Key Insights:

- The most important recent development for investors is the surge in bond yields, amplifying the worst bear market for bonds in US history

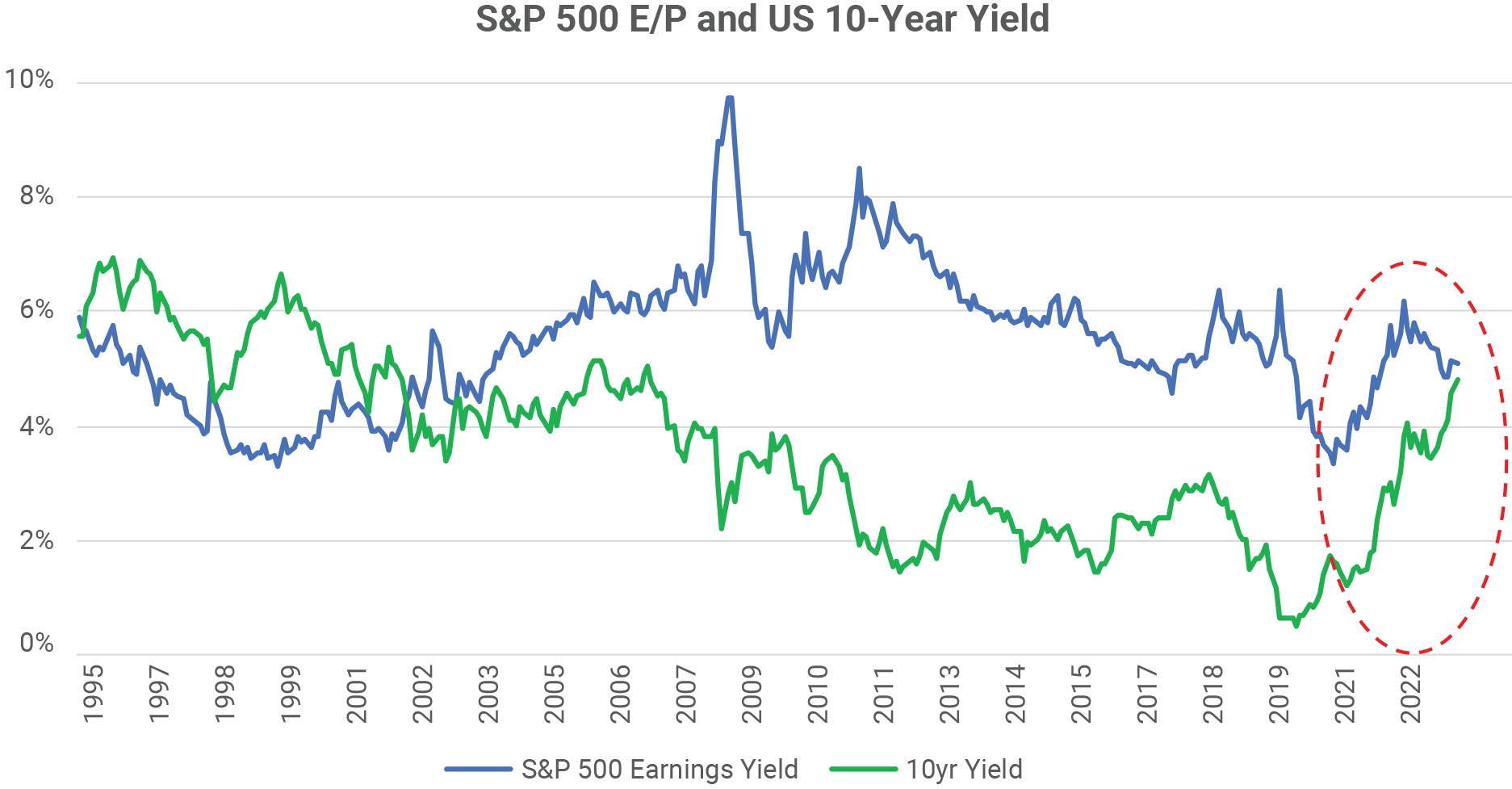

- The US ten-year Treasury yield is on the verge of rising above the earnings yield of the S&P 500 for the first time in over twenty years

- The convergence of US stock market earnings yields and bond yields implies that the future return for US stocks may not be much better than for US bonds

- The rapid doubling (or more) of borrowing costs and the mark-to-market losses on bank balance sheets will curtail lending and pressure US economic growth

A Historic Selloff

Investors generally expect investments in US Treasury securities to provide safety and diversification. In the last three years they have provided neither. The rise in US ten-year yields from 0.5% to 4.8% caused investors in US ten-year Treasury securities to lose 25% of their investment. This is by far the largest three-year loss experienced by investors in US ten-year Treasuries. The only other time that ten-year rates rose more than 4% in three years was in the early 1980’s, but at that time coupon payments in excess of 10% per year cushioned the blow. Since US stocks are now down only 7% since December 2021, the bear market in bonds has become much larger than the bear market in stocks.

Bond Yields Catch Up to Stock Yields

US ten-year yields have nearly caught up to the earnings yield for the S&P 500. The main implication of the convergence of bond yields with stock yields is that the stock market return is likely to exceed the return of the bond market by a lot less than we have come to expect.

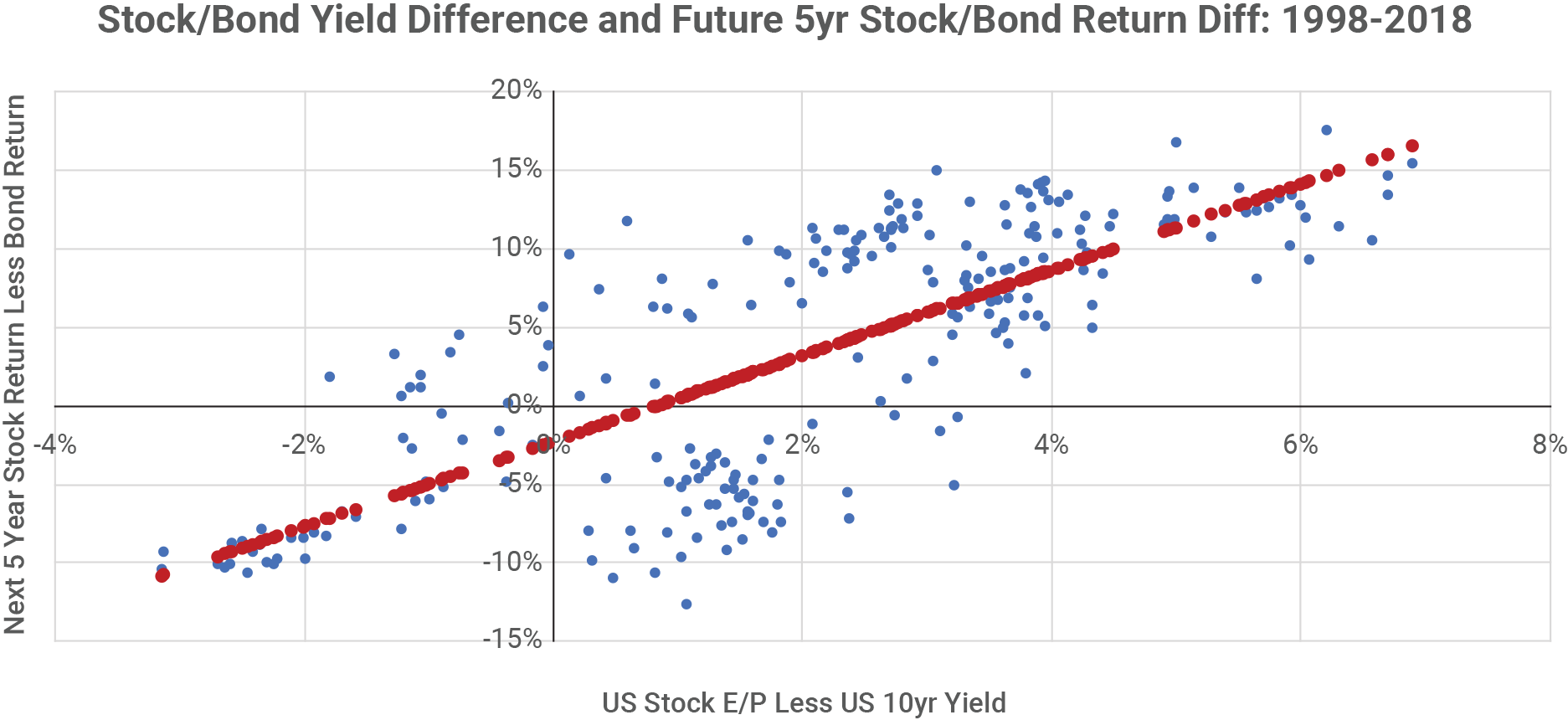

We can see that stock market performance might not be much better than bond market performance in the scatter chart below. Each blue dot on the chart is a monthly observation of the starting difference between the S&P 500 earnings yield (E/P) and the US ten-year yield, and the subsequent five-year annualized return difference. The best fit regression is illustrated by the red dots. While the chart is noisy, the relationship is as we expect – the higher the difference between the earnings yield of stocks and the ten-year yield the more that stock returns exceeded bond returns. When the stock market Earnings/Price was at or lower than the ten-year yield, the stock market tended to deliver lower returns than bonds in the next five years.

The return of the stock market is very difficult to predict over the short term, as we’ve seen this year. However, most estimates of the annual return of the S&P 500 over the next decade, including ours, fall between 6% and 7% per year. An investor would have a good chance of a 6% return over the next decade simply by owning intermediate-term US corporate bonds, which currently yield more than 6%. Since the price volatility of the stock market is more than double the volatility of corporate bonds, equity investors are not being offered much of a return advantage to justify taking the additional risk.

Economic Impacts of Higher Rates Not Felt Yet

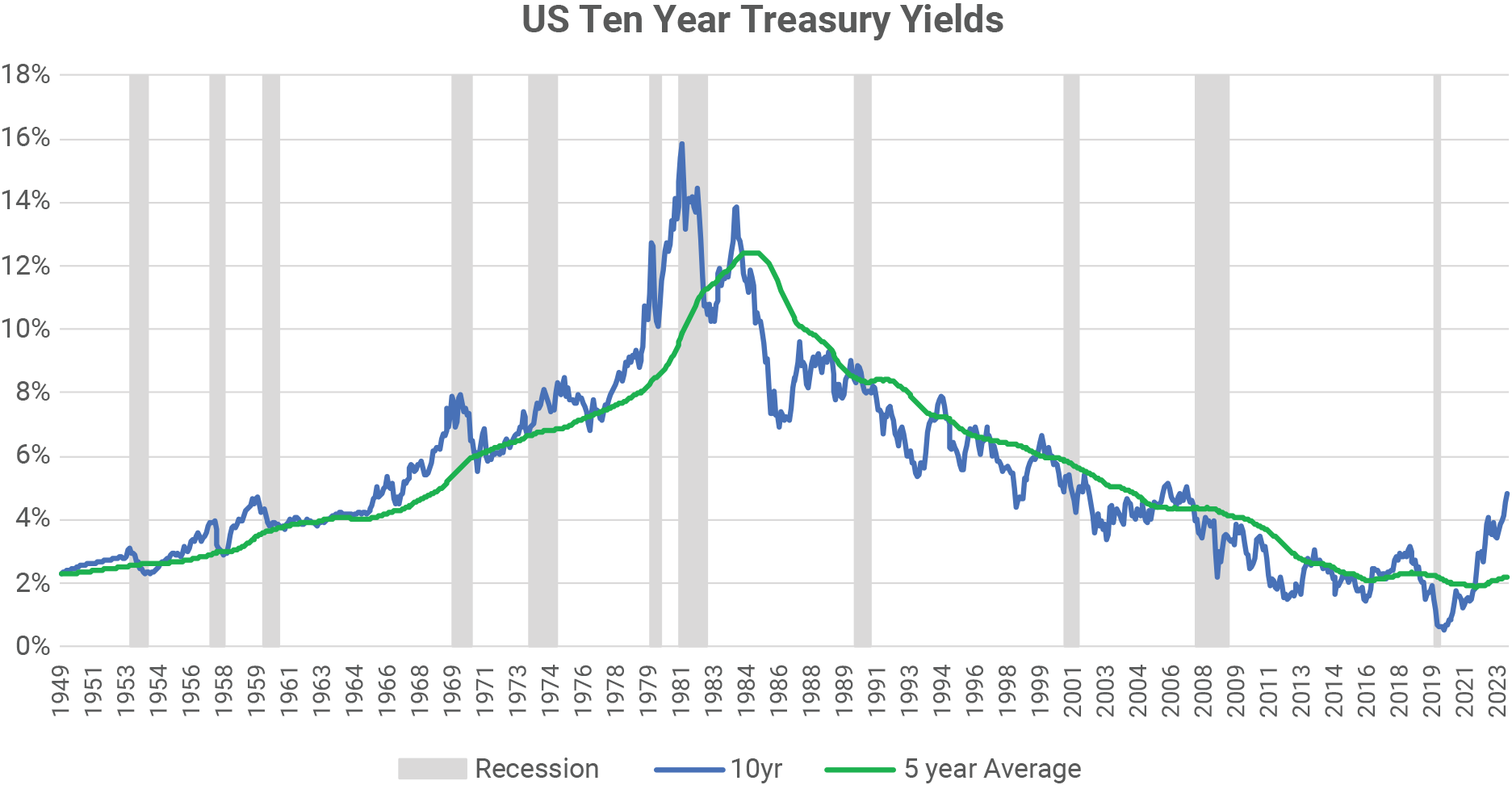

The chart below compares the current 10-year rate to the average over the preceding five years. The current rate has risen 2.6% above the 5-year average, the largest gap in forty years. In the past, whenever the current rate rose well over the prior average the US had a recession. It is a straightforward relationship: economic growth is highly dependent on credit creation. When loans become harder to obtain and more costly, economic growth tends to slow.

What are credit conditions today? While what happened at Silicon Valley Bank back in March seems like ancient history at this point, we think the cycle is far from over so it’s worthwhile to consider whether other banks have similar issues.

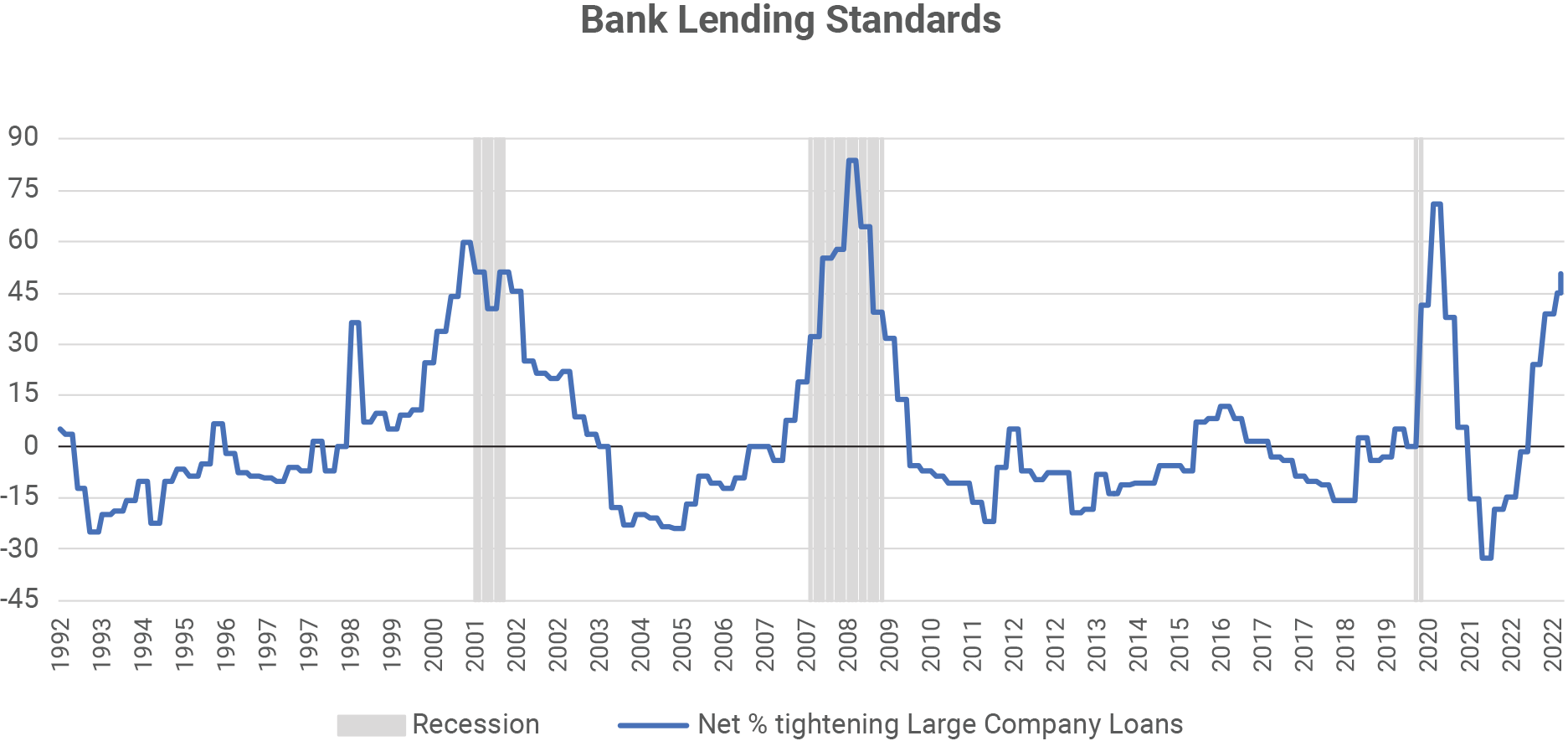

When SVB failed in March, the reason for the exodus of deposits was that losses on the bank’s holdings of US Treasury securities caused the bank to become technically insolvent, with assets worth less than liabilities. Government securities are widespread in the banking system – of the $23 trillion of US commercial bank assets nationwide, more than $4 trillion is US Treasury and agency securities. Commercial banks also hold $5.5 trillion of real estate loans which have been impacted both by rising interest rates and by declines in the market values of underlying properties. Meanwhile, bank deposits are down almost $1 trillion year over year, the largest decline in history. These developments affect the financial health of the banking system. As shown in the following chart, lending standards have only previously been as tight as they are now during the depths of US recessions. Back in March, Silicon Valley Bank failed when the ten-year Treasury was at 3.5%; with the yield at 4.8%, the number of banks with weak balance sheets has increased.

On the demand side for credit, the cost of borrowing has more than doubled in a short period of time. Thirty-year home mortgage rates are 8% now vs. 3% in mid-2021. Investment grade corporate loan rates have jumped from 2% to 6%, while high-yield loans have gone from below 4% to over 9%. While many corporations locked in financing at favorable rates when it was available, as loans come due and need to be refinanced, profits will suffer, and corporate defaults will rise – and we are starting to see loan defaults begin to rise as rates stay higher for longer. Write-offs of bad loans by banks are already as high as they were during the depth of the pandemic recession.

Summary

The stock market needs to offer a higher expected return than the bond market to compensate investors for taking more risk. In the last three years the US ten-year Treasury yield has risen by more than 4%, catching up to the stock market earnings yield. This has caused the expected return advantage of US stocks over US bonds to be much lower than it was three years ago. Moreover, we expect the escalation of borrowing costs and the impairment of the value of assets held by commercial banks will be a negative influence on US economic growth. We maintain a cautious posture toward US equities for Atlas Capital clients.

Key Insights:

A Historic Selloff

Investors generally expect investments in US Treasury securities to provide safety and diversification. In the last three years they have provided neither. The rise in US ten-year yields from 0.5% to 4.8% caused investors in US ten-year Treasury securities to lose 25% of their investment. This is by far the largest three-year loss experienced by investors in US ten-year Treasuries. The only other time that ten-year rates rose more than 4% in three years was in the early 1980’s, but at that time coupon payments in excess of 10% per year cushioned the blow. Since US stocks are now down only 7% since December 2021, the bear market in bonds has become much larger than the bear market in stocks.

Bond Yields Catch Up to Stock Yields

US ten-year yields have nearly caught up to the earnings yield for the S&P 500. The main implication of the convergence of bond yields with stock yields is that the stock market return is likely to exceed the return of the bond market by a lot less than we have come to expect.

We can see that stock market performance might not be much better than bond market performance in the scatter chart below. Each blue dot on the chart is a monthly observation of the starting difference between the S&P 500 earnings yield (E/P) and the US ten-year yield, and the subsequent five-year annualized return difference. The best fit regression is illustrated by the red dots. While the chart is noisy, the relationship is as we expect – the higher the difference between the earnings yield of stocks and the ten-year yield the more that stock returns exceeded bond returns. When the stock market Earnings/Price was at or lower than the ten-year yield, the stock market tended to deliver lower returns than bonds in the next five years.

The return of the stock market is very difficult to predict over the short term, as we’ve seen this year. However, most estimates of the annual return of the S&P 500 over the next decade, including ours, fall between 6% and 7% per year. An investor would have a good chance of a 6% return over the next decade simply by owning intermediate-term US corporate bonds, which currently yield more than 6%. Since the price volatility of the stock market is more than double the volatility of corporate bonds, equity investors are not being offered much of a return advantage to justify taking the additional risk.

Economic Impacts of Higher Rates Not Felt Yet

The chart below compares the current 10-year rate to the average over the preceding five years. The current rate has risen 2.6% above the 5-year average, the largest gap in forty years. In the past, whenever the current rate rose well over the prior average the US had a recession. It is a straightforward relationship: economic growth is highly dependent on credit creation. When loans become harder to obtain and more costly, economic growth tends to slow.

What are credit conditions today? While what happened at Silicon Valley Bank back in March seems like ancient history at this point, we think the cycle is far from over so it’s worthwhile to consider whether other banks have similar issues.

When SVB failed in March, the reason for the exodus of deposits was that losses on the bank’s holdings of US Treasury securities caused the bank to become technically insolvent, with assets worth less than liabilities. Government securities are widespread in the banking system – of the $23 trillion of US commercial bank assets nationwide, more than $4 trillion is US Treasury and agency securities. Commercial banks also hold $5.5 trillion of real estate loans which have been impacted both by rising interest rates and by declines in the market values of underlying properties. Meanwhile, bank deposits are down almost $1 trillion year over year, the largest decline in history. These developments affect the financial health of the banking system. As shown in the following chart, lending standards have only previously been as tight as they are now during the depths of US recessions. Back in March, Silicon Valley Bank failed when the ten-year Treasury was at 3.5%; with the yield at 4.8%, the number of banks with weak balance sheets has increased.

On the demand side for credit, the cost of borrowing has more than doubled in a short period of time. Thirty-year home mortgage rates are 8% now vs. 3% in mid-2021. Investment grade corporate loan rates have jumped from 2% to 6%, while high-yield loans have gone from below 4% to over 9%. While many corporations locked in financing at favorable rates when it was available, as loans come due and need to be refinanced, profits will suffer, and corporate defaults will rise – and we are starting to see loan defaults begin to rise as rates stay higher for longer. Write-offs of bad loans by banks are already as high as they were during the depth of the pandemic recession.

Summary

The stock market needs to offer a higher expected return than the bond market to compensate investors for taking more risk. In the last three years the US ten-year Treasury yield has risen by more than 4%, catching up to the stock market earnings yield. This has caused the expected return advantage of US stocks over US bonds to be much lower than it was three years ago. Moreover, we expect the escalation of borrowing costs and the impairment of the value of assets held by commercial banks will be a negative influence on US economic growth. We maintain a cautious posture toward US equities for Atlas Capital clients.

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

June 2024 Recap

May 2024 Recap

April 2024 Recap

March 2024 Recap