For years, active retail traders have exhorted one another to “Buy the Dip,” or BTD. More than just buying the dip, they often crowded into a few themes and individual stocks that were popular on social media: electric vehicles, crypto, fintech, gaming, to name a few. Last year was a punishing one for BTD investors. Using the ARK Innovation ETF as a proxy for retail favorites, ARKK was down 67% in 2022 vs. -18% for the S&P 500 and -32% for the Nasdaq 100.

Despite last year’s losses, BTD investors retain some potency. In the first quarter of 2023, the beaten-down Growth stocks rallied back vigorously. Meanwhile, Value names, last year’s safe havens, fell to the bottom of the Q1 performance rankings. In fact, Q1 2023 is one of the worst quarters in history for the performance of Value stocks relative to Growth stocks.

Could it be that the rebound of Growth stocks in the last quarter is a sign that the comeback from last year’s bear market is now firmly underway?

While we are sympathetic to this argument, we would note several observations that give us pause:

- Growth stocks often merit elevated earnings multiples because the earnings of those stocks are growing rapidly. Right now, on average, the real earnings of Growth stocks are shrinking.

- Growth stocks are currently quite expensive relative to Value stocks. The current “Value vs. Growth” gap is wider than 90% of the observations since 1991.

- Growth stocks tend to do badly during recessions, and the risk of a US recession went up in Q1.

If we are right, the current moment offers a good opportunity for investors to take profits on Growth stocks and rotate to more defensive Value holdings.

Historically large Value/Growth performance divergence

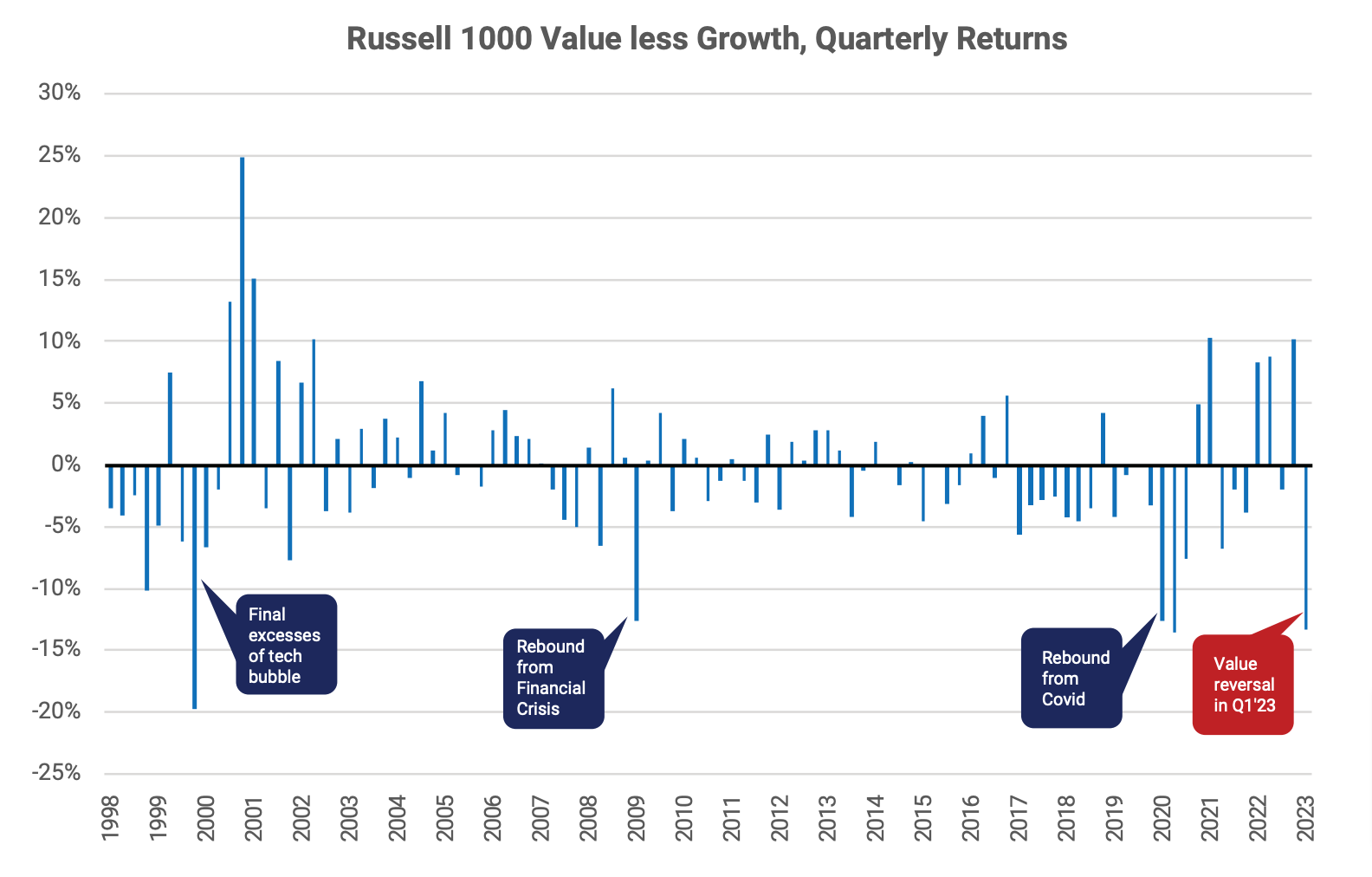

In Q1 2023, the Russell 1000 Value index of large US stocks rose only 1%, vs. 14% for the Russell 1000 Growth index. As the chart below shows, this is one of the worst performances for Value stocks vs. Growth stocks in a quarter. In the last 25 years, the only other times Value stocks have done as badly were during the final burst of speculation in the tech bubble and in the recoveries from the bottom of the bear markets caused by the Global Financial Crisis and the COVID shutdown. Our premise is that Q1 2023 is more likely to be like 1999, another burst of excess from BTD investors – rather than a sign of a durable recovery from a bear market.

“Growth” stocks are not experiencing “growth”

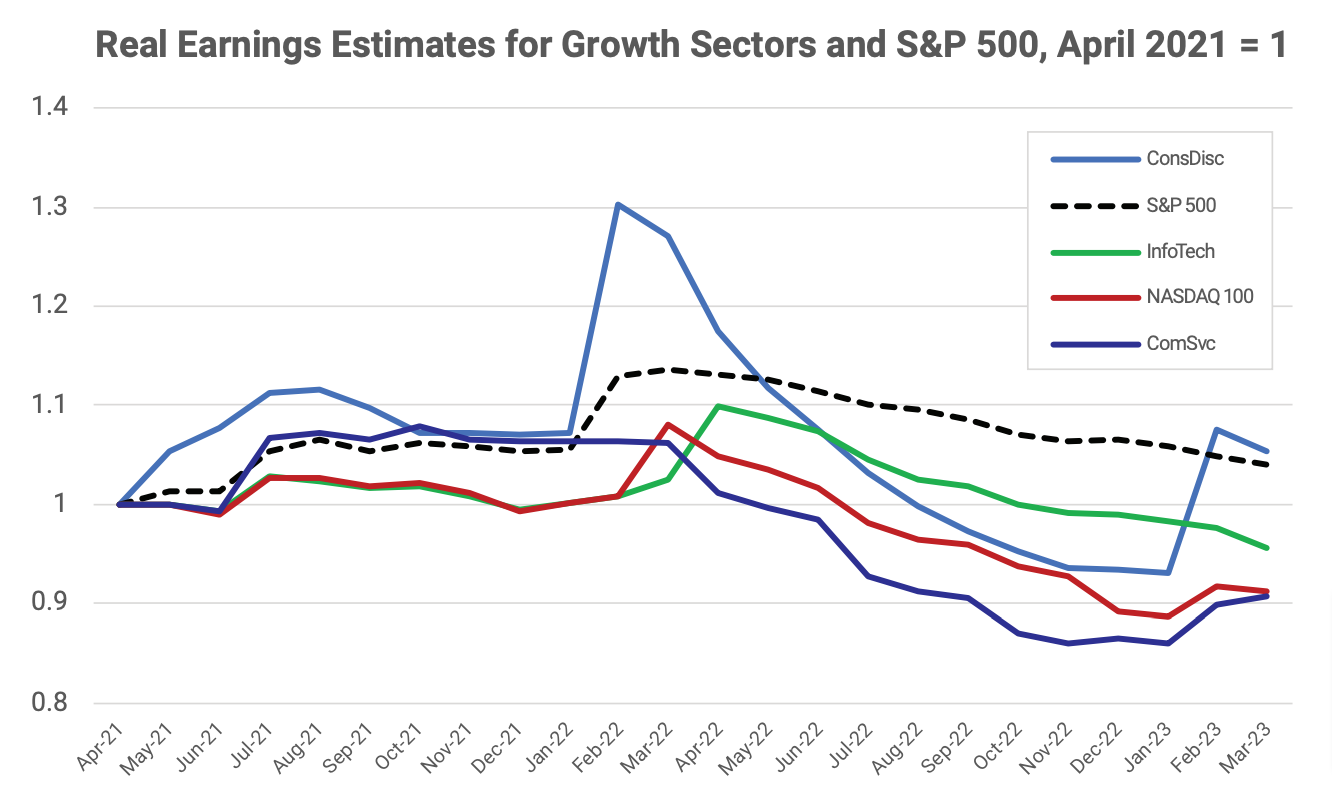

One can understand paying premium price/earnings ratios for stocks or sectors which have very strong earnings growth. But do high multiples make sense when real earnings are shrinking?

The below chart shows the real (inflation adjusted) one year forward projected earnings of the three most Growth-oriented US sectors, as well as for as the NASDAQ 100 and the S&P 500[1]. Growth stock enthusiasts should be concerned that, on average, real earnings expectations for many of their favorite stocks are declining, faster than for the earnings of S&P 500 as a whole. If there is a recession, earnings growth could become even worse.

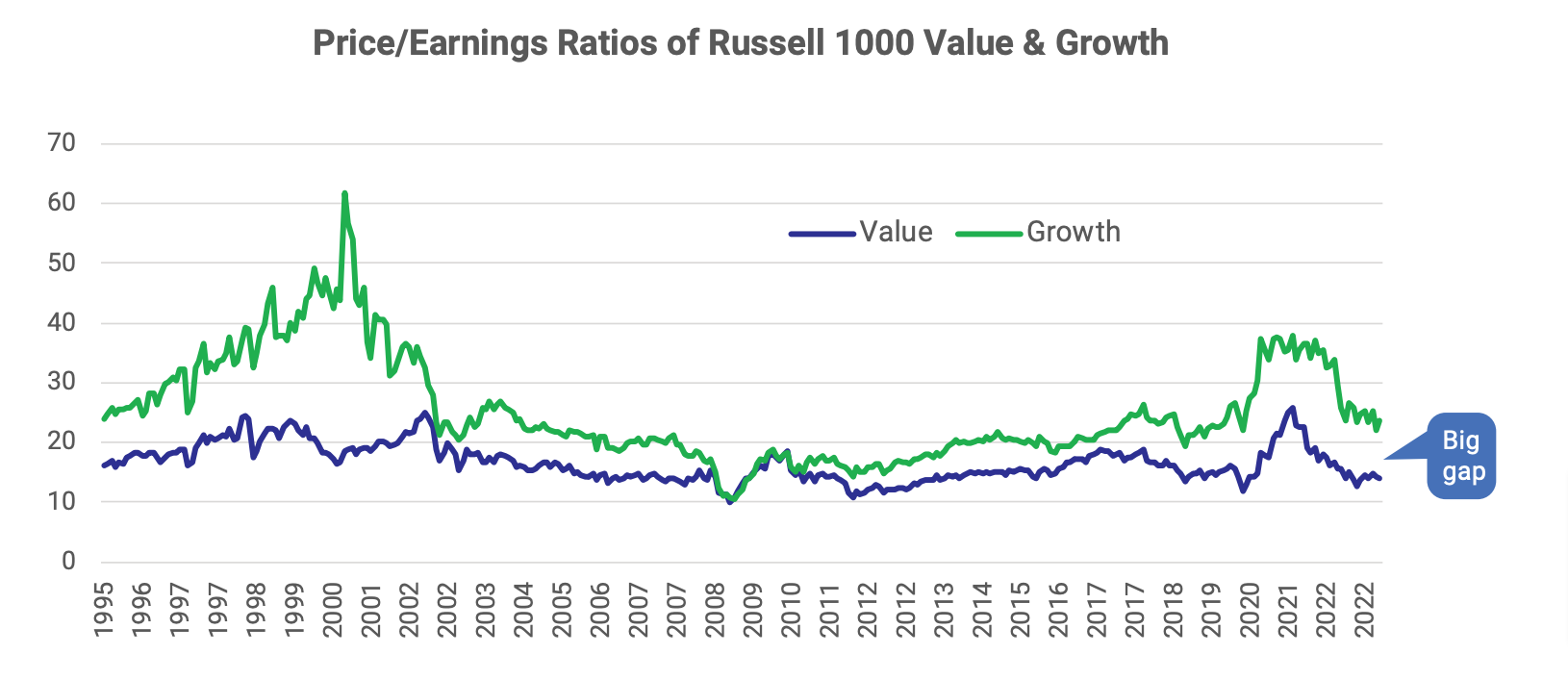

Value stocks are cheap relative to Growth stocks

The below chart shows the price/earnings ratios of the Russell 1000 Value and Growth indices of large US stocks. When the gap between the P/E ratios has been large it has been a good time to favor Value stocks over Growth stocks.

The current gap between these P/E ratios is in the top 10% of all observations since 1991. On average when the gap has been in the top 20%, the Russell 1000 Value index outperformed the Russell 1000 Growth index by more than 10% in the following year. According to AQR[2] and others, Value stocks remain about as cheap relative to Growth stocks as they have ever been.

The Silicon Valley Bank failure makes a recession more likely

We are concerned about the stock market rally after the failure of Silicon Valley Bank (SVB) on March 10. From March 10 to 31, the S&P 500 was up by more than 6%, accounting for much of its 7.5% gain for the quarter.

While the banking crisis seems to be contained for the moment and one can argue that SVB had a rather unique business model, the failures of SVB and others could be a sign of fragility in the financial system and in the economy. Until the SVB failure, few investors were focused on the fact that numerous banks have liabilities exceeding the value of their assets. Now that bank customers know this, they are starting to reduce their bank deposits. A recent report[3] indicates that if US customers quickly reduced their uninsured bank deposits by half, another 186 US banks would be at risk of failure.

What has not been as widely understood is that small and mid-size banks account for about two-thirds of the commercial mortgage lending in the US, and these banks are more vulnerable than the largest banks. The stress on banks will tighten financial conditions, putting more pressure on an economy still digesting the rapid increase in interest rates by the Fed. This is the main reason why most economists increased their probability of a US recession after the SVB failure.

Summary

The Q1 Value vs. Growth performance gap was so large that it is tempting to argue that the worst impacts of rising interest rates are behind us and it’s time to embrace Growth and cyclical stocks again. However, we believe that the risk of a recession remains, and the probability of a recession increased after the failures of Silicon Valley Bank and other banks. Given the large gap between Value and Growth valuations as well as the continued economic uncertainty, it might be a good opportunity to capture the unexpected windfall gains on Growth stocks, and shift toward more defensive Value stocks instead.

For years, active retail traders have exhorted one another to “Buy the Dip,” or BTD. More than just buying the dip, they often crowded into a few themes and individual stocks that were popular on social media: electric vehicles, crypto, fintech, gaming, to name a few. Last year was a punishing one for BTD investors. Using the ARK Innovation ETF as a proxy for retail favorites, ARKK was down 67% in 2022 vs. -18% for the S&P 500 and -32% for the Nasdaq 100.

Despite last year’s losses, BTD investors retain some potency. In the first quarter of 2023, the beaten-down Growth stocks rallied back vigorously. Meanwhile, Value names, last year’s safe havens, fell to the bottom of the Q1 performance rankings. In fact, Q1 2023 is one of the worst quarters in history for the performance of Value stocks relative to Growth stocks.

Could it be that the rebound of Growth stocks in the last quarter is a sign that the comeback from last year’s bear market is now firmly underway?

While we are sympathetic to this argument, we would note several observations that give us pause:

If we are right, the current moment offers a good opportunity for investors to take profits on Growth stocks and rotate to more defensive Value holdings.

Historically large Value/Growth performance divergence

In Q1 2023, the Russell 1000 Value index of large US stocks rose only 1%, vs. 14% for the Russell 1000 Growth index. As the chart below shows, this is one of the worst performances for Value stocks vs. Growth stocks in a quarter. In the last 25 years, the only other times Value stocks have done as badly were during the final burst of speculation in the tech bubble and in the recoveries from the bottom of the bear markets caused by the Global Financial Crisis and the COVID shutdown. Our premise is that Q1 2023 is more likely to be like 1999, another burst of excess from BTD investors – rather than a sign of a durable recovery from a bear market.

“Growth” stocks are not experiencing “growth”

One can understand paying premium price/earnings ratios for stocks or sectors which have very strong earnings growth. But do high multiples make sense when real earnings are shrinking?

The below chart shows the real (inflation adjusted) one year forward projected earnings of the three most Growth-oriented US sectors, as well as for as the NASDAQ 100 and the S&P 500[1]. Growth stock enthusiasts should be concerned that, on average, real earnings expectations for many of their favorite stocks are declining, faster than for the earnings of S&P 500 as a whole. If there is a recession, earnings growth could become even worse.

Value stocks are cheap relative to Growth stocks

The below chart shows the price/earnings ratios of the Russell 1000 Value and Growth indices of large US stocks. When the gap between the P/E ratios has been large it has been a good time to favor Value stocks over Growth stocks.

The current gap between these P/E ratios is in the top 10% of all observations since 1991. On average when the gap has been in the top 20%, the Russell 1000 Value index outperformed the Russell 1000 Growth index by more than 10% in the following year. According to AQR[2] and others, Value stocks remain about as cheap relative to Growth stocks as they have ever been.

The Silicon Valley Bank failure makes a recession more likely

We are concerned about the stock market rally after the failure of Silicon Valley Bank (SVB) on March 10. From March 10 to 31, the S&P 500 was up by more than 6%, accounting for much of its 7.5% gain for the quarter.

While the banking crisis seems to be contained for the moment and one can argue that SVB had a rather unique business model, the failures of SVB and others could be a sign of fragility in the financial system and in the economy. Until the SVB failure, few investors were focused on the fact that numerous banks have liabilities exceeding the value of their assets. Now that bank customers know this, they are starting to reduce their bank deposits. A recent report[3] indicates that if US customers quickly reduced their uninsured bank deposits by half, another 186 US banks would be at risk of failure.

What has not been as widely understood is that small and mid-size banks account for about two-thirds of the commercial mortgage lending in the US, and these banks are more vulnerable than the largest banks. The stress on banks will tighten financial conditions, putting more pressure on an economy still digesting the rapid increase in interest rates by the Fed. This is the main reason why most economists increased their probability of a US recession after the SVB failure.

Summary

The Q1 Value vs. Growth performance gap was so large that it is tempting to argue that the worst impacts of rising interest rates are behind us and it’s time to embrace Growth and cyclical stocks again. However, we believe that the risk of a recession remains, and the probability of a recession increased after the failures of Silicon Valley Bank and other banks. Given the large gap between Value and Growth valuations as well as the continued economic uncertainty, it might be a good opportunity to capture the unexpected windfall gains on Growth stocks, and shift toward more defensive Value stocks instead.

[1] Source, Bloomberg. S5COND, S5INFT, S5TELS, NDX, SPX. Chart rescales each series such that April 2021 = 1.

[2] https://www.aqr.com/Insights/Research/White-Papers/Value-Why-Now-Capturing-the-Comeback-in-Its-Early-Innings

[3] Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs? by Erica Xuewei Jiang, Gregor Matvos, Tomasz Piskorski, Amit Seru :: SSRN

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

September 2024 Recap

August 2024 Recap

July 2024 Stock Recap

June 2024 Recap