If there is a US recession in 2023 it would be the most anticipated recession in history. Indeed, we don’t recall another time when such a high proportion of strategists and economists are predicting a recession. Usually, recessions catch the experts by surprise! Most strategists are also proclaiming that the recession will be a “mild” one.

The equity bear market so far has been relatively moderate and orderly, with US and global stocks down a bit more than 18% in 2022. That’s not too bad considering the headwinds facing the market: starting 2022 with the 2nd most extreme stock market bubble in US history, the Russia/Ukraine war, the worst inflation for 40 years and the Fed hiking interest rates at the fastest pace in its history. We believe that a key support for the equity market so far is indeed the expectation that the recession, if we have one, will be mild and it won’t be long before economic growth resumes once more. And therefore, the additional downside to the stock market is limited and one may as well buy stocks now to position for the next bull market.

We have seen many plausible arguments regarding why the recession ought to be mild, so we won’t repeat them here. In this quarterly letter, we examine the question: Would a mild recession be mild for the stock market? We should not take that for granted, because history suggests even mild recessions have sometimes led to painful losses for equity investors.

Most modern era US recessions have been mild

If the next US recession is indeed a “mild” one, that would be typical for US recessions of the modern era. Since 1945, eight of the twelve recessions had a decline in real GDP of less than 3%. Other than the large but brief COVID recession of 2020, the worst modern era recession was the Global Financial Crisis of 2007 – 2009, with a maximum decline in real GDP of only 5.1%. US recessions up to and including the 1945 recession were much worse than the modern era ones, with average GDP declines on the order of 20%!

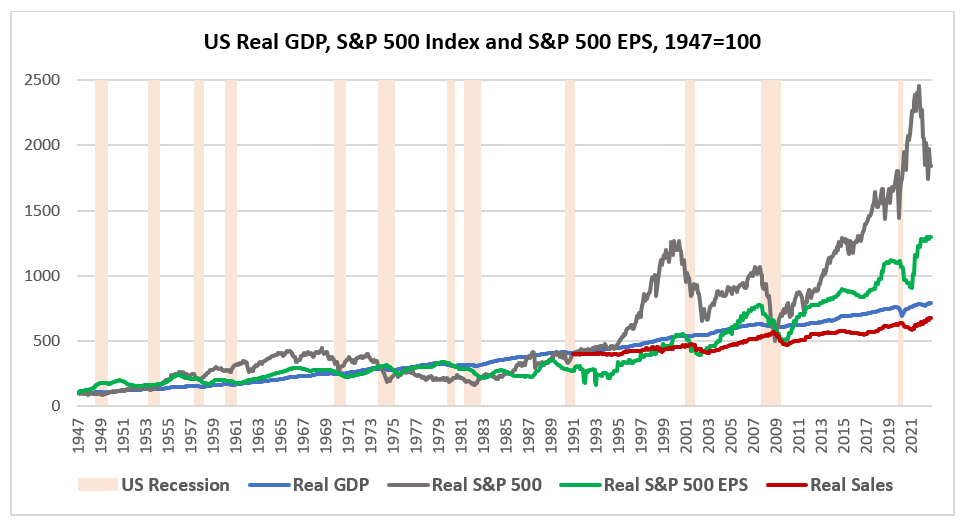

The chart below shows real (inflation adjusted) US GDP, the real S&P 500 index price and real S&P 500 earnings with a starting value in 1947 of 100 for each.

The main takeaways from the chart are:

- Most modern recessions have been mild. It’s hard to even detect the recession periods from viewing the blue line, other than the blip for the COVID recession in 2020. Based on this history, it’s relatively safe for a strategist to predict that the next recession will be mild as well!

- The impact of recessions on earnings (green line) is much more pronounced than the impact on GDP, and tends to linger after the recession is over.

- The negative impact of recessions on stock prices (grey line) can be even larger than the impact on earnings, as investors re-evaluate their risk tolerance.

- The growth in real sales per share (red line) has been no better than GDP growth. There has been an enormous gap between the growth in sales and the much higher growth in earnings. Profit margins (EPS/sales), have almost tripled since the early 1990’s. If this massive expansion in profit margins is not sustainable, that would be a further risk to equity investors.

In short, nearly all recessions have been “mild”; it’s not the magnitude of the recession itself, but rather the (much larger) impact on corporate earnings that drives the stock price correction. So, has the stock market priced in the corporate earnings impact from a potentially mild recession? We are doubtful.

Equity correction so far was about interest rates, not (yet) from a recession view

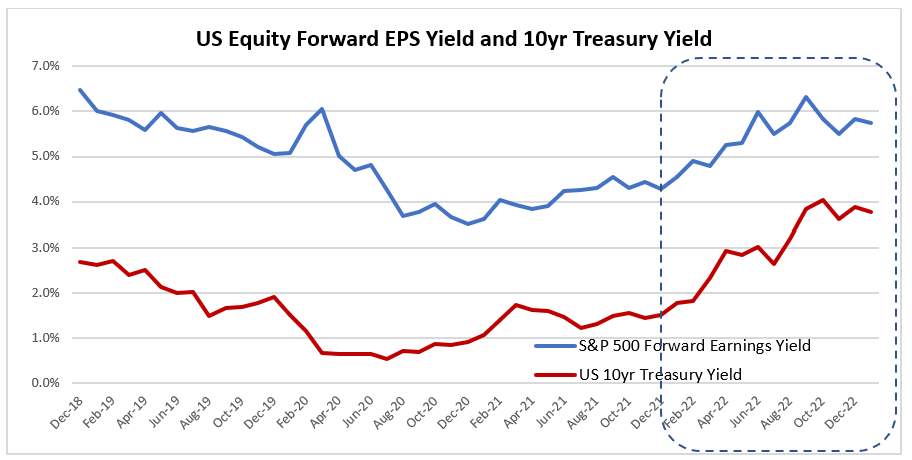

Over the course of history, equity market returns have been about 4% per year higher than the returns on government bonds (this is called the equity risk premia, the extra return for taking extra risk). In the chart below, we can see that in 2022 (boxed), the ten-year treasury yield (red line) rose from 1.5% to 3.9%. To keep up, the forward earnings yield (estimated earnings one year forward divided by price) of the S&P 500 rose from 4.3% to 5.8%. This change in the forward earnings yield is more than enough to explain the 18% loss in the S&P 500 last year. In fact, the increase in US equity earnings yields in 2022 was less than the increase in bond yields, so equities got more expensive relative to bonds, not less!

What kind of earnings decline can be expected in a mild recession?

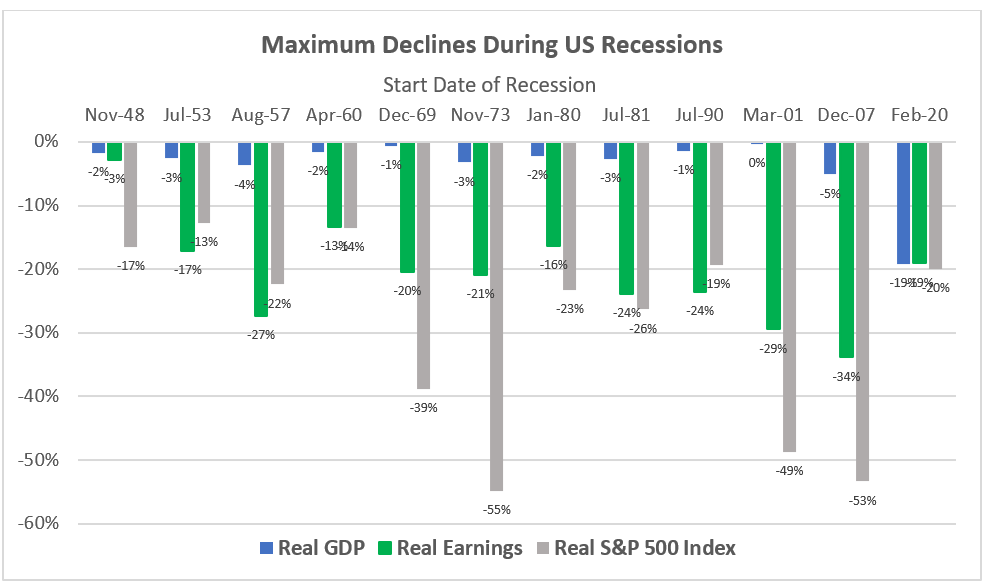

The following chart shows the maximum decline in real GDP, real earnings and real S&P 500 index price surrounding each of the past twelve recessions. The geometric average of these outcomes has been a 3.8% decline in real GDP, a 21% decline in real earnings and a 31% decline in the real value of the S&P 500.

Screenshot 2023 01 11 115454

Based on this history, the consensus view of a mild recession this year ought to be accompanied by a projection of about a 20% decline in the earnings per share of the S&P 500. But that is not yet happening. According to Bloomberg, the consensus earnings for the S&P 500 in 2023 are $219 per share. That would be a decline of 2% from 2022 earnings. Inflation is expected to be 4% in 2023, so the 2% decline in nominal earnings would be a 6% decline in real earnings. There is no magic to the 20%, and let’s say a mild recession lands us somewhere in the middle, it would suggest that the market has not fully priced in the potential earnings decline.

Summary

We think of the 2022 equity bear market as primarily an adjustment of equity earnings yields to bond yields. This recession risk is the next potential threat faced by equity investors. But, if the recession is “mild,” how bad could it really be? Unfortunately, history shows us that even small economic contractions have been accompanied by rather severe corrections in stock prices, and that can happen again.

The famous physicist Niels Bohr once remarked “Prediction is very difficult, especially if it’s about the future!” Recessions are notoriously hard to forecast. The fact that so many strategists are confidently predicting one this year, with most of them saying it will be a mild one, probably increases the odds that something different will happen – no recession, or a non-mild one. The point here is that there is a disconnect between the mild recession view and the expectation of only a minor reduction in earnings or stock prices. If the consensus about the recession is correct, the consensus about the stock market is probably too optimistic.

Q4 2022 Client Equity Positioning

Atlas Capital’s systematic process for equity market selection seeks favorable value metrics and positive sentiment (price momentum). Each month, the Atlas website[1] provides an updated set of charts showing our value and momentum assessment for equity regions, sectors, and countries. We also update our assessment of the downside risk faced by equity investors[2]. As described below, Atlas clients benefited from the tilts in their equity portfolios in Q4.

Regional selection

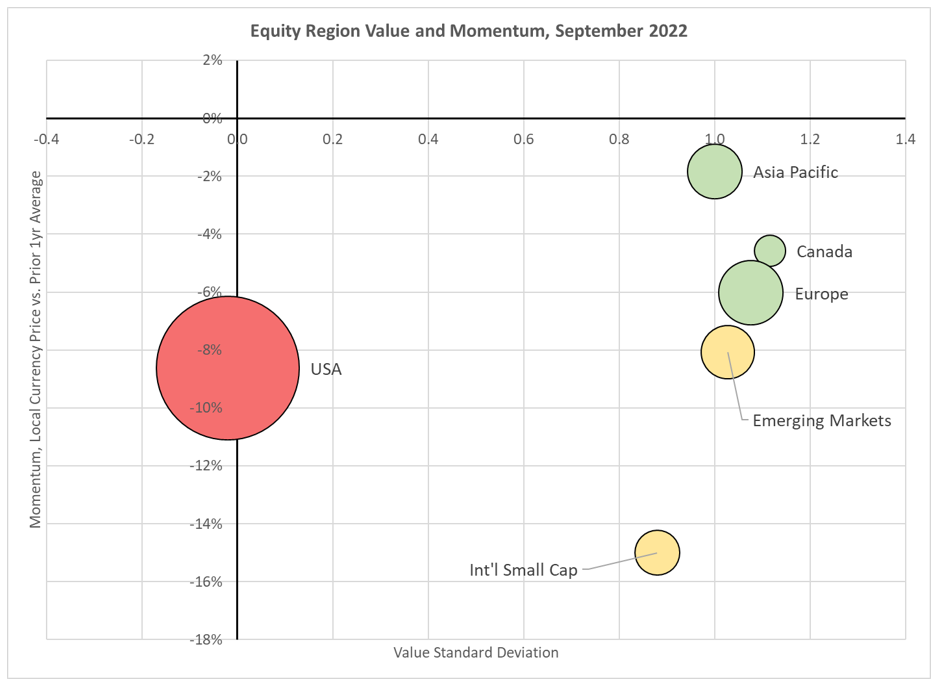

At the end of September, we viewed the US as the least favorable region for equity investors, with unfavorable value and momentum relative to non-US equity markets. In this chart (and on the website) the size of the bubble indicates the market weight of the equity region. The color of the bubble indicates whether last quarter we were over the benchmark weight (green), neutral (yellow) or under the benchmark (red).

Client regional equity weights were tilted accordingly, leading to favorable outcomes. The US stock market underperformed the global equity index by 3%, while Europe beat the index by 11% and Asia/Pacific was ahead by 3%. The better relative performance of the international markets was aided by the fall in the US dollar – the euro and Japanese yen each rose about 9% vs. the dollar in Q4.

US Sector Selection

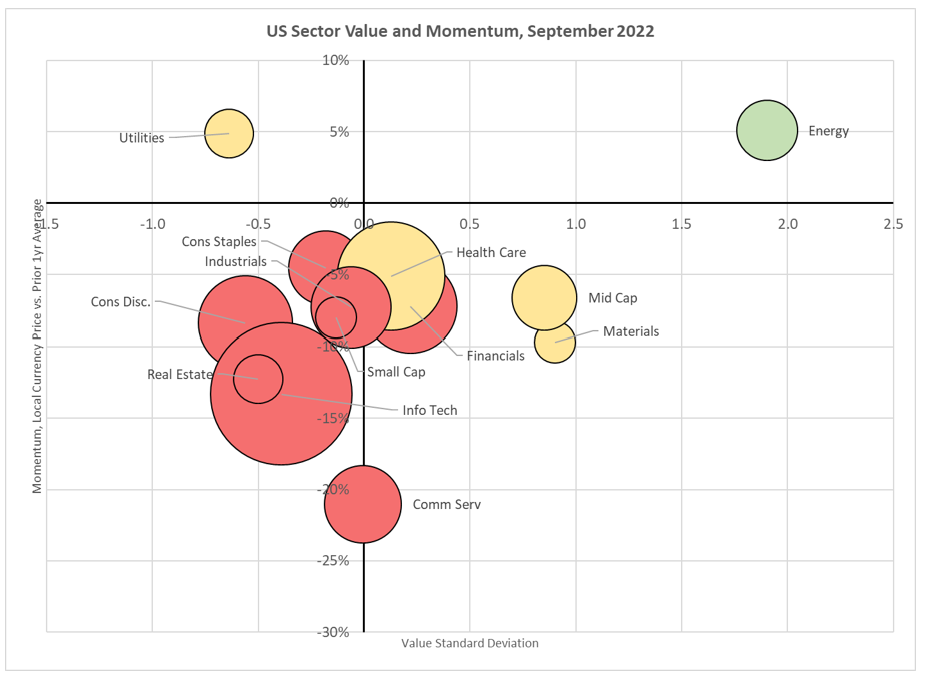

As mentioned, the US ranked at the bottom of our assessment of equity regions, and therefore we were underweight (red) most sectors. Four US choices had a neutral weight (yellow) and only energy was an overweight (green).

Client positioning in US sectors was quite favorable in Q4, particularly the overweight to the energy sector (which outperformed the S&P 500 by 15%) and the underweight to consumer discretionary (which lagged the S&P 500 by 16%, due mainly to the 54% decline in Tesla stock and the 26% fall in Amazon).

Fixed Income Investments

In the September 2022 rebalance we maintained a relatively defensive posture in client equity portfolios, with 5% in short-term TIPS and 5% in short-term investment grade bonds. The conservative fixed income positions gained about 1% in Q4 but were a detractor because global equities were up 9%. The detrimental effects of fixed income positions were offset by the positive influence of regional and sector selection in equities.

A Great Year for Value

Atlas Capital uses value and trend factors to select stocks for many of our larger clients. Last year was an OK year for trend investing and a terrific year for value investing. In 2022 the S&P 500 index was down 18.1% while the S&P 500 Value index was down only 5.3%. The global equity index was down 18.4%, while the global Value index was down 7.6%. Using Value tilts for stock selection was helpful to clients in Q4 and throughout the year.

Looking Ahead

We are maintaining the defensive fixed income positions in client portfolios in Q1 2023. We are concerned about the ongoing decline in global economic data and expect the ultimate bottom price for equities lies in the future. We reduced our regional tilts somewhat for Q1, with a smaller underweight to US and smaller overweights to Asia and Europe. Our US sector positioning in Q1 has similar tilts to the positioning last quarter.

Once the economic information (and equity prices) bottom out, we believe it will be helpful to add back to client equity allocations. It is likely that point will also be a good opportunity to invest back some of the other higher-risk asset classes which we took out of client portfolios at the beginning of last year to reduce losses in the downturn.

Thanks for your interest. I’d be happy to receive comments or questions at [email protected].

[1] https://atlasca.com/current-market-assessment/#quantitativeassessment

[2] https://atlasca.com/equity-downside-risk-dashboard/

If there is a US recession in 2023 it would be the most anticipated recession in history. Indeed, we don’t recall another time when such a high proportion of strategists and economists are predicting a recession. Usually, recessions catch the experts by surprise! Most strategists are also proclaiming that the recession will be a “mild” one.

The equity bear market so far has been relatively moderate and orderly, with US and global stocks down a bit more than 18% in 2022. That’s not too bad considering the headwinds facing the market: starting 2022 with the 2nd most extreme stock market bubble in US history, the Russia/Ukraine war, the worst inflation for 40 years and the Fed hiking interest rates at the fastest pace in its history. We believe that a key support for the equity market so far is indeed the expectation that the recession, if we have one, will be mild and it won’t be long before economic growth resumes once more. And therefore, the additional downside to the stock market is limited and one may as well buy stocks now to position for the next bull market.

We have seen many plausible arguments regarding why the recession ought to be mild, so we won’t repeat them here. In this quarterly letter, we examine the question: Would a mild recession be mild for the stock market? We should not take that for granted, because history suggests even mild recessions have sometimes led to painful losses for equity investors.

Most modern era US recessions have been mild

If the next US recession is indeed a “mild” one, that would be typical for US recessions of the modern era. Since 1945, eight of the twelve recessions had a decline in real GDP of less than 3%. Other than the large but brief COVID recession of 2020, the worst modern era recession was the Global Financial Crisis of 2007 – 2009, with a maximum decline in real GDP of only 5.1%. US recessions up to and including the 1945 recession were much worse than the modern era ones, with average GDP declines on the order of 20%!

The chart below shows real (inflation adjusted) US GDP, the real S&P 500 index price and real S&P 500 earnings with a starting value in 1947 of 100 for each.

The main takeaways from the chart are:

In short, nearly all recessions have been “mild”; it’s not the magnitude of the recession itself, but rather the (much larger) impact on corporate earnings that drives the stock price correction. So, has the stock market priced in the corporate earnings impact from a potentially mild recession? We are doubtful.

Equity correction so far was about interest rates, not (yet) from a recession view

Over the course of history, equity market returns have been about 4% per year higher than the returns on government bonds (this is called the equity risk premia, the extra return for taking extra risk). In the chart below, we can see that in 2022 (boxed), the ten-year treasury yield (red line) rose from 1.5% to 3.9%. To keep up, the forward earnings yield (estimated earnings one year forward divided by price) of the S&P 500 rose from 4.3% to 5.8%. This change in the forward earnings yield is more than enough to explain the 18% loss in the S&P 500 last year. In fact, the increase in US equity earnings yields in 2022 was less than the increase in bond yields, so equities got more expensive relative to bonds, not less!

What kind of earnings decline can be expected in a mild recession?

The following chart shows the maximum decline in real GDP, real earnings and real S&P 500 index price surrounding each of the past twelve recessions. The geometric average of these outcomes has been a 3.8% decline in real GDP, a 21% decline in real earnings and a 31% decline in the real value of the S&P 500.

Screenshot 2023 01 11 115454

Based on this history, the consensus view of a mild recession this year ought to be accompanied by a projection of about a 20% decline in the earnings per share of the S&P 500. But that is not yet happening. According to Bloomberg, the consensus earnings for the S&P 500 in 2023 are $219 per share. That would be a decline of 2% from 2022 earnings. Inflation is expected to be 4% in 2023, so the 2% decline in nominal earnings would be a 6% decline in real earnings. There is no magic to the 20%, and let’s say a mild recession lands us somewhere in the middle, it would suggest that the market has not fully priced in the potential earnings decline.

Summary

We think of the 2022 equity bear market as primarily an adjustment of equity earnings yields to bond yields. This recession risk is the next potential threat faced by equity investors. But, if the recession is “mild,” how bad could it really be? Unfortunately, history shows us that even small economic contractions have been accompanied by rather severe corrections in stock prices, and that can happen again.

The famous physicist Niels Bohr once remarked “Prediction is very difficult, especially if it’s about the future!” Recessions are notoriously hard to forecast. The fact that so many strategists are confidently predicting one this year, with most of them saying it will be a mild one, probably increases the odds that something different will happen – no recession, or a non-mild one. The point here is that there is a disconnect between the mild recession view and the expectation of only a minor reduction in earnings or stock prices. If the consensus about the recession is correct, the consensus about the stock market is probably too optimistic.

Q4 2022 Client Equity Positioning

Atlas Capital’s systematic process for equity market selection seeks favorable value metrics and positive sentiment (price momentum). Each month, the Atlas website[1] provides an updated set of charts showing our value and momentum assessment for equity regions, sectors, and countries. We also update our assessment of the downside risk faced by equity investors[2]. As described below, Atlas clients benefited from the tilts in their equity portfolios in Q4.

Regional selection

At the end of September, we viewed the US as the least favorable region for equity investors, with unfavorable value and momentum relative to non-US equity markets. In this chart (and on the website) the size of the bubble indicates the market weight of the equity region. The color of the bubble indicates whether last quarter we were over the benchmark weight (green), neutral (yellow) or under the benchmark (red).

Client regional equity weights were tilted accordingly, leading to favorable outcomes. The US stock market underperformed the global equity index by 3%, while Europe beat the index by 11% and Asia/Pacific was ahead by 3%. The better relative performance of the international markets was aided by the fall in the US dollar – the euro and Japanese yen each rose about 9% vs. the dollar in Q4.

US Sector Selection

As mentioned, the US ranked at the bottom of our assessment of equity regions, and therefore we were underweight (red) most sectors. Four US choices had a neutral weight (yellow) and only energy was an overweight (green).

Client positioning in US sectors was quite favorable in Q4, particularly the overweight to the energy sector (which outperformed the S&P 500 by 15%) and the underweight to consumer discretionary (which lagged the S&P 500 by 16%, due mainly to the 54% decline in Tesla stock and the 26% fall in Amazon).

Fixed Income Investments

In the September 2022 rebalance we maintained a relatively defensive posture in client equity portfolios, with 5% in short-term TIPS and 5% in short-term investment grade bonds. The conservative fixed income positions gained about 1% in Q4 but were a detractor because global equities were up 9%. The detrimental effects of fixed income positions were offset by the positive influence of regional and sector selection in equities.

A Great Year for Value

Atlas Capital uses value and trend factors to select stocks for many of our larger clients. Last year was an OK year for trend investing and a terrific year for value investing. In 2022 the S&P 500 index was down 18.1% while the S&P 500 Value index was down only 5.3%. The global equity index was down 18.4%, while the global Value index was down 7.6%. Using Value tilts for stock selection was helpful to clients in Q4 and throughout the year.

Looking Ahead

We are maintaining the defensive fixed income positions in client portfolios in Q1 2023. We are concerned about the ongoing decline in global economic data and expect the ultimate bottom price for equities lies in the future. We reduced our regional tilts somewhat for Q1, with a smaller underweight to US and smaller overweights to Asia and Europe. Our US sector positioning in Q1 has similar tilts to the positioning last quarter.

Once the economic information (and equity prices) bottom out, we believe it will be helpful to add back to client equity allocations. It is likely that point will also be a good opportunity to invest back some of the other higher-risk asset classes which we took out of client portfolios at the beginning of last year to reduce losses in the downturn.

Thanks for your interest. I’d be happy to receive comments or questions at [email protected].

[1] https://atlasca.com/current-market-assessment/#quantitativeassessment

[2] https://atlasca.com/equity-downside-risk-dashboard/

Share with a Friend

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

What are credit spreads telling us about the U.S. stock market?

October 2024 Recap

September 2024 Recap

August 2024 Recap