The empirical evidence for short-term reversal in the stock market has been established for more than thirty years in academic studies by Fama, French, Jegadeesh, and others. The behavioral explanation is that investors can initially overreact to bad or good information. A portion of the overreaction is reversed shortly after that as the information is evaluated with more composure. There is also a supply/demand explanation, whereby sudden large movements in a stock price attract value-oriented investors who buy the stock which has plunged or sell the stock which has soared.

The concept of the short-term reversal seems at first to be contrary to that of momentum. However, the period of time considered is the key difference. Stock price momentum is a persistent signal over six months to a year. For example, screening for momentum on December 31st, you might rank the total return over the period from January 1st of that same year up until the end of October or November (most recent twelve months minus the most recent one or two months). The most recent month (at a minimum) is excluded because price action during this period is not a good signal to use for momentum of single stocks, on average. In fact, analyzing recent period price action tends to give the opposite signal, hence the concept of the short-term reversal.

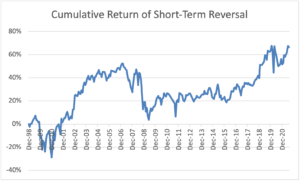

The graph below provides the cumulative return of the short-term reversal factor in US stocks from December 1998 to July 2021, as indicated by the Fama/French website maintained by Dartmouth professor Kenneth French. The chart indicates the cumulative results of a strategy with monthly trading whereby the 30% of US stocks with the worst performance in the prior month are bought, and the 30% with the best performance are sold short. While this approach has been profitable over the long term, it is also quite volatile and has the least weight among the factors utilized in the Atlas Capital investment decision process.

Source: Fama/French dataset, http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html#Research