Intelligent Tax Alpha

Any sophisticated investment adviser will consider tax liabilities an important consideration of portfolio construction for taxable client accounts. However, advisers typically employ rudimentary tax loss harvesting (TLH) strategies where securities with unrecognized losses are sold and replaced with new securities. This simple approach is rooted in common sense but has several short falls. One, an investor incurs substantial amounts of transaction costs as the manager aggressively sells losers and buys replacements. Second, the strategy runs out of steam after a few years as all losses are recognized. Investors are left with a dilemma of holding static portfolios containing large unrealized gains simply because they don’t want to pay capital gains tax; not a bad problem, but one that may introduce a variety of new portfolio risks:

– Lumpy concentrations with poor diversification

– Low return holdings that are nowhere near the efficient frontier curve

– Exposure to declining industries

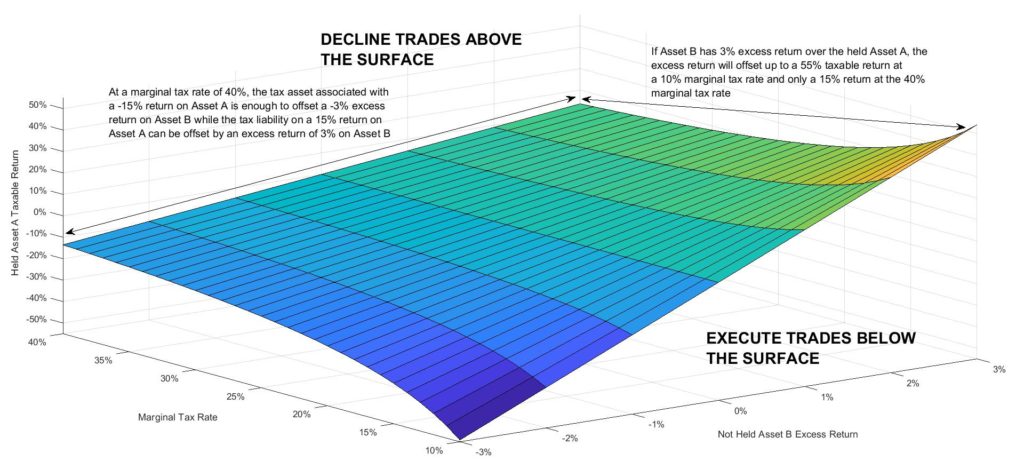

As we’ve discussed elsewhere in our Resources Section, Atlas screens for stocks that score well using our multi-factor model. Investment candidates for inclusion in client portfolios are also optimized for tax efficiency combined with transaction cost analysis. Tax alpha can’t be analyzed in a vacuum; it’s an input to optimal portfolio construction that maximizes risk controlled expected return. Our model looks at the time value of deferring taxes paid for 20 years as part of analyzing expected returns of existing holdings versus replacement candidates. Yes, losses will be recognized. However, the key to tax efficient investing is not being hesitant to recognize gains if disciplined analysis dictates such action.

Note: The graph above represents hypothetical possibilities of an investor located in California with capital gains tax rates between 10% and 40%. The example also assumes a 20-yr timeline for the tax deferral discounted at an annual rate of 4%. The assumptions for excess and taxable returns are for illustrative and instructional purposes and do not represent any particular investment portfolio.