Most investors have bought or sold a public common stock at one point in their lives. The process is quite transparent and simple to understand. Normally, stocks have very tight bid-ask spreads (the price difference between where the current market will buy the stock and where it will sell the stock), fairly deep trade volume such that the investor’s transaction won’t skew the market for the stock, and miniscule commissions. At any point in time an investor can look up the price of a stock and it will be representative of current market value or the most recent trading day’s closing value. Most stocks trade on some form of stock exchange (actual or virtual) and all brokers have sophisticated systems geared towards driving your transaction to the most efficient execution site.

None of these conditions apply to the market for bonds.

The number of unique bonds dwarfs the number of unique common stocks available for purchase. A company like General Electric has but one common stock that trades in US dollars, yet has in excess of 1200 different dollar-denominated bonds. As might be expected, not every one of those bonds trades as frequently as the common stock. And this is merely an example for a corporation. There are many other types of bonds. US Treasuries, Mortgage-Backed, Municipals, and Asset-Backed are just a few bond investment categories. In short, just imagine an investment universe materially larger than the aggregate size of the world’s bourses in both number of securities and total market value. Most of these bonds do not trade on an exchange, but rather in an “over the counter” or OTC market. OTC market transactions are negotiated directly by two parties without the supervision or clearing function of an exchange. Where a security last traded can have no bearing on the next trade. You don’t have the transparent information exchanges usually provide (depth of market, short interest, updated float, etc). Bond markets are opaque. In essence, the bond market is the domain of institutions, not individuals. We’re not saying individuals can’t invest in bonds, only that they need to be knowledgeable, careful and mindful of market nuances.

Bonds traditionally have a place in diversified investment portfolios because of their predictability of cash flow, lower price volatility, and structured time frame for return of principal capital. Many bonds can have volatility and out-sized returns – witness the well chronicled Collaterized Debt Obligations (CDOs) and sub-prime mortgage-backed structures blamed for the 2008 global financial crisis (they weren’t the cause, just the canary in the mine) – but such bonds are beyond the scope of this article. With so many variables and such opacity, it is not unreasonable for most investors to make mistakes when bond investing. Let’s look at some of the most common mistakes and a couple of solutions.

1) Not understanding markups

As mentioned above, the bond market is really the domain of institutional investors. A common transaction size is a minimum of $5million to $10million. Large institutional dealers don’t care about smaller sizes and if they do, that business is managed by a separate department from the traditional business. There are many smaller dealer firms that traffic in this size. As with any distribution business, as you move down in size, you increase the influence of intermediaries. Think manufacturer, wholesaler, commercial retailer, small neighborhood retailer. Each level needs to earn an economic return and as such traditionally has higher end-user prices. The same dynamic approach to investing and to the bond market. Additionally, many dealer trading desks do not position a large inventory of securities; they act as agent trying to match up buyers and sellers. The markups can add up because there are multiple mouths to feed – your salesperson, that firm’s trader, potentially an intermediary to another firm’s trader, the other firm’s trader, the other firm’s salesperson, the end buyer or seller of your bond.

What’s the individual investor to do if they don’t start with a $500 million base? After all, for most high net worth investors, even $5 million is a large allocation to one bond. A good solution is to buy bonds only when they are first issued. At initial issuance, all buyers get the same price so you can be confident that you aren’t sacrificing yield by paying markups. Additionally, bonds are supposed to be conservative allocations to a portfolio; buy reasonable maturity (inside of 10 years) high quality issuers (governments, corporations or municipalities) and hold the bonds to maturity. A well diversified portfolio with a nice dispersion of maturities will provide steady annual cash flow. Another solution is to hire a fee-only investment advisor with sophisticated institutional experience to navigate your portfolio through the maze of perils and complexities. In all honesty, there’s no way to gain such experience if your background is in exchange traded markets.

2) Not knowing your bond’s transaction prices

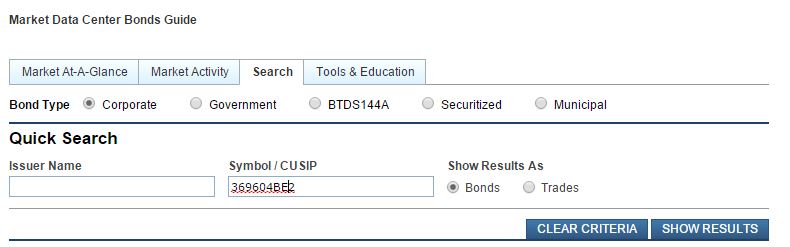

When you are following a public common stock, you can seamlessly find out where it’s trading over the internet at any market portal like Yahoo! Finance, Google Finance, The Wall St. Journal or Bloomberg.com. Just type in the company’s ticker symbol for current trading levels, historical price action, and related information. There is no equivalent ticker symbol for 99.9% of the bonds available so this process is useless for fixed income securities. Instead of a ticker symbol, the identifying key most frequently used for bonds is called a CUSIP, a nine-digit alphanumeric code. (CUSIP stands for Committee on Uniform Security Identification Procedures. Drop that little bit of knowledge at your next cocktail party.) It’s not as elegant or simple as a ticker symbol, but it is a clear identifier. If you have a portfolio of bonds, the CUSIP should appear in your monthly statement somewhere in the security description. All bond transactions for US Government, Corporate, and Municipal securities must be reported to the Financial Industry Regulatory Authority (FINRA). Armed with this knowledge, you can go to the FINRA portal, click on the “Search” tab, input your bond’s 9-digit CUSIP and appropriate bond category, to get data on the trading history of the bond in question. For example: General Electric 0.85% due 10/9/2015. CUSIP is 36960BE2.

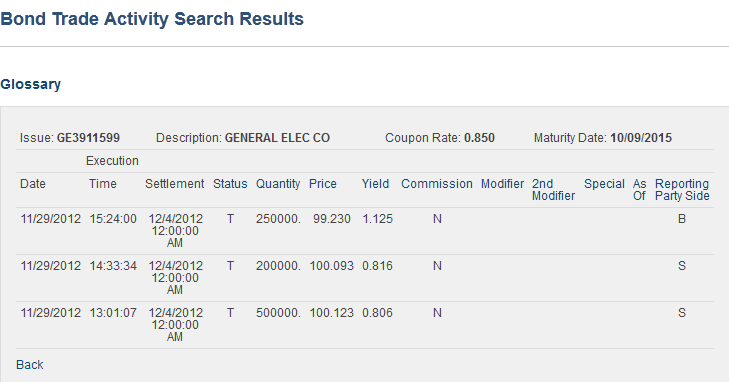

Adjusting the date range you’d like to review will show trading activity:

In this instance, the bond traded three times on November 29th. Notice how much yield levels varied intraday. Such is the nature of bond markets. For those curious, the appropriate market levels on that day were the bottom two trades; whoever sold the 250,000 bond lot sold them too cheaply. It always useful to know bond trading levels because it helps investors determine if a level is fair or if they are being exploited by a dealer.

3) Hunting for Yield

It’s very difficult these days to get excited about bond yields. Nominal yields are at historic lows and, as a result, investors may take additional risk in an effort to maximize yield. Most investors know the simple ways to earn extra yield: buy longer dated maturities or buy lower rated debt. However, there are other ways that investors may unknowingly assume huge risk while getting a little extra yield.

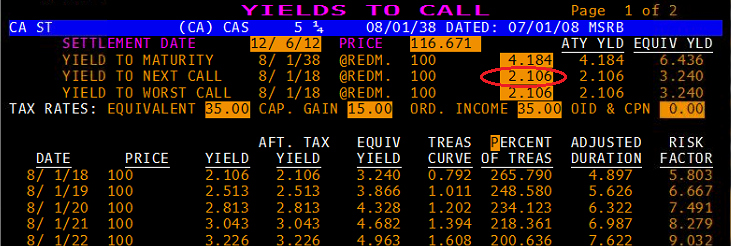

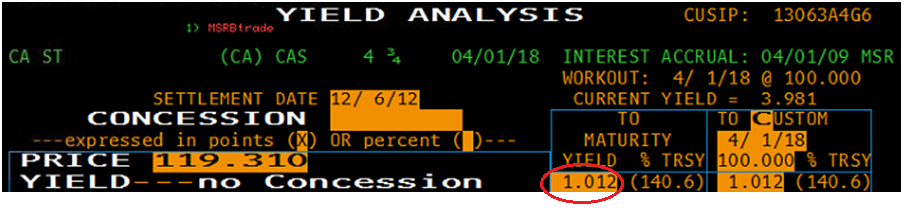

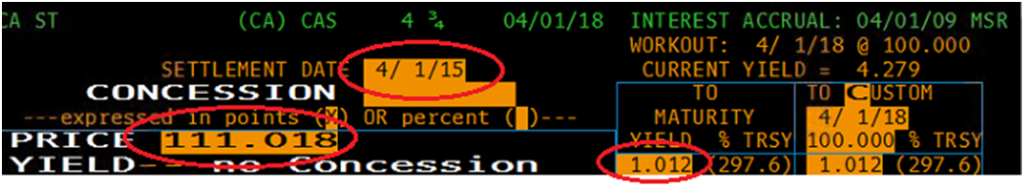

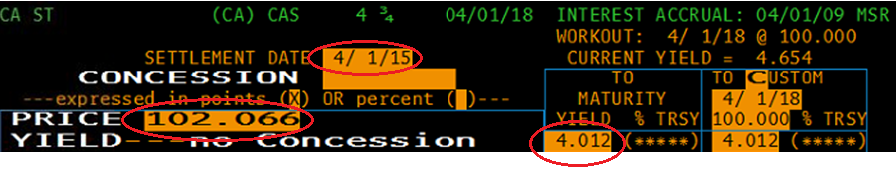

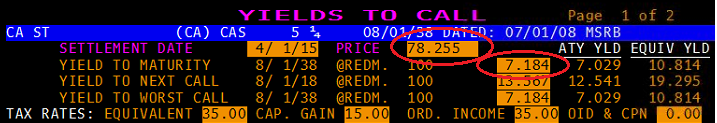

One surreptitious way investors can be duped into thinking they will get extra yield is not fully appreciating a bond’s structure. In essence, bond valuation is about risk and putting a mathematical value on a return expectation commensurate for that risk. We won’t bore (or scare) the reader with technical terms or analytics, but not all yields are created equal if options are imbedded in the bonds. Let’s look at 2 California State General Obligation bonds. Both bonds have the same seniority and priority of claim: A) CA 5 3/4s due 8/1/2038 and B) CA 4 3/4s due 4/1/18. The long maturity Bond A can be called away from you on 8/1/18 by the State if the Treasurer chooses to do so. Assume the State will always do so if it has the means (i.e. they can issue new bonds in the capital markets, or Lord forbid, they actually have excess cash in the State coffers). Think of the State as having the option to call your bond away similar to the option you have to pre-pay your mortgage at any time; the actual yield earned on the instrument can be altered by the option to pre-pay prior to maturity. The short maturity Bond B has no call option; unless there is a default, cash flows will be as expected through the bond’s final maturity. This bond is known as a non-callable bond. Below are recent prices for each bond:

Bond A:

Bond B:

Look closely at the yields calculated for each bond. Bond B will pay you slightly more than 1% yield to the 4/1/18 maturity while Bond A will pay you 2.1% to the mathematically expected call date (early maturity) of 8/1/18. Current yields are so low on all types of bonds, it’s reasonable to expect that Bond A will be called away from you in 2018. So why not buy that bond and get the extra 1.1% yield from now until then? Is the extra yield a gift or fool’s gold? Welcome to the world of bond option analytics. Bond B will return all of your capital by 2018, while Bond A has a “high probability” of returning all your capital by 2018. What happens if yields rise substantially before then? Bond B will still mature and Bond A may or may not get called. If rates rise from current level to those that existed in pre-2008, Bond A will not be called. As you can conclude, your willingness to buy Bond A is tied to your expectations for future interest rates. If you are highly confident rates will remain low from now until 2018, then you might be inclined to buy Bond A. If you don’t like forecasting the direction of interest rates, Bond B is for you. If you are trying to maximize your yield, expect your broker to try to sell you Bond A. Just remember, markets have a tendency to beat you up when you least expect.

4) Over concern about rising rates

Many investors are mindful of low current interest rates and conclude that rates “can only rise from here”. This is a fair statement. A valid portfolio tactic would be to allocate capital to equities if you feel returns are too unappealing in fixed income. However, some investors who want fixed income’s inherent conservative risk exposure are loath to buy bonds because they are fearful of portfolio price declines. Over concern about rising rates is a mistake. Rising future rates are already priced into the bond market and can be seen by the upward sloping yield curves for all assets as you extend maturities. If you are still not alleviated, think about what actually happens to your bond price. Bonds historically have less price volatility than stocks because of their predictable cash flows. Look at Bond B above and a couple of scenarios:

Scenario 1 – rates are the same in 29 months, 3 years left to maturity.

Scenario 2 – rates are 3% higher in 29 months, 3 years left to maturity.

Scenario 1 simply shows the bond’s value assuming no change in interest rates. Notice how the bond’s value has gone from 119.31 to 111.018. This is due to the passage of time – the investor will have received several coupon payments and the bond’s price has to accrete to par (i.e. 100) by maturity date. Remember, bond prices are not dollar prices, but merely percentages of par amount. 111.018 is equal to 111.018% of par. For most bonds, par amount is $1000. Hence a bond priced at 111.018 has a dollar value of $1110.18 per bond. The reason the bond price is greater than 100% of par is the 4 3/4% annual coupon.

Scenario 2 assumes rates have risen from 1% to 4% in April 2015. At that interest rate, Bond B would be worth 102.066 instead of 111.018. Less than a 10% price decline for a quadrupling in rates. Additionally, if you hold the bond to maturity, this is only a mark-to-market adjustment, not a realized loss.

The reason such a rise in rates has such a modest effect on the bond’s price is tied to the maturity of the security. We advocate investors buy short to intermediate maturities (inside of 10 years) for their portfolio. Longer term bonds have far more interest rate risk exposure. Revisiting Bond A shows that the same 3% increase (applied to the maturity yield) results in a more dramatic price decline to 78.255.

5) Over-paying for liquidity

Many investors maintain large amounts of capital in money market funds even though they have no imminent cash needs. Money market yields are effectively 0%. Look at a current money market fund prospectus and you’ll find that almost all fund asset yields flow to cover fund expenses and instead of the investor. Why maintain large cash like investments with no immediate need for liquidity? You’re basically over-paying for liquidity you don’t need. An investor would be better suited putting together a laddered-maturity portfolio of short term bonds or CDs. You’re capital earns a return, your portfolio will have periodic maturities that can be withdrawn or reinvested (perhaps in a higher interest rate environment), and as shown above, have (at worst) modest bond price sensitivity.

Conclusion

We’ve reviewed some of themes to consider when investing in bonds. Fixed income investing can get pretty technical, but avoiding some common mistakes will help form a sound investment thesis. Feel free to contact us for a consultation.

Bert