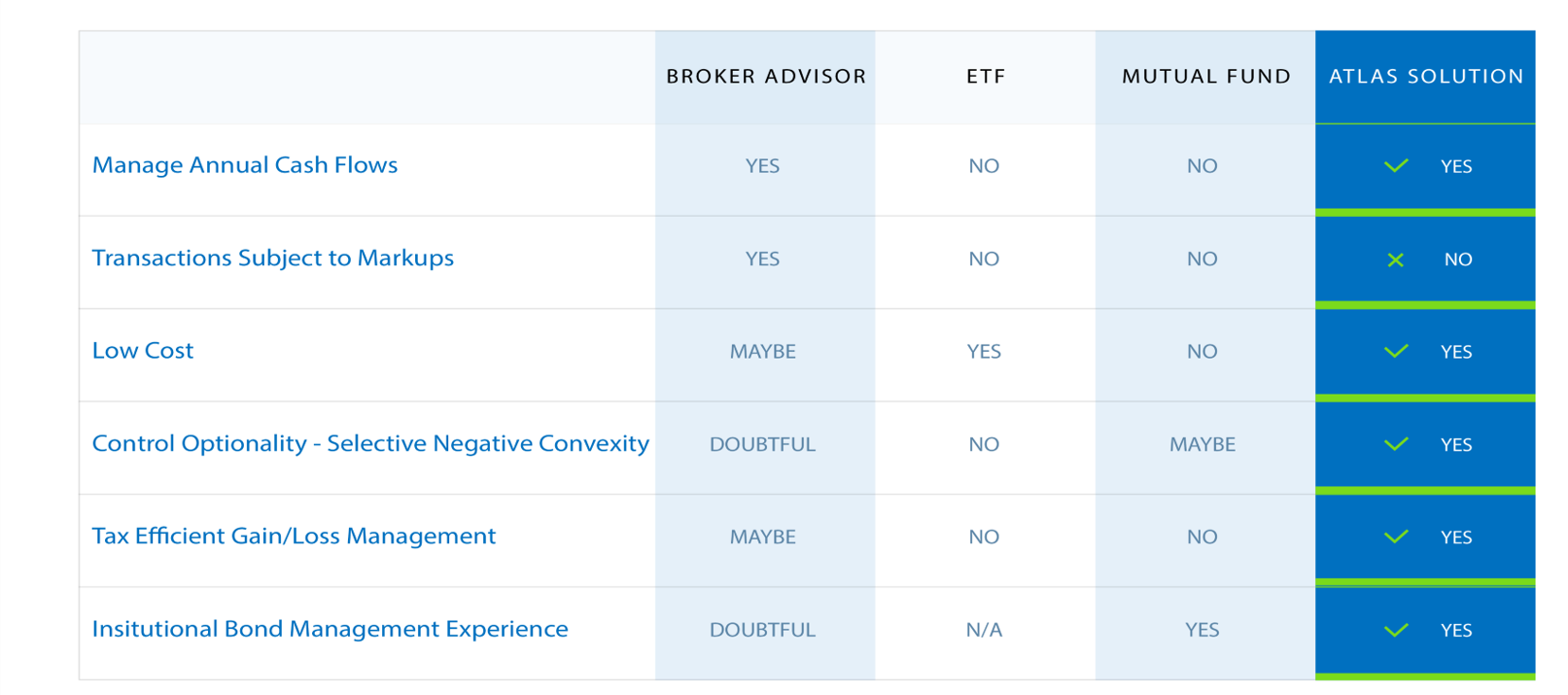

Atlas creates conservative investment portfolios using fixed income securities. Such an allocation to individual bond securities can be part of a stand alone strategy or a client balanced account. We believe investors seeking a higher level of risk should get such exposure through equity securities, not bonds. A fixed income allocation is tailored to each client’s specific objectives and marginal tax bracket. Though uniquely constructed, each bond portfolio has these characteristics:

- High quality – Holdings traditionally rated Single-A of higher.

- Diversified – Guarantor exposures typically vary within a 1% – 5% range depending on the size of the portfolio.

- Municipal Bonds – Emphasize General Obligations and Essential Services (Water/Sewer, Utility, certain Public Transport). Avoid Economic Development and securities tied to project economic success

- Corporate Bonds – Emphasize broad industrial holdings; almost no financial services exposure

- Government Bonds – Modest exposure, emphasize Treasury Inflation Protected Securities (TIPs) and Agencies

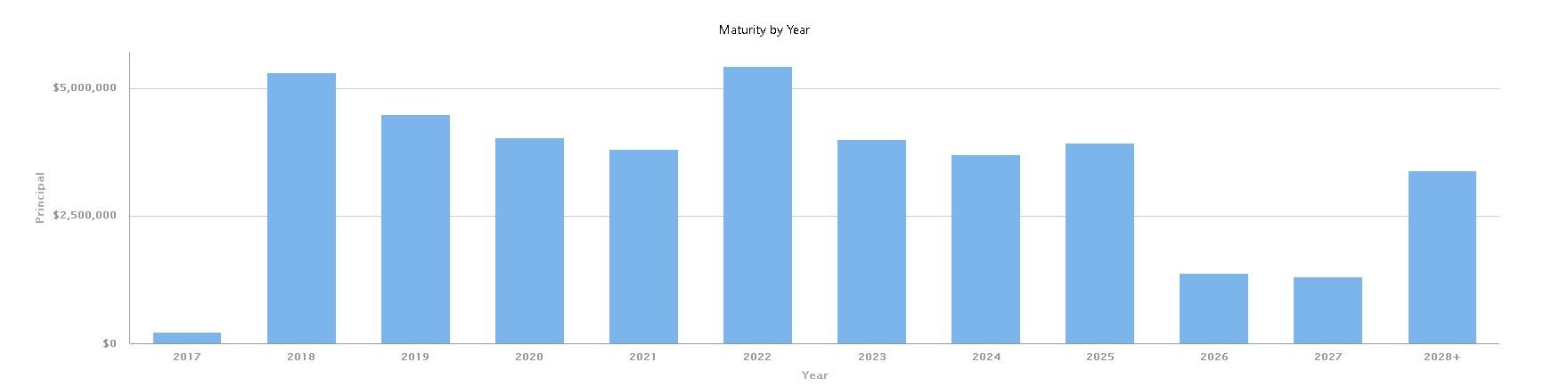

- Laddered – Portfolios have maturity distributions that ensure cash flows are spaced out and predictably timed. Even if underlying market interest rates are rising, portfolios are not disproportionately exposed. Additionally, coupon income can be reinvested as market conditions dictate. Individual security allocations in lieu of ETFs allow for more efficient cash flow timing and tax optimization.

- Limit Optionality – Many bonds have intricate options that allow issuers to call the bond prior to maturity. This option is more likely to be exercised when interest rates are falling and you least want your bond’s cashflows to be taken away from you. Atlas emphasizes bonds that have no call features to help guarantee predictability of future cash flows.

- Buy and Hold – Fixed Income securities are bought with the expectation of holding them to maturity. Bonds held to maturity are insulated from realized gain/loss tax consequences; the intra-holding period mark-to-market gain/loss is never recognized.

Fixed Income Strategy

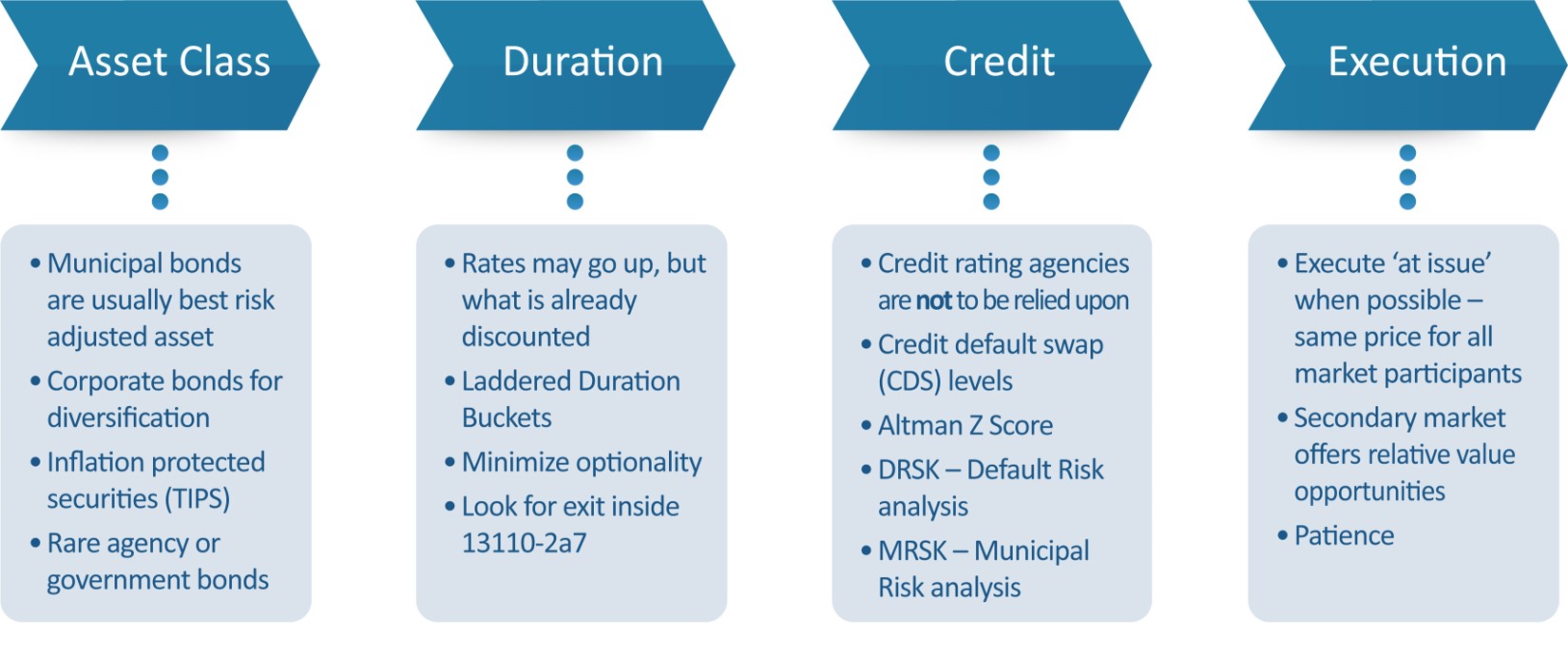

Atlas only considers simple, liquid fixed income securities. Municipals, Corporates and Government bonds. We avoid Structured notes, Principal Protected notes, Collateralized Mortgage Obligations (CMOs), Collateralized Debt Obligations, or any complex or opaque securities constructed to look like a bond. We determine duration exposures by analyzing the client’s existing portfolio and interest rate forward curves to optimally add investment. Several metrics are analyzed before credit risk is accepted. Execution is more complex than experienced in equity markets; our institutional trading expertise and nimble size allows our clients to benefit from efficient trade implementation.