Importance of Asset Allocation

More than 30 years ago, Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower published an influential paper called “Determinants of Portfolio Performance.” The conclusion was that nearly all the differences in outcomes between any two investors were the result of their baseline asset allocation choices. Very little of the observed differences resulted from selection of investment managers or tactical allocation. There have been many additional papers on this topic in the years since “Determinants” came out, some which affirm and some which challenge the conclusion. But even the challengers accept that the asset allocation choice is a dominant factor in investment portfolio outcomes.

The key questions which should be considered in any asset allocation decision are:

- What investment return outcome is sought?

- How much risk of loss is tolerable?

- What is the best way to achieve the desired investment outcome at the lowest risk?

There is a natural tension between objectives 1 and 2. An investor who seeks a higher investment return typically must also face a higher risk of loss. An investor seeking safety may not achieve a very high investment return. At Atlas Capital, we work closely with our clients to arrive at the most appropriate mix between desired return and downside risk for each client, the third step in the list above.

Most advisors have relatively static and unsystematic approaches to asset allocation. The Atlas Capital Advisors allocation approach stands out relative to most other advisors in three ways:

- The overall risk decision

- Allocations within the equity market

- Choices outside the equity market

Overall Risk

Most of the time, the choice with the higher expected return for a long-term investor is an investment in a higher risk asset class such as public equity. Atlas Capital has done years of research on the conditions under which public equity is not likely to be a high return asset class. Further discussion of this research may be found in Markets and the Economy. Our systematic approach helps identify the rare occasions in which investing in the stock market has elevated downside risk. On those occasions, Atlas Capital will reduce the overall stock market risk in client portfolios. Our current dashboard of Equity Downside Risk is here.

Allocations Within Equities

Atlas also has a well-defined systematic approach for choosing geographies and sectors within the global stock market. Our equity implementation has higher than index weight in those geographies and sectors which score well on factors established by academic and proprietary research. This approach is designed to generate a higher return than what might otherwise be obtained with a capitalization-weighted index strategy. Further discussion of the Atlas approach to global equity investing may be found in Multi-Factor Investing.

Allocations Outside of Equities

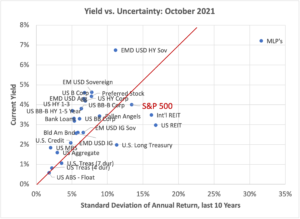

Atlas applies its research orientation and systematic approach outside of the equity market as well. We evaluate more than twenty yield-oriented asset classes, seeking the asset classes which have the most favorable relationship between expected return and risk. The chart below shows the current yield and risk for these yield-oriented choices. We estimate returns for each asset class by adjusting the current yield in the chart up or (usually) down for capital appreciation, defaults, and downgrades. We then choose a subset of investments with a favorable return/risk relationship as well as a positive sentiment. Through this dynamic process, the client achieves a better relationship of return to risk than what might be available with static allocations.