Investors, as people, have a tendency to favor what they know. They are more comfortable, feel like they are taking less risk, investing in markets they know. Many individuals can claim that their instincts, their feelings, have been drivers of their professional successes. As such, the majority of US investors tend to favor US markets. And why not, the US is home to the most efficient, largest, capital formation environment. However, the US, by no means, is the only viable equity market. Investors know this, yet still hesitate to tread into foreign waters. It’s important to recognize that capital has no feelings, no instincts; it’s agnostic. Capital ultimately flows to where it can earn the most efficient returns. Frequently, capital flows into the US. But, capital doesn’t always flow into the US.

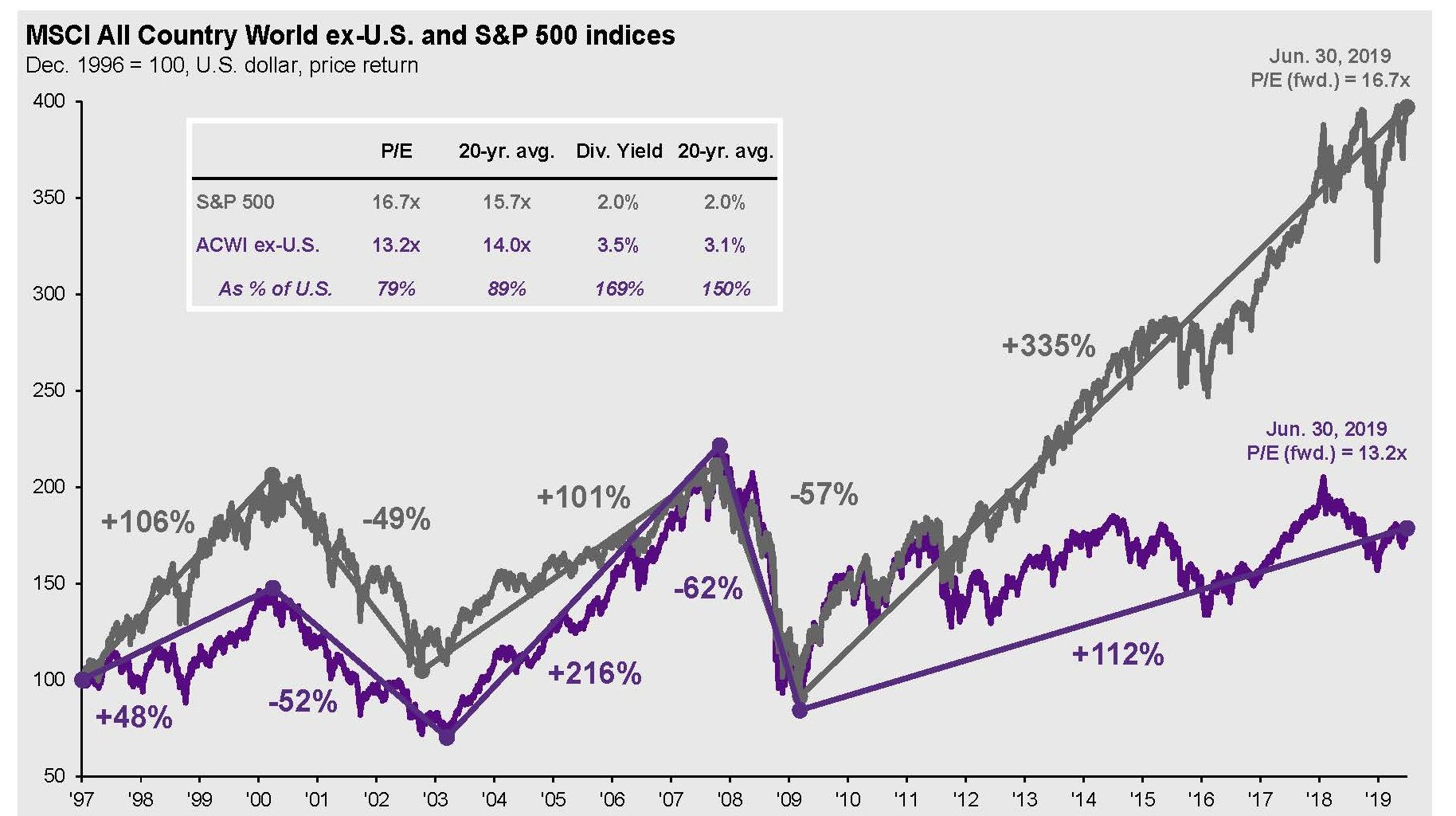

International markets continue to be valued at significant discounts to US markets. The graphic below, produced by JP Morgan research, supports the statement; International stocks are cheaper and higher yielding versus US stocks than their 20-year average.

Constructing a well diversified long term investment portfolio should have a substantial allocation to US stocks. After all, it is the deepest capital market in the world. However, depending on what metrics you use, international equities make up roughly 50% of the global capital market. Does it make sense to completely ignore half of the overall market?

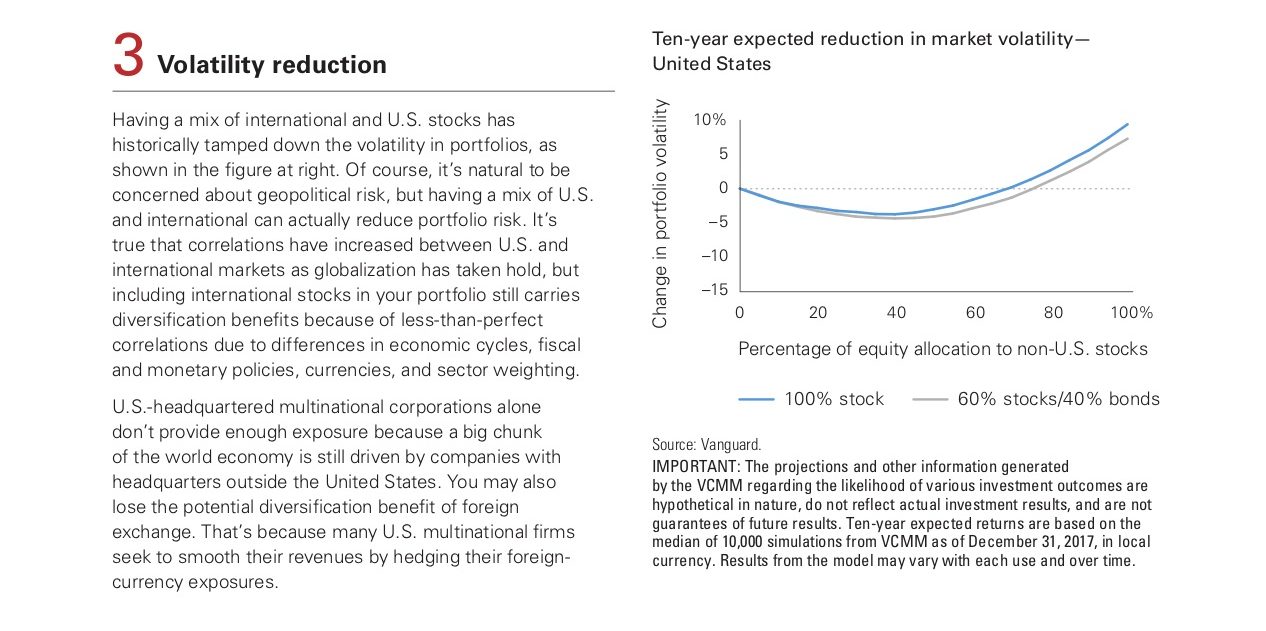

Our friends at Vanguard recently published a short piece supporting some of our perspectives on the merits of having international allocations as part of well constructed investment portfolios.