Download this article as a PDF

Congratulations! If you are reading this paper with more than a casual interest, it is very likely that you are the owner of Employee Stock Options and are considering an appropriate strategy for exercising them. This article is not intended to be an exhaustive academic exercise on how to squeeze the last bit of economic value out of your options, but rather to provide a general strategic framework which you can use for exercising employee stock options.

To exercise early or not? Options typically have an expiration date that can be far off in the future. Is there a reason that you would exercise these options prior to that date? The answer to that question really depends on the value you place on portfolio risk diversification. An early exercise will inevitably destroy some of the economic value of your option, but the clear benefit of an early exercise strategy is the ability to diversify your asset base into something that isn’t as correlated with your job.

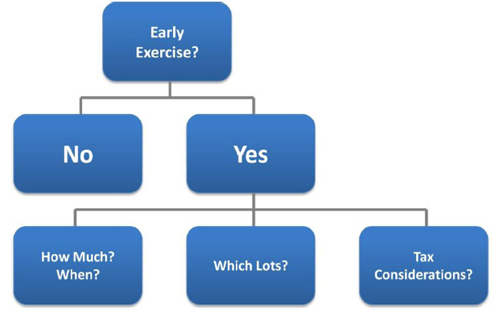

Basic employee stock option exercise decision tree:

If the stock in your company drops from where it is now, your options may end up worthless. Furthermore, depending on how far the stock drops, your JOB may end up worthless as well. Without too much consideration, the decision of whether to diversify or not is often an easy one to make – if you can diversify at a reasonable cost, DO IT!

At what cost?

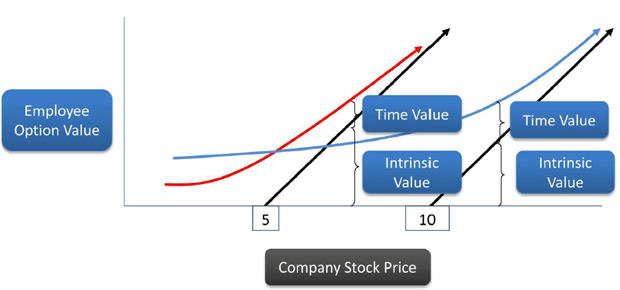

Without getting into the ‘greeks’ of option valuation, it is sufficient to say that the value of your options is derived from two principal components:

1. The ‘intrinsic value’ (simply meaning the stock price less the exercise price)

2. The ‘time value’ (the difference between the total economic value of the option and the intrinsic value)

What is important to note is that by exercising your option early, you effectively destroy the time value component of your option – this is the true cost of early exercise (ignoring tax impacts, which we will address later).

The ratio of the time value to the intrinsic value can differ significantly depending on the volatility of the stock price and the time to expiration. Dividends and interest rates are also factors, but typically have less of an impact.

A key framework for deciding on which options to exercise and at what stock price this makes sense relies on some of the basic mathematics of the Black–Scholes option pricing formula. The following example details the price of two separate option grants. The first grant’s total value (time value + intrinsic) is shown in red (strike price of 5) and the second grant’s total value is shown in blue (strike price of 10).

The ratio of time value to intrinsic value that is acceptable to be destroyed in the name of diversification is different depending on individual circumstances.

What is interesting to note in the example is that an option with a strike price of 5 and a stock price of 8 may be worth exercising early whereas an option with a strike price of 10 and a stock price of 15 may NOT be worth exercising. In the experience of Atlas Capital, the threshold for entertaining early exercise is a ratio of roughly 30-50% (the time value would represent no more than 30-50% of the intrinsic value of the option to be exercised). The acceptable ratio can vary with the option holder’s appetite for risk of holding the option, and the amount of potential diversification desired.

Tax considerations

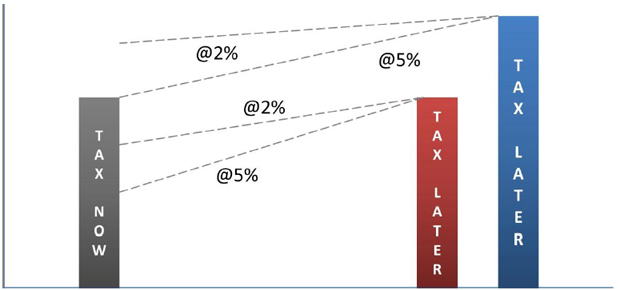

There are many assumptions to consider when contemplating the tax implications of an early exercise of employee stock options. While we do not offer tax advice, the problem can be reduced to the consequence of paying taxes via an early exercise (presumably paid this year) vs. the present value of the tax obligation that will ultimately be paid in the future. For this example, in order to isolate the tax implications of the decision, we will assume that the exercise will occur at the exact same stock price and thus the gross proceeds will be the same in either case.

Critical assumptions for determining the present value of your future tax obligation are as follows:

1. What will be the applicable tax rate applied to employee options exercised in the future?

2. What discount rate should be used to determine the present value of the future tax liability?

The unfortunate reality for question #1 is that the United States is on a unsustainable path of reckless fiscal policy that in some shape or form will result in higher tax rates in the future. While this is not a 100% certainty, all signs point in the direction of future effective tax rates above today’s historically low rates.

Furthermore, the present value of a future tax liability can be reduced by the mechanism of discounting this future cash flow at some interest rate that should reflect the opportunity cost of funds available today that could be invested until some point in the future. Government bond rates would typically be used for this calculation and these rates have become incredibly low in recent years.

Let’s compare the exercise of these options today (tax now) with the exercise in the future (tax later) in two scenarios.

1. Red Scenario – taxes will be the same in the future

2. Blue Scenario – taxes will be higher in the future

In each case, the rate at which we discount the value of this future tax liability will be calculated using both the 2% and a 5% discount rate.

Unfortunately, a likely scenario of rising taxes and low discount rates (the current 10 year government bond yield is 2%) produces a present value of future tax liability that looks quite high compared to the current tax liability.

ISO v. Non Qualified Stock Options

You may be fortunate enough to have received what are called Incentive Stock Options (ISOs) as compared to the more normal grant of Non Qualified Stock Options (Non-Quals). The nice thing about ISOs is the potential for a more favorable tax treatment, should you decide to exercise and then hold the shares for an entire year before selling (in which case you may receive long term capital gains tax treatment). The HUGE danger with this strategy is that your calculated (but not yet realized) exercise gains will be treated as income for Alternative Minimum Tax (AMT) based on your exercise price. Should the value of your shares fall, you may still owe the government MORE THAN THE VALUE OF YOUR SHARES! There are horror stories of individuals losing their house and everything they own in an effort to pay the tax bill to Uncle Sam.

Receiving long term capital gains treatment for ISOs in a much less risky manner can be achieved with a bit of planning. If you first exercise and hold your ISOs on the 1st day of January, you have a lot more control over the situation. By the end December, if it looks as though you are going to lose more money in AMT than you would be gaining by paying a lower capital gains tax rate, you can simply sell your exercised shares by December 31st, thus realizing the loss in the same tax year. If you choose not to sell at the end of the year, your exposure could be limited to only a few days into the following year until the long term holding period kicks in before selling.

Conclusion

While it can be painful to potentially ‘leave money on the table’ by exercising options before expiration, there are often some very valid reasons to do so. Having a highly concentrated exposure in one stock results in a portfolio with a less than optimal risk/reward profile, and strategically diversifying some of this position will move a portfolio closer to the efficient frontier. Understanding the components of your option values, as well as the tax implications is key in this analysis. If you are fortunate enough to be facing these decisions and would like professional guidance and expert analysis, please contact Atlas Capital Advisors.