amounts for retirees using the following assumptions:

Investment Strategy

The retiree is invested in US stocks and bonds. At age 65, the allocation is 65% to stocks and 35% to bonds. Each year, 1% of the portfolio is shifted from stocks to bonds, such that by age 95 the mix is 35% in stocks and 65% in bonds.

Inflation

We assume US Consumer Price Inflation of 2.5%. This is approximately the average US inflation rate of the past 30 years. Note we are assuming that the US Federal Reserve will succeed in its goal of bringing inflation down from currently high levels.

Return on Investment

The assumed annual return on US stocks is 5.5%. That is lower than the historical returns on US stocks but is justified by current valuations.

The long-term assumed annual return on US bonds is 3.0%. This assumption is also lower than the historical returns on US bonds, but reasonable given current bond yields.

Uncertainty in Returns

We assume 15% annual risk for stocks and 6% risk for bonds, based on historical volatility.

Model Results

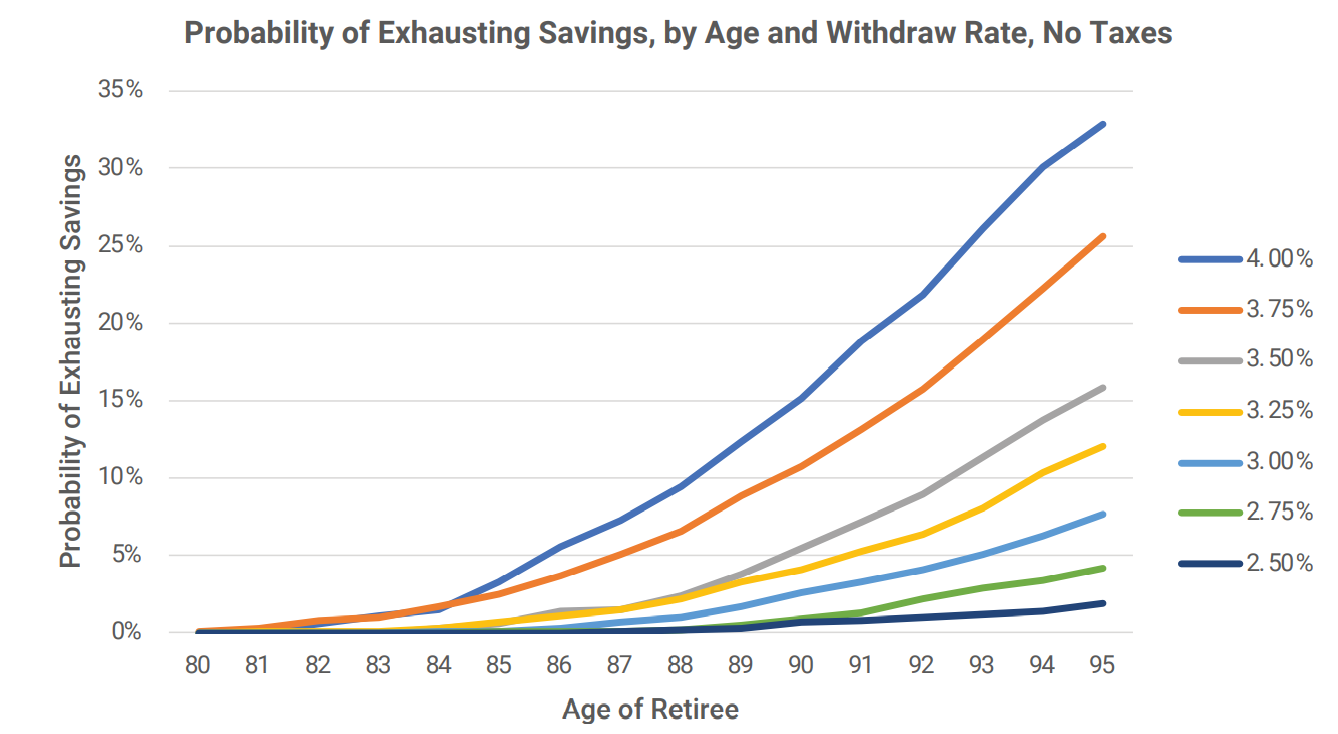

The following chart shows the probability of exhausting retirement savings as a function of the starting withdrawal percentage at age 65 and the age of the retiree. As the dark blue line on the chart indicates, a retiree who followed the traditional advice of a 4% starting withdrawal amount would face a 10% probability of exhausting all savings by age 88 and a one-third probability of having no remaining savings by age 95. A retiree with a goal of having no more than a 10% probability of running out of money by age 95 would need to start with a withdrawal rate between 3% and 3.25% of initial assets. Morningstar reached a similar conclusion in a research report released last year. [1] The Morningstar report concluded that a 3.3% starting withdrawal rate is sustainable, because future investment returns are likely to be lower than past returns have been. For those with an interest to explore the topic further, the Morningstar report provides a useful survey of the literature regarding sustainable spending in retirement, as well as a set of possible

enhancements to the traditional withdrawal model.

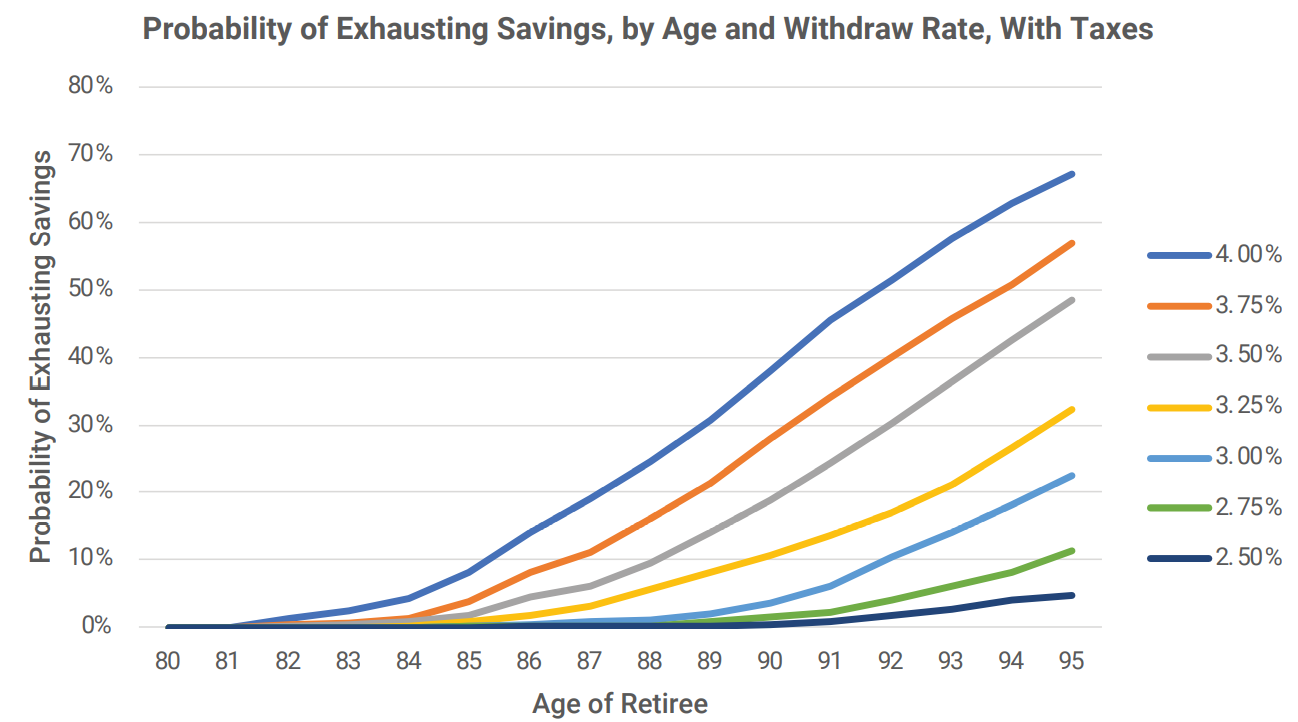

Impact of Taxation

Impact of Taxation

A shortcoming in the Morningstar report and most of the other literature regarding sustainable retirement savings is that taxes are not considered. If a retiree has their savings in a taxable account, any yield from investments and any realized capital gains will be taxed. We ran a second version of the simulation in which the retiree takes the regular withdrawal amount, rising with inflation, plus the amount needed to pay taxes as they are incurred. The probability of exhausting savings rises once outflows for taxes are included. Under these assumptions, as illustrated in the following chart, a starting withdrawal rate of 2.75% is needed to maintain a 90% probability of continuing to have savings at age 95.

Real-World Considerations

These simulations assume that a retiree makes a spending plan at age 65 and is bound to follow that plan for the next 30 years. In reality, there will be opportunities for mid-course corrections. Retirees should adjust the withdrawal plan along the way if they find that the initial plan leads to a balance of remaining savings which is materially different than expected. This analysis does not consider additional sources of retirement income, such as Social Security, a pension, annuity, or other recurring income. Retirees with income from these additional sources would have a lesser requirement to use their personal retirement savings for living expenses. The 3% withdrawal rule is based on long-term assumptions for inflation and the returns on stocks and bonds. Actual outcomes will likely be better or worse than these assumptions, affecting the sustainable withdrawal rate. For instance, if we change the inflation assumption from 2.5% to 3.5%, leaving the other assumptions unchanged, the sustainable withdrawal amount falls by about 0.3%.

Conclusion

Investors should expect that the realized returns from US stocks and bonds will be lower than usual in the upcoming decades. The reduction in expected returns leads to a reduction in the amount which a retiree may safely withdraw from savings. A starting withdrawal rate of about 3%, rising with inflation, appears to be the sustainable amount today for US investors, rather than the traditional guidance of 4%. This reduction in sustainable spending capacity puts additional pressure on individuals to save more for retirement and/or accept a lower standard of living during retirement.

[1] Source: Morningstar, https://www.morningstar.com/lp/the-state-of-retirement-income