In 1992-1993, Eugene Fama and Kenneth French published several academic papers that provided investing ideas that expanded on the classic Capital Asset Pricing Model (CAPM). They showed that over long periods, 90% of returns from diversified portfolios could be explained by 1) beta (the overall stock market return, adjusted for correlation and volatility), 2) valuation, and 3) size. The size of a company is represented by its market capitalization (number of shares outstanding multiplied by the market price per share). Typically, small companies tend to be riskier and produce higher excess returns compared to large companies. This is not always the case, and deviations from this rule can occur dramatically and for long periods. However, when taken into account alongside other key factors, the size of a company can help in the asset decision process.

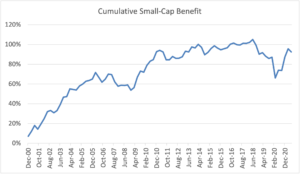

As an example of the potential benefit of small-cap investing, the chart shows the cumulative difference in return between the MSCI ACWI small-cap index and the MSCI ACWI (capitalization-weighted) index.

Investors in the small-cap index would have earned about double the total return of the capitalization-weighted index in the period from December 1998 to June 2021.

Source: Bloomberg, M1WDSC Index for ACWI (All-Country World Index, an index of global equities) small-cap and NDUEACWF for ACWI cap-weighted. The ratio of the cumulative return of ACWI small-cap to the cumulative return of ACWI capitalization-weighted.