Investment theory suggests that investors are sensible and adjust prices based upon risk. Assets with very low risk (such as US Treasury bills) are priced to provide a low return, while assets with very high risk (e.g., start-up companies that have just gone public) provide high future returns. However, empirical data suggests that this relationship breaks down within the stock market. The stocks with the highest volatility do not generate the highest returns.

The comparison looks even worse based on the ratio of a future return to risk. As with other factors, there is a debate about why higher-risk and higher returns stocks do not reward investors with high returns, on average. A behavioral explanation is that investors may consider high-flying stocks to be like lottery tickets and are willing to pay elevated prices on the chance of picking a winner.

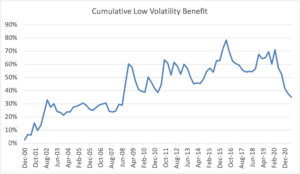

As an example of the potential benefit of low volatility investing, the chart shows the cumulative difference in return between the MSCI ACWI minimum volatility index and the MSCI ACWI (capitalization-weighted) index. Investors in the minimum volatility index would have earned about 35% more return than the capitalization-weighted index in the period from December 1998 to June 2021.

The period since March 2020 has been unfavorable for this factor, as the high volatility stocks have boomed. Low volatility tends to be a useful factor in downturns, as in 2000 – 2002 and 2008. It has a relatively low weight in the Atlas Capital multi-factor model.

Source: Bloomberg, M00IWD$O Index for ACWI (All-Country World Index, an index of global equities) minimum volatility and NDUEACWF for ACWI cap-weighted. The ratio of the cumulative return of ACWI minvol to the cumulative return of ACWI capitalization-weighted.