What’s Discussed

According to McKinsey & Company, the business sector is 72% of global GDP.[1] Therefore, the health of “the economy” is largely a function of the health of businesses. Another measure of the health of businesses is the stock market. Because of this linkage, economic data can be a powerful tool to understand stock market outcomes.

In this paper, we present a simple metric for the state of the global economy: the proportion of the economic indices which improved in the prior year. We call this the “Percentage Improving” or “PI.” We then make the following observations:

- The one-year performance of the global stock market is closely aligned with the PI.

- When the PI is below 45% and falling, it has been better on average to not invest in stocks.

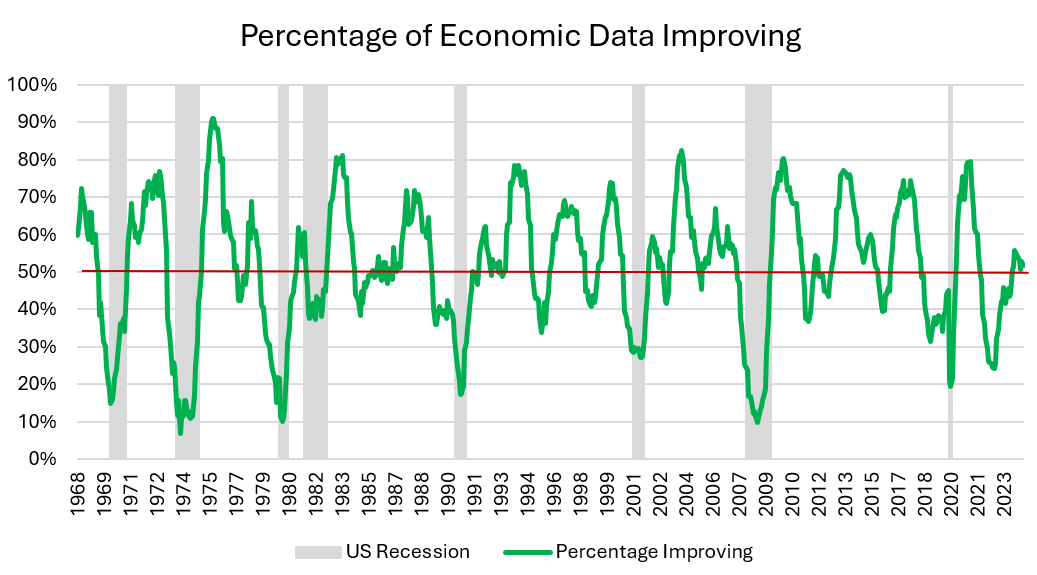

The Percentage Improving (PI)

At Atlas Capital, we track more than three hundred economic indices. These indices represent the fourteen largest countries by GDP and all the major categories of economic information including employment, GDP growth, confidence, industrial production, consumption, housing, and financial conditions. We then calculate the proportion of the indices which improved over the prior twelve months (PI).

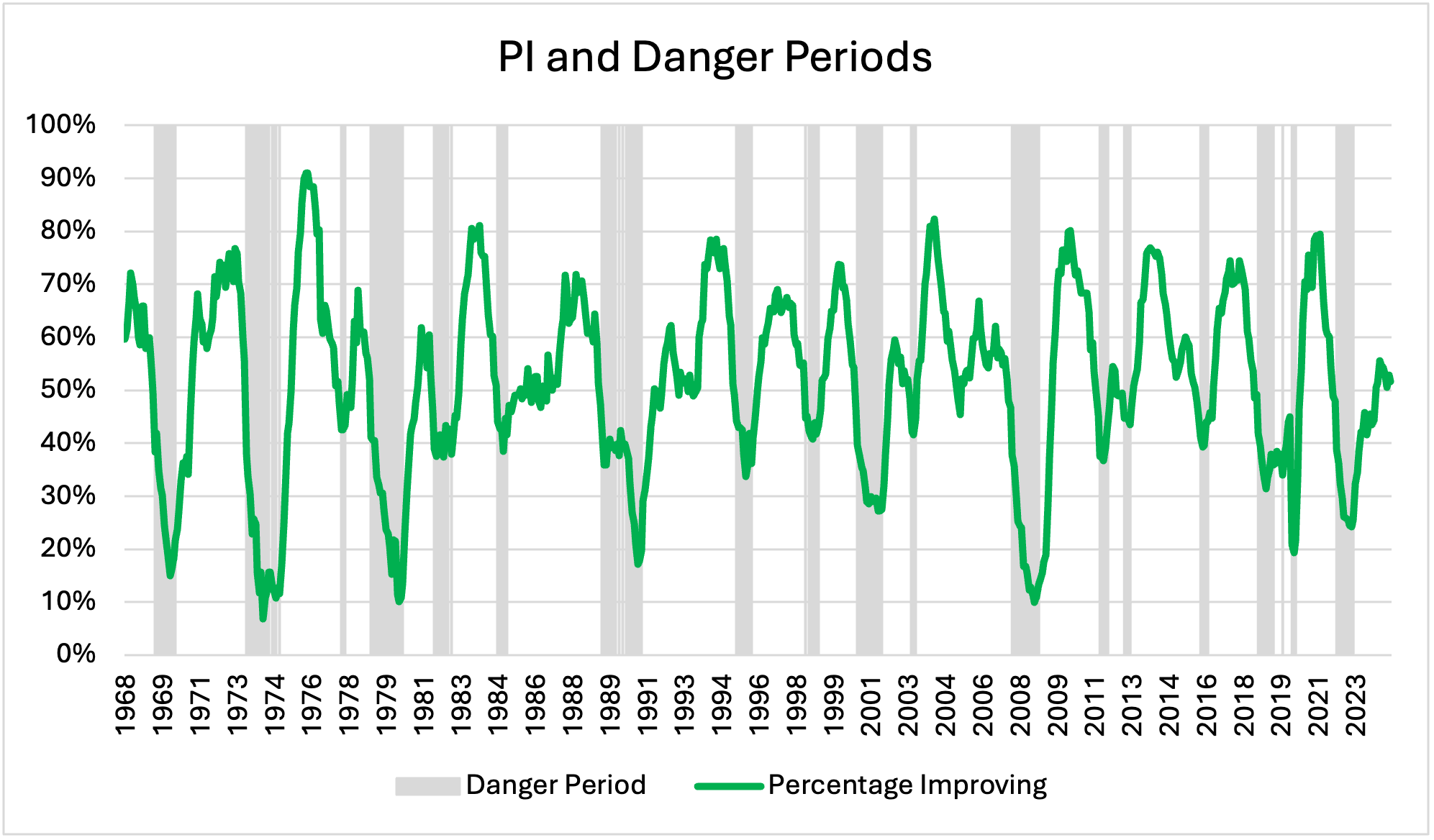

The green line on the chart shows the PI. When the PI is below 50%, the majority of economic indicators became weaker in the prior year. In most of the instances in which the PI fell below 30%, the US was in a recession.

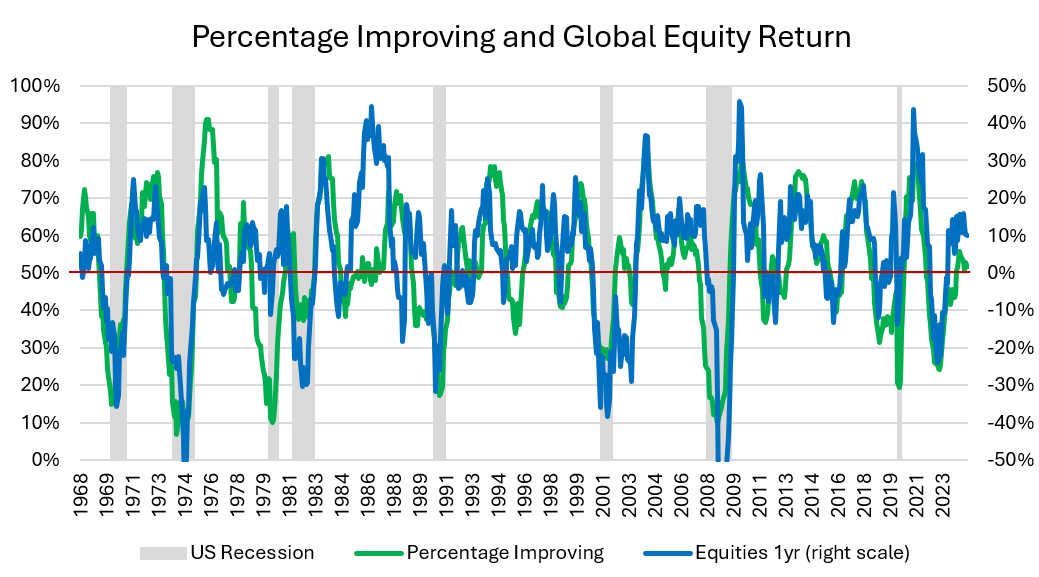

The PI and the Stock Market

The following chart adds a blue line to the chart above, showing the one-year performance of global equities relative to cash. The close connection between the global economy and stock market outcomes is clear. Since 1968, the two lines have often been on top of one another. The turning points were the same as well.

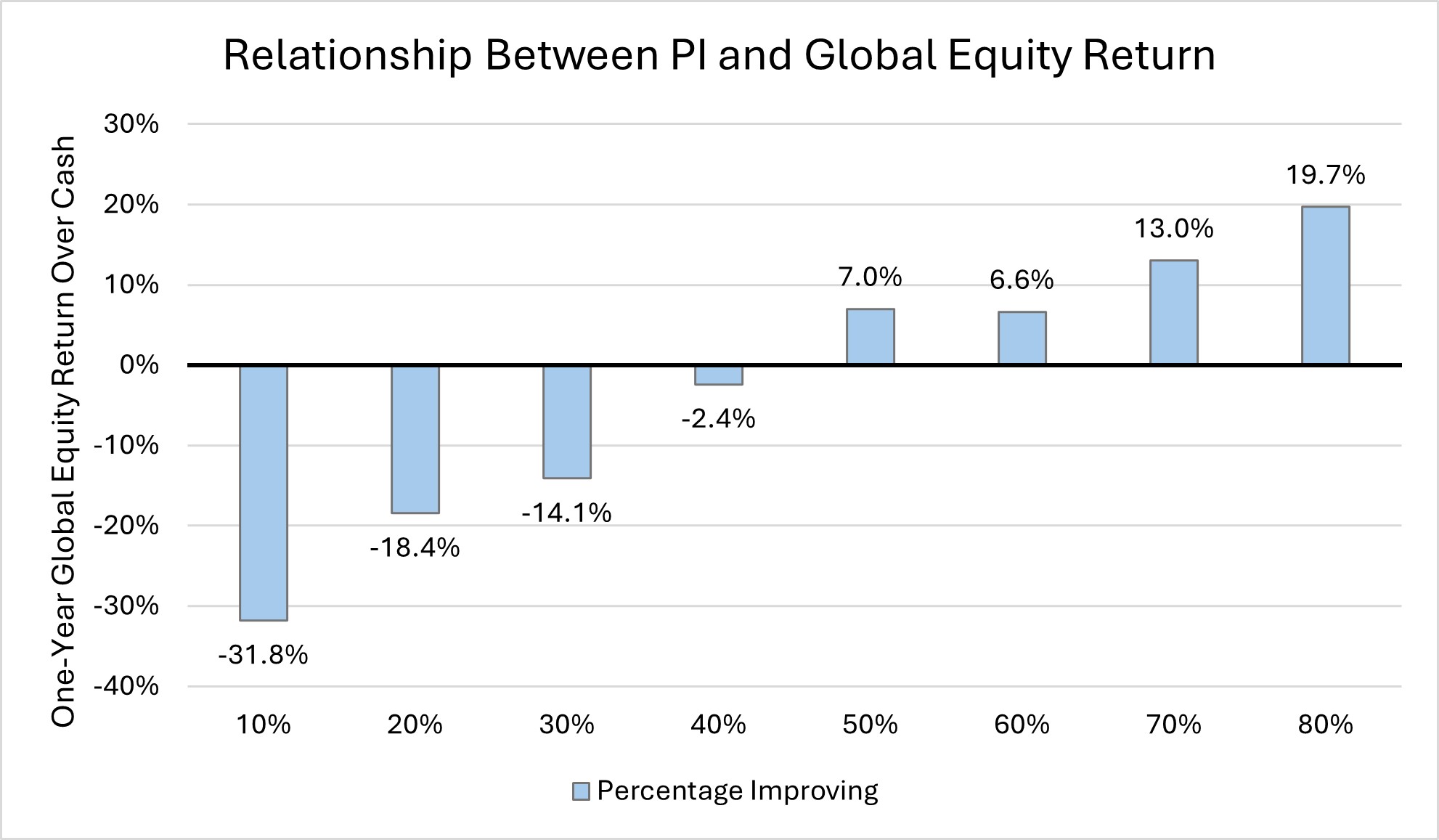

Another way to look at the powerful relationship between the PI and stock market returns is to calculate the historical average stock market return as a function of the PI.[2] On average, global equities have had a better return than cash only when most economic indices improved, i.e., when the PI has been at 50% or higher.

When Equity Investors Should Worry

The most dangerous times to be invested in the stock market have been when the PI was low and falling. In the following chart, the shaded “Danger Periods” are when the PI was below 45% and the PI trend was down. This has happened 25% of the time. In those periods, the average return of global equities was 6.3% per year below the return of cash. In the non-shaded periods, the average return of global equities was 7.4% higher than cash.

Summary

The performance of the stock market is tightly linked to the performance of the global economy. Historically, the stock market has delivered a return well above cash if most economic indicators improved in the prior twelve months. On average, the global equity return was meaningfully below cash when the percentage of economic data improving (PI) was below 45% and falling.

The economic dataset is the most important component of the framework used by Atlas Capital Advisors to identify equity downside risk. Monthly updates of this information are provided by Atlas on our website at https://atlasca.com/core-concepts/markets-and-the-economy/.

[2] The PI buckets used for calculating the average shown on the chart are all values within 5% of the point. For instance, the 50% point is an average of all instances in which the PI was between 45% and 55%.

Disclaimer

The information and opinions contained in this presentation are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information or opinions contained herein. Atlas does not give any representation, warranty or undertaking, or accept any liability, as to the accuracy or the completeness of the information or opinions contained herein. This presentation does not constitute an offer or solicitation to any person in any jurisdiction. Any such offering will only be made in accordance with the terms and conditions set forth in a private placement memorandum or other offering document. Recipients should not rely on this material in making any future investment decision. We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Atlas and its affiliates do not assume any responsibility for the accuracy or completeness of such information. Atlas does not undertake any obligation to update the information contained herein as of any future date. Any views or opinions expressed may not reflect those of the firm as a whole. Any illustrative models or investments presented in this document are based on a number of assumptions and are presented only for the limited purpose of providing a sample illustration. Any hypothetical performance information contained herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. Any sample illustration is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Atlas’s control. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. This document may include projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. Investments are subject to risk, including the possible loss of principal. There is no guarantee that projected returns or risk assumptions will be realized or that an investment strategy will be successful. No representation, warranty or undertaking is made as to the reasonableness of the assumptions made herein or that all assumptions made herein have been stated. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. The information contained in this document is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date and Atlas does not undertake any obligation to update the information contained herein as of any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for background purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make its own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her/ its specific portfolio or situation, it is encouraged to consult with the professional advisor of his/her/its choosing. Investment advisory and management services are provided by Atlas Capital Advisors, Inc. Atlas is registered as an investment advisor with the Securities and Exchange Commission.