In the investment community, the year 1999 has a special place in history; investors in the S&P 500 lost more than 40% in the subsequent bear market. It was a different type of bear market from the Global Financial Crisis in 2007-2008 or the Covid-induced shock of March 2020 in that it began at a point of extreme valuation levels and euphoria about new market participants. Ever since, arguments about whether the current stock market is (or isn’t) like 1999 have been a recurring topic in market commentary, especially when the stock market hits new heights.

So, it’s not surprising at all that there has been escalating chatter about “is it like 1999?” all over the place in 2021 as the S&P hit record highs 68 times (vs. only 35 times in 1999). While we are no market pundits, we, like many veteran investors, have quite a queasy feeling in the stomach – the similarities between now and 1999 are hard to ignore.

High Prices for Innovative Companies

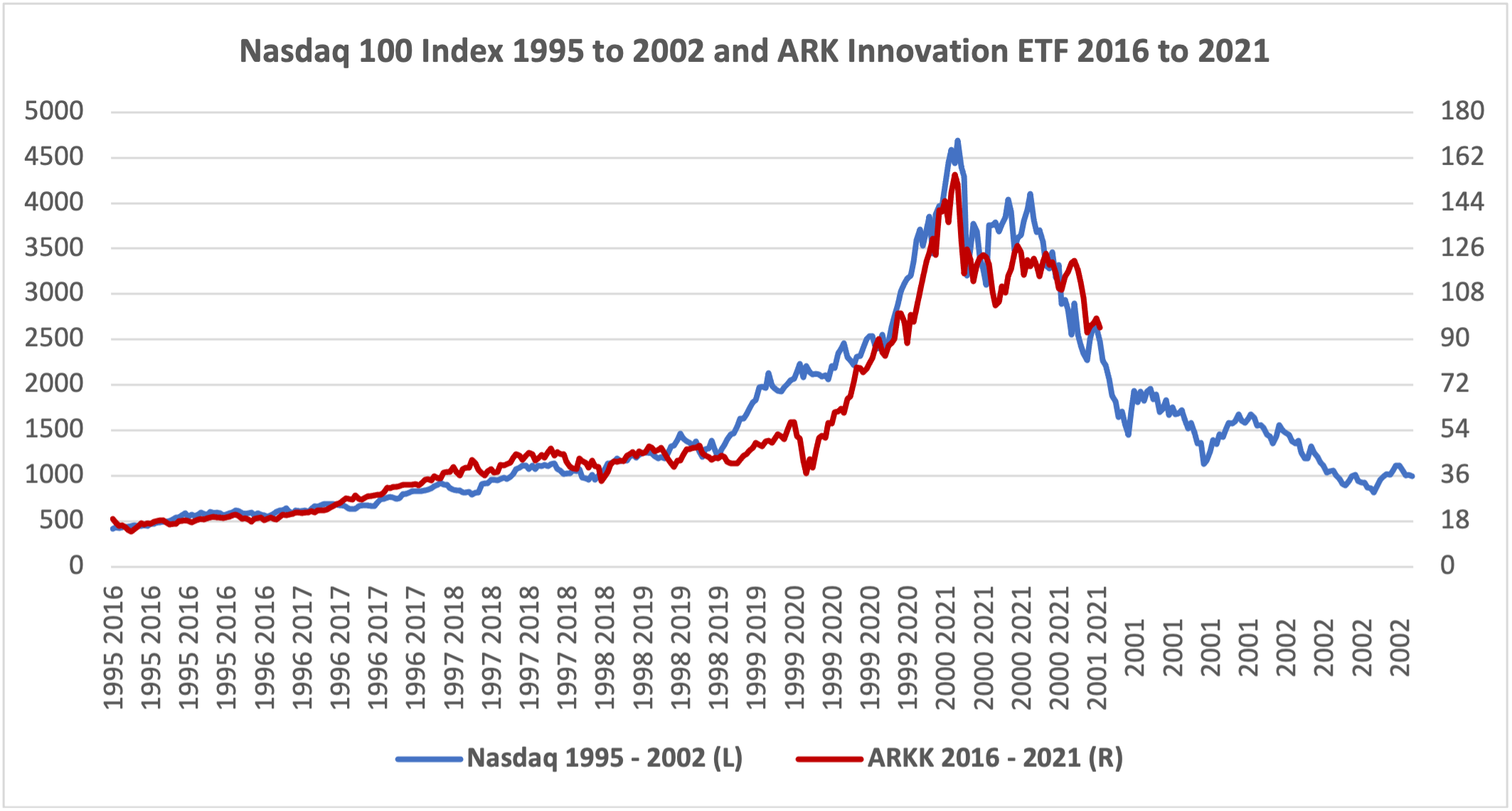

One striking similarity between now and 1999 is the great enthusiasm for new companies with innovative business models. The line in blue on the chart below is the NASDAQ 100 index from 1995 to 2002, representing investment in the innovative companies of the tech boom. The line in red is the price of the Ark Innovation ETF (ticker ARKK), starting in 2016, which invests in the innovative companies of today. The price patterns are quite similar so far – accelerating price growth leading to an explosive surge to a sharp peak, followed by nearly a year of sideways trading and then the correction begins.

Source: Bloomberg, NDX Index, ARKK US Equity

Source: Bloomberg, NDX Index, ARKK US Equity

Exceptionally Elevated Valuations

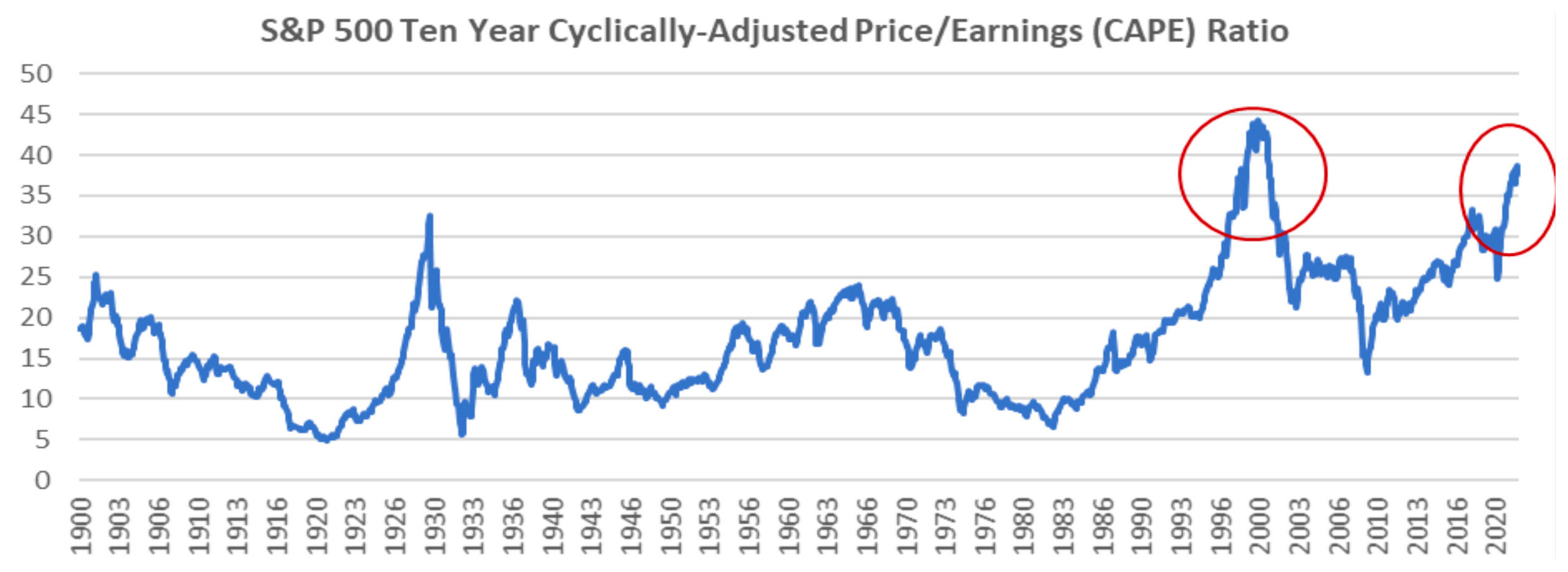

Another striking similarity is the extreme valuation metrics for the S&P 500. The chart below shows the cyclically adjusted price earnings (CAPE) ratio for the S&P 500 since 1900. The CAPE ratio is calculated by dividing the S&P 500 index price by the average inflation-adjusted earnings of the past ten years. It was developed by Nobel laureate Robert Shiller, who demonstrated that future S&P 500 returns are strongly influenced by starting valuations, with high CAPEs leading to low future returns. Based on this research, the currently elevated CAPE of nearly 40 portends worse than usual outcomes for US equity investors.

Source: Robert Shiller Dataset: http://www.econ.yale.edu/~shiller/data.htm, Jan 1900 to December 2021.

Another long-term value metric is the ratio of the market value of the S&P 500 to the GDP of the United States. This relationship was popularized by Warren Buffett, who called it “the best single measure of where valuations stand at any given moment.” As the chart to the right1 indicates, this ratio has never been more elevated. It shouldn’t be a surprise that Mr. Buffett’s Berkshire Hathaway now holds $500 billion in cash and equivalents, the most ever held by the company.

When we compare 1999 to 2021 on shorter-term valuation metrics2, the price to earnings ratios are a bit better (lower) now than in 1999, and price to book is about the same. But the ratios of price to Cash flow, EBITDA and Sales are much worse now than in 1999. The right column in the table shows the percentile of the 2021 value metric relative to the prior history. Most are close to 100% meaning they are among the highest (worst) readings for that metric in US stock market history.

| Ratio of Price to: |

1999 |

2021 |

Percentile |

| Trailing Earnings |

29.3 |

26.2 |

94% |

| Forward Earnings |

26.8 |

23.2 |

90% |

| Book Value |

5.0 |

4.9 |

99% |

| Cash Flow |

16.5 |

19.8 |

98% |

| EBITDA |

10.7 |

15.6 |

98% |

| Sales |

2.3 |

3.2 |

100% |

1 Source: Goldman Sachs research report “Piloting Through”, Sharmin Mossavar-Rahmani, et. al., January 2022

2 Source: Bloomberg, SPX Index, percentile based on period since 1965 or beginning of data series.

Monetary Policy Tightening

The dot-com bust which began in 2000 is attributed to the combination of extreme starting valuation of the stock market and monetary policy tightening by the Federal Reserve. A series of regular increases took the Federal Funds rate from 4.75% in mid-1999 to 6.5% in mid-2000. Tighter monetary policy weakened the US economy, which went into recession in early 2001. The Fed has indicated they will begin tightening soon to counteract the surge in inflation, which turned out to not be “transitory”. Since higher interest rates tend to slow the economy, we could once again have a dangerous combination of exuberant market prices being out of sync with slowing economic growth.

US Economic Trend (Worse Now)

And in fact the economic picture now is already less favorable than in 1999. Changes in stock prices tend to align with the changes in the economic data3. An important difference between 1999 and now is that in 1999 the US economic data had a positive and improving trend. The current trend in the US economic data is barely positive and worsening.

Inflation (Worse Now)

Inflation poses another economic problem for US equity investors. The most recent year saw US inflation of 6.8%, vastly higher than the 2.7% experienced in 1999. Usually, spikes in inflation have been detrimental to equity outcomes, at least in the short term.

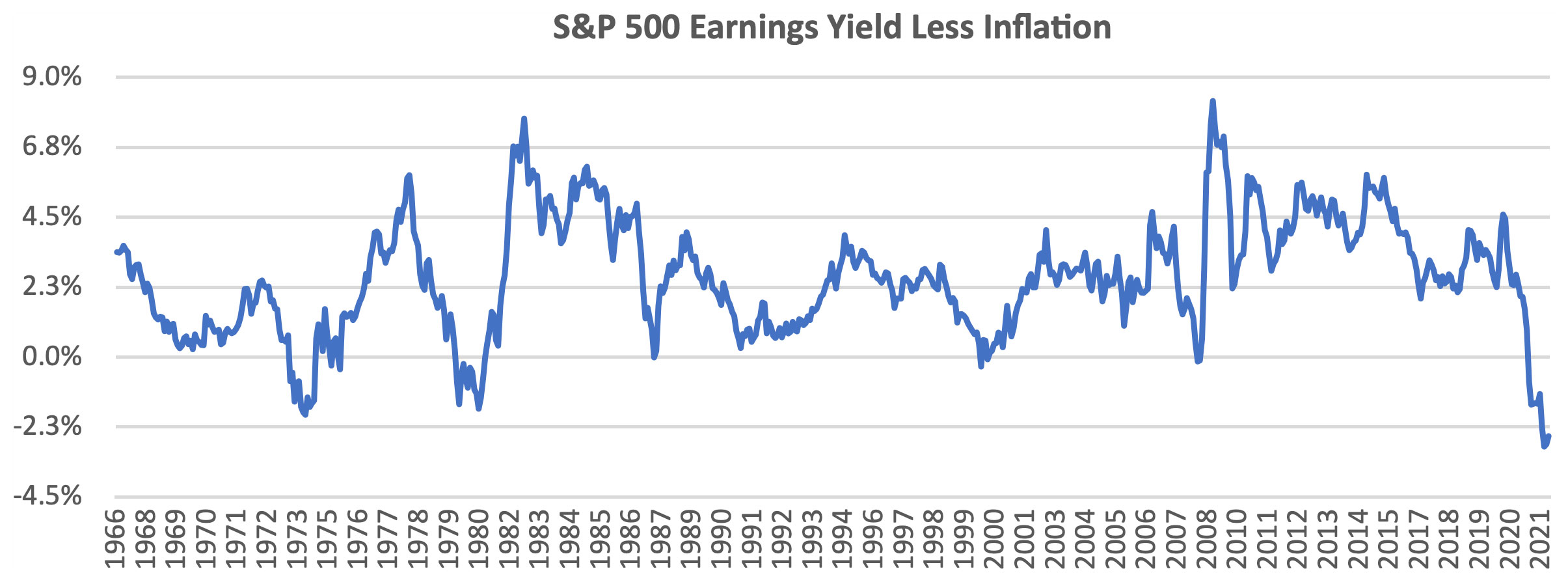

Stock market bulls argue that the lofty valuations of US equities make sense because US interest rates are historically low. The December 2021 P/E ratio of 26.2 means an earnings yield (E/P) of 3.8%, which was perhaps not so bad given that the 10-year US treasury bond yield was just 1.7%. Back in December 1999, the P/E of 29.3 provided an earnings yield of 3.4%, which was 3% lower than the 10-year treasury yield of 6.4%. But, as we discussed in a prior letter4, market intervention by the Federal Reserve has caused US interest rates to be far below where they normally would be given current levels of inflation and economic growth. We believe it is more valid to compare the earnings yield of the S&P 500 to the current rate of inflation, as in the chart below. On that basis, the US stock market earnings yield today is farther below inflation than at any time in the past 75 years.

3 See: https://atlasca.com/core-concepts/markets-and-the-economy/

4 https://atlasca.com/understanding_disconnect/

Source Bloomberg: SPX Index, CPI Indx Index, December 1966 to December 2021

Credit Market Conditions (Worse Now)

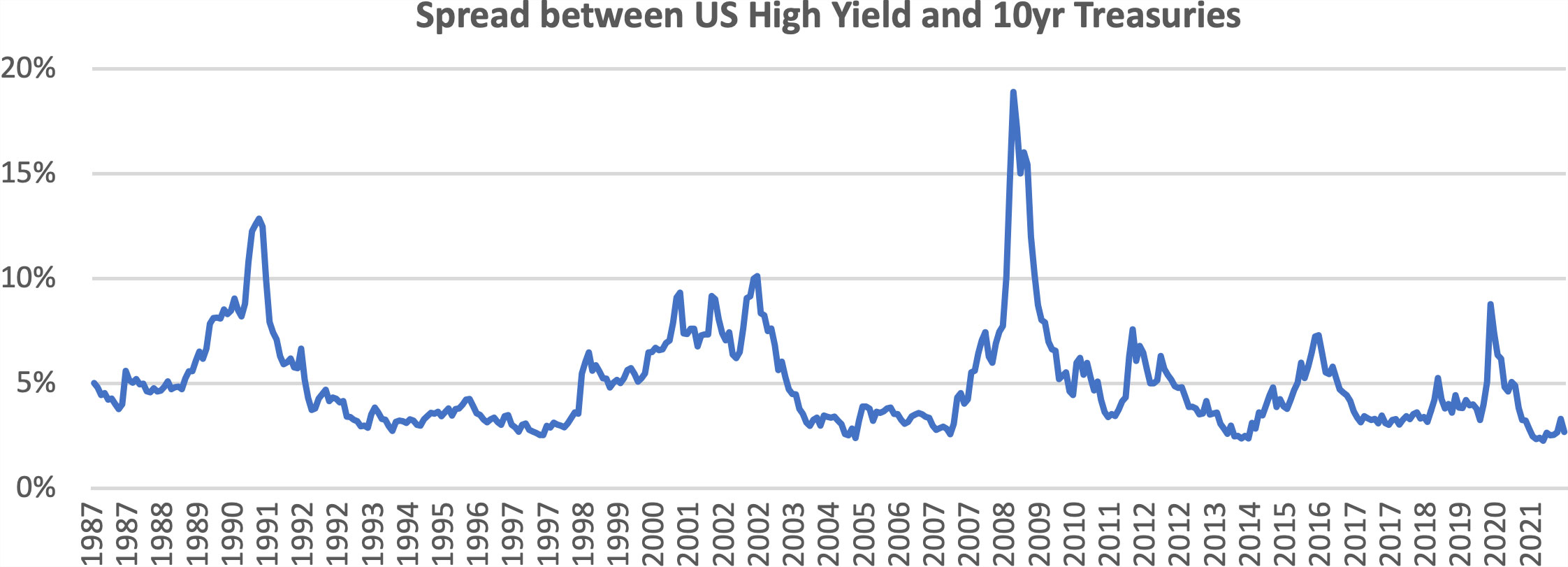

An important component of the Atlas equity risk dashboard is the state of the credit market5. The most severe equity bear markets were those which were accompanied by disruption in credit markets. Credit-related metrics are worse today than they were in 1999. Corporate debt is a higher proportion of GDP now than then. Below investment grade and BBB-rated debt is a much higher proportion of overall credit now than it was in 1999. Despite this, at the end of 2021 the spread between high-yield debt and US government debt was just 2.7%, only 0.5% above the lowest ever observed and much lower than the 5.1% spread available in December 1999.If Fed tightening leads to an economic slowdown, the credit markets are not yet priced for it.

Source Bloomberg: CSI BARC Index, Jan 1987 to Dec 2021

Source Bloomberg: CSI BARC Index, Jan 1987 to Dec 2021

5 https://atlasca.com/equity-downside-risk-dashboard/

Conditions for Financial Crisis

Recently, Harvard professor Robin Greenwood and colleagues published a working paper6 with the results of their research on financial crises across time and countries. They found that when the conditions below were present, the probably of a financial crisis in the next three years was 40%:

- Elevated equity market valuations

- High market volatility

- A surge in household and/or corporate borrowing

- Growth of higher-risk credit as a share of total credit

- Surge in initial public offerings of stocks

- Disproportionate rise in the prices of newer firms

- General signs of “speculative excess”

These conditions are easy to observe now. But one should bear in mind this implies only a 40% chance of crisis and over the next three years, so not necessarily right away.

Conclusion

Frothy equity valuations by themselves are rarely sufficient to trigger an equity bear market. Usually, valuations are high for understandable reasons: the economy is good, earnings are growing, interest rates are low, credit is readily available, etc. Most of the large and prolonged bear markets of the past began when stocks were expensive and then there was a catalyst, a “left tail” event, which tempered market optimism. Many potential “catalyst” events do not end up causing a lasting market correction (think trade war with China, COVID, US election mess, surging inflation, to name a few). There are clearly quite a few possible catalysts on the horizon: Fed tightening slows the economy, financial instability in China, a resurgence in COVID infections, etc. While catalysts are usually easy to identify, the market’s reaction to them is unpredictable.

Nevertheless, we observe that many of the characteristics of the 1999 bubble market are present today, and some market and economic conditions are even worse now than in 1999. Therefore, we believe that US equity returns in the next three years will be meaningfully lower than investors enjoyed in the last three years. With lower expected returns and potentially high volatility as well, we are advising clients to be cautious about their US equity positioning.

6Source: “Predictable Financial Crises”, Robin Greenwood, et. al, 2021, https://www.hbs.edu/ris/Publication%20Files/20-130_77e0879b-606a-4bbe-bd5a-1aa9dd77b6fe.pdf

In the investment community, the year 1999 has a special place in history; investors in the S&P 500 lost more than 40% in the subsequent bear market. It was a different type of bear market from the Global Financial Crisis in 2007-2008 or the Covid-induced shock of March 2020 in that it began at a point of extreme valuation levels and euphoria about new market participants. Ever since, arguments about whether the current stock market is (or isn’t) like 1999 have been a recurring topic in market commentary, especially when the stock market hits new heights.

So, it’s not surprising at all that there has been escalating chatter about “is it like 1999?” all over the place in 2021 as the S&P hit record highs 68 times (vs. only 35 times in 1999). While we are no market pundits, we, like many veteran investors, have quite a queasy feeling in the stomach – the similarities between now and 1999 are hard to ignore.

High Prices for Innovative Companies

One striking similarity between now and 1999 is the great enthusiasm for new companies with innovative business models. The line in blue on the chart below is the NASDAQ 100 index from 1995 to 2002, representing investment in the innovative companies of the tech boom. The line in red is the price of the Ark Innovation ETF (ticker ARKK), starting in 2016, which invests in the innovative companies of today. The price patterns are quite similar so far – accelerating price growth leading to an explosive surge to a sharp peak, followed by nearly a year of sideways trading and then the correction begins.

Exceptionally Elevated Valuations

Another striking similarity is the extreme valuation metrics for the S&P 500. The chart below shows the cyclically adjusted price earnings (CAPE) ratio for the S&P 500 since 1900. The CAPE ratio is calculated by dividing the S&P 500 index price by the average inflation-adjusted earnings of the past ten years. It was developed by Nobel laureate Robert Shiller, who demonstrated that future S&P 500 returns are strongly influenced by starting valuations, with high CAPEs leading to low future returns. Based on this research, the currently elevated CAPE of nearly 40 portends worse than usual outcomes for US equity investors.

Source: Robert Shiller Dataset: http://www.econ.yale.edu/~shiller/data.htm, Jan 1900 to December 2021.

Another long-term value metric is the ratio of the market value of the S&P 500 to the GDP of the United States. This relationship was popularized by Warren Buffett, who called it “the best single measure of where valuations stand at any given moment.” As the chart to the right1 indicates, this ratio has never been more elevated. It shouldn’t be a surprise that Mr. Buffett’s Berkshire Hathaway now holds $500 billion in cash and equivalents, the most ever held by the company.

When we compare 1999 to 2021 on shorter-term valuation metrics2, the price to earnings ratios are a bit better (lower) now than in 1999, and price to book is about the same. But the ratios of price to Cash flow, EBITDA and Sales are much worse now than in 1999. The right column in the table shows the percentile of the 2021 value metric relative to the prior history. Most are close to 100% meaning they are among the highest (worst) readings for that metric in US stock market history.

1 Source: Goldman Sachs research report “Piloting Through”, Sharmin Mossavar-Rahmani, et. al., January 2022

2 Source: Bloomberg, SPX Index, percentile based on period since 1965 or beginning of data series.

Monetary Policy Tightening

The dot-com bust which began in 2000 is attributed to the combination of extreme starting valuation of the stock market and monetary policy tightening by the Federal Reserve. A series of regular increases took the Federal Funds rate from 4.75% in mid-1999 to 6.5% in mid-2000. Tighter monetary policy weakened the US economy, which went into recession in early 2001. The Fed has indicated they will begin tightening soon to counteract the surge in inflation, which turned out to not be “transitory”. Since higher interest rates tend to slow the economy, we could once again have a dangerous combination of exuberant market prices being out of sync with slowing economic growth.

US Economic Trend (Worse Now)

And in fact the economic picture now is already less favorable than in 1999. Changes in stock prices tend to align with the changes in the economic data3. An important difference between 1999 and now is that in 1999 the US economic data had a positive and improving trend. The current trend in the US economic data is barely positive and worsening.

Inflation (Worse Now)

Inflation poses another economic problem for US equity investors. The most recent year saw US inflation of 6.8%, vastly higher than the 2.7% experienced in 1999. Usually, spikes in inflation have been detrimental to equity outcomes, at least in the short term.

Stock market bulls argue that the lofty valuations of US equities make sense because US interest rates are historically low. The December 2021 P/E ratio of 26.2 means an earnings yield (E/P) of 3.8%, which was perhaps not so bad given that the 10-year US treasury bond yield was just 1.7%. Back in December 1999, the P/E of 29.3 provided an earnings yield of 3.4%, which was 3% lower than the 10-year treasury yield of 6.4%. But, as we discussed in a prior letter4, market intervention by the Federal Reserve has caused US interest rates to be far below where they normally would be given current levels of inflation and economic growth. We believe it is more valid to compare the earnings yield of the S&P 500 to the current rate of inflation, as in the chart below. On that basis, the US stock market earnings yield today is farther below inflation than at any time in the past 75 years.

3 See: https://atlasca.com/core-concepts/markets-and-the-economy/

4 https://atlasca.com/understanding_disconnect/

Source Bloomberg: SPX Index, CPI Indx Index, December 1966 to December 2021

Credit Market Conditions (Worse Now)

An important component of the Atlas equity risk dashboard is the state of the credit market5. The most severe equity bear markets were those which were accompanied by disruption in credit markets. Credit-related metrics are worse today than they were in 1999. Corporate debt is a higher proportion of GDP now than then. Below investment grade and BBB-rated debt is a much higher proportion of overall credit now than it was in 1999. Despite this, at the end of 2021 the spread between high-yield debt and US government debt was just 2.7%, only 0.5% above the lowest ever observed and much lower than the 5.1% spread available in December 1999.If Fed tightening leads to an economic slowdown, the credit markets are not yet priced for it.

5 https://atlasca.com/equity-downside-risk-dashboard/

Conditions for Financial Crisis

Recently, Harvard professor Robin Greenwood and colleagues published a working paper6 with the results of their research on financial crises across time and countries. They found that when the conditions below were present, the probably of a financial crisis in the next three years was 40%:

These conditions are easy to observe now. But one should bear in mind this implies only a 40% chance of crisis and over the next three years, so not necessarily right away.

Conclusion

Frothy equity valuations by themselves are rarely sufficient to trigger an equity bear market. Usually, valuations are high for understandable reasons: the economy is good, earnings are growing, interest rates are low, credit is readily available, etc. Most of the large and prolonged bear markets of the past began when stocks were expensive and then there was a catalyst, a “left tail” event, which tempered market optimism. Many potential “catalyst” events do not end up causing a lasting market correction (think trade war with China, COVID, US election mess, surging inflation, to name a few). There are clearly quite a few possible catalysts on the horizon: Fed tightening slows the economy, financial instability in China, a resurgence in COVID infections, etc. While catalysts are usually easy to identify, the market’s reaction to them is unpredictable.

Nevertheless, we observe that many of the characteristics of the 1999 bubble market are present today, and some market and economic conditions are even worse now than in 1999. Therefore, we believe that US equity returns in the next three years will be meaningfully lower than investors enjoyed in the last three years. With lower expected returns and potentially high volatility as well, we are advising clients to be cautious about their US equity positioning.

6Source: “Predictable Financial Crises”, Robin Greenwood, et. al, 2021, https://www.hbs.edu/ris/Publication%20Files/20-130_77e0879b-606a-4bbe-bd5a-1aa9dd77b6fe.pdf

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

What are credit spreads telling us about the U.S. stock market?

October 2024 Recap

September 2024 Recap

August 2024 Recap