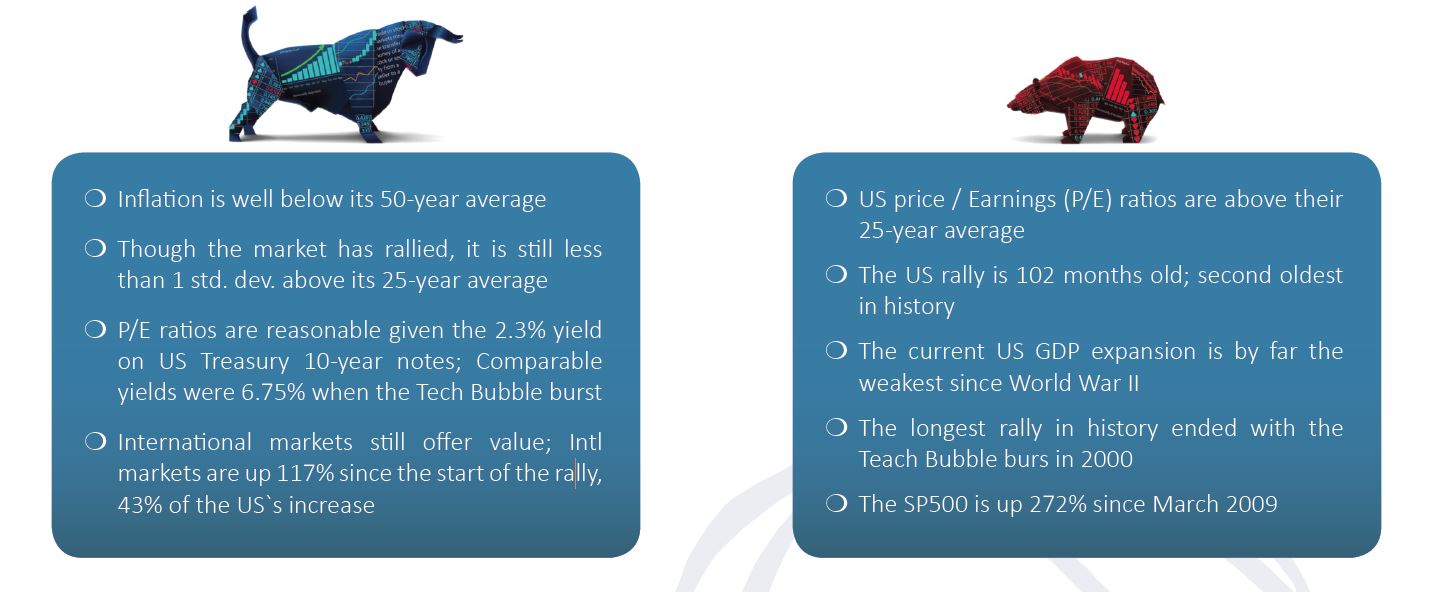

More and more investors are growing concerned about current equity valuations and are wondering “should I get out of the market”. Ironically, there are arguments to support both bullish and bearish sides of the debate:

Academic research widely supports the notion that long-term investing requires a commitment to an investment discipline. Additionally, there’s plenty of evidence demonstrating how difficult it is to successfully, and repeatedly, time market entry and exit. But, there is no denying the market has had an extended period of positive returns and many investors feel stress about the length of their success. Those wanting to sell stocks will likely be subject to sizable capital gains tax bills. Many products exist that allow market participants to “conceptually” hedge their portfolios. We intentionally use quotes to qualify the effectiveness of these strategies because strategies like buying puts options or purchasing structured financial products are inherently inefficient.

If you want to effectively hedge (but not sell) your portfolio, by far the most efficient and inexpensive strategy is to sell stock index futures contracts that are correlated to your existing holdings. Academic research widely supports the notion that long-term investing requires a commitment to an investment discipline. Additionally, there’s plenty of evidence demonstrating how difficult it is to successfully, and repeatedly, time market entry and exit. But, there is no denying the market has had an extended period of positive returns and many investors feel stress about the length of their success. Those wanting to sell stocks will likely be subject to sizable capital gains tax bills. Many products exist that allow market participants to “conceptually” hedge their portfolios. We intentionally use quotes to qualify the effectiveness of these strategies because strategies like buying puts options or purchasing structured financial products are inherently inefficient.

What is an index futures contract? A stock index futures contract is an exchange traded contract to buy or sell the value of the index at a future date at a fixed price. The contract is ‘cash settled’ which means that at expiration (or sale) of the contract, the contract will either pay or receive a certain amount of cash that equates to the difference between the market price and the price at the time the contract was entered.

How much does a futures contract cost? A futures contract doesn’t cost anything. An investor profits or loses based on changes in the contract price. There are very small commissions (~$3 for $125,000 worth of index) to enter into or exit a futures contract. One must post collateral (initial margin) that will guarantee the daily mark-to-market (MTM) reconciliation between the two participants in the futures contract. To the extent that the contract moves unfavorably, the investor must also post maintenance margin to continue to hold that contract. The holder of the contract will receive money to the extent that the contract moves favorably.

Posting collateral sounds complicated? It is not, there are custodians who have linked brokerage accounts with futures accounts (e.g. Interactive Brokers) so that investors can borrow against the value of their stock holdings (at very low rates) and post collateral against their linked futures account. If necessary, collateral will change daily between the brokerage account and futures account.

What is the risk? The difference between valuation movements in your stock holdings and futures contracts, while likely highly correlated, may not be perfect. If you hold a single stock in your brokerage account, the futures contacts may not be an effective hedge. Futures contracts are typically designated against broad stock market indexes (e.g. the S&P 500) and there may be basis risk between the movement of that broad index and your underlying equity portfolio.

What about taxes? The good news is that selling a futures contract against your stock holdings is not a taxable event from an IRS perspective. A futures contract is considered a “Section 1256 contract” by the IRS. Net realized and unrealized gains/losses are aggregated at the end of each tax year. Aggregated gains/losses are taxed on a 60% long term capital and 40% short term capital basis. States tax futures gains/losses as ordinary income.

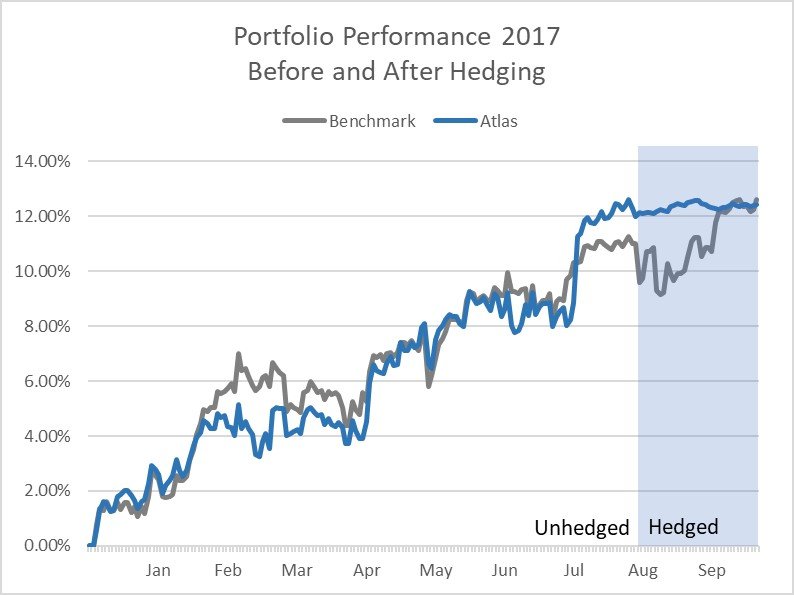

The chart represents an actual example of a globally diversified equity portfolio that was unhedged until early August. At that time, a strategic basket of index futures was shorted to hedge market exposure. The ensuing period (shaded) represents performance of the portfolio in a market that continued to rally (as represented by the long-only benchmark).

A typical emotional response would be “buyer’s remorse” – “I shouldn’t have hedged”. Keep emotion out of the decision process; the strategy employed effectively protected the corpus of the portfolio without selling securities or incurring unnecessary capital gains.

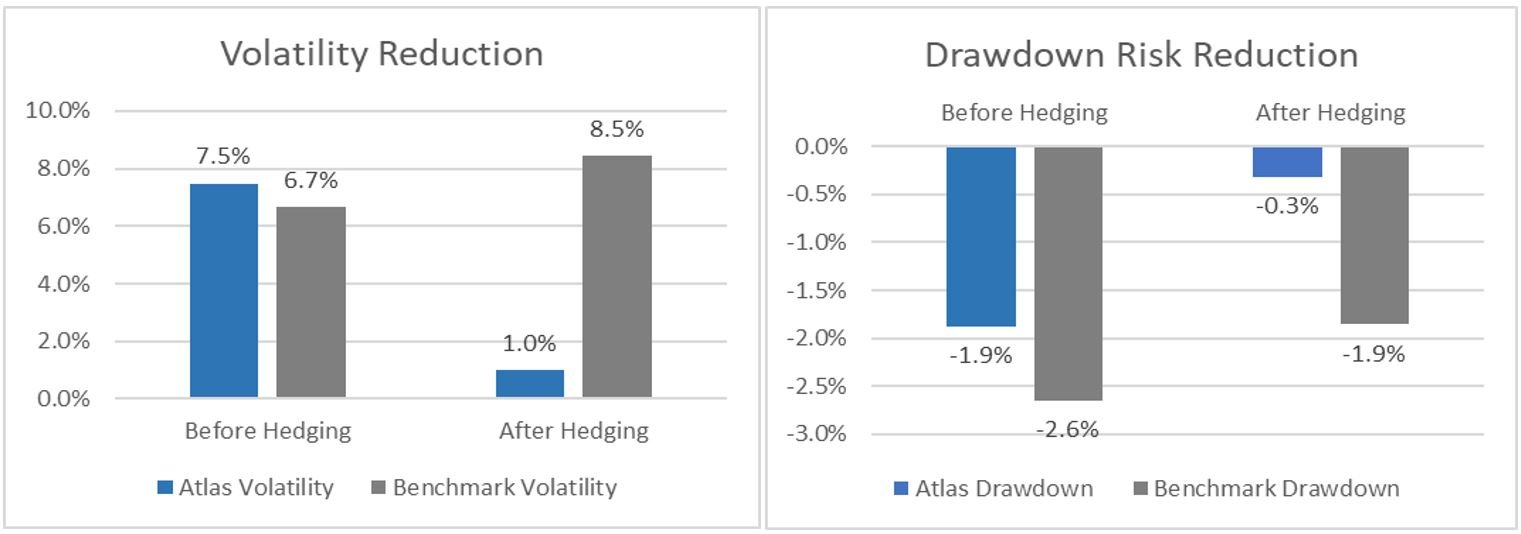

Not surprisingly, the overall risk to investor capital is drastically mitigated by applying hedges; both portfolio volatility and drawdown experience are significantly reduced. Portfolio metrics would be similar in a provocative down market. Timing markets isn’t the best course to follow for long-term investing. Nonetheless, shorting index futures is the most efficient and least costly strategy to employ for investors wishing to periodically exit the market.