What’s discussed

The tariff plans which the Trump administration announced on April 2, and has been revising since, have roiled investment markets. If a regime of much higher tariffs continues, it is likely to test the resilience of investment markets and the global economy. The main points made below about the US tariffs being considered are:

- They are unlikely to be sustainable, economically or politically

- They are inconsistent with US fiscal policy

- The objectives probably will not be realized

- The economic impulse is toward “stagflation”

- “Stagflation” is as bad as it gets for most investors

High US tariffs have been unsustainable

Tariffs as a means to protect domestic producers and raise government revenue have a history going back at least to Ancient Greece. While not all tariffs have been destructive, the general view among economists is that tariffs have a negative impact on economic growth and often disproportionately harm the country that imposes the tariff. That view is consistent with the US experience with tariffs.

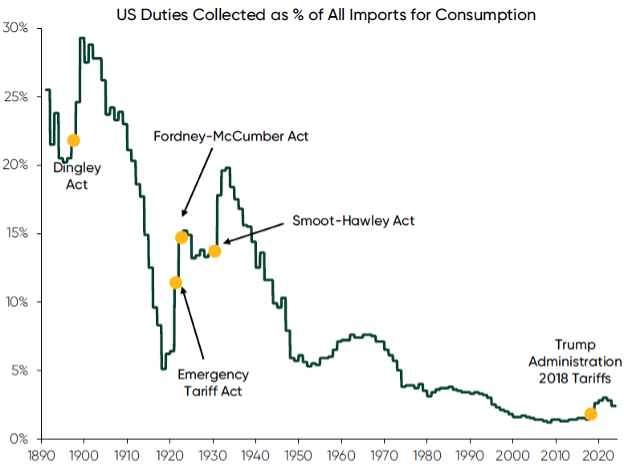

William McKinley was a keen protectionist who is greatly admired by Donald Trump. When McKinley ran for president in 1896, he said, “I am a tariff man, standing on a tariff platform,”[1] words which sound familiar today. The tariff regimes under consideration by the Trump administration, both the initial April 2 plan and the plan as of April 16 with punitive tariffs on China, raises average taxes on imports to near 20%, levels that McKinley would have appreciated.[2]

As a cautionary tale for the Trump tariffs, the 20%+ tariffs of the McKinley administration proved to be unsustainable. Before being assassinated in 1901, McKinley gave a speech which recognized that the high US tariffs were limiting export markets for US producers and proposing the mutual lowering of trade barriers. The US experienced three recessions from 1899 to 1907, and tariffs were revised to lower levels in 1909.

Another notorious increase in US tariffs was the Smoot-Hawley Tariff Act of 1930. Those tariffs, which led to retaliatory tariffs by other countries, are now considered to be a grave policy error, which deepened and prolonged the Great Depression. The US unemployment rate was 8% when the bill passed, 16% a year later and 25% after two years. The S&P 500 index lost 80% of its value from the 1930 high to the low in 1932.

The political consequences of Smoot-Hawley for the Republican party were also profound. The public blamed the Republican party for its counterproductive economic policies in 1929 – 1932. Both Smoot and Hawley were defeated in the 1932 election. Thereafter, Republicans languished in the political wilderness for decades, attaining majorities in both the US House and Senate in only four of the next sixty years.

The math doesn’t work

Much has been said about the problems with the formula used by the Trump administration to derive “reciprocal” tariffs on more than 200 countries. Less discussed is the relationship between federal budget deficits and trade deficits, and how it is hard for the US to have one without the other.

Students of economics learn this formula for the relationship between federal budget deficits and the trade balance:

(SP – IP) + SG = (X – M)

Private savings less private investment (SP – IP) plus government savings (SG) equals the trade surplus, exports minus imports (X – M). If the private sector pays its own way, with private savings being close to private investment, then for the government to run a budget deficit (if SG is negative), the country must also have a trade deficit to gather savings from outside its borders. In 2024, the negative $1 trillion trade balance (X – M) helped make it possible for federal government savings (SG) to be negative $2 trillion.

The US is a net importer of goods from the rest of the world and in exchange we provide the world with US securities. At present, foreigners hold 30% of the outstanding US government debt, 30% of US corporate debt and 20% of the US stock market.[3] This arrangement has allowed the US to spend beyond its means at a reasonable cost, year after year, and promoted economic growth in both the US and our trading partners.

As the equation indicates, if the US achieves a lower trade deficit, but does not reduce government deficits by a like amount, then the adjustment would need to be higher saving or lower investment by the private sector. Neither of those adjustments would be good for US economic growth. Moreover, if the tariff regime leads to a US recession, the recession would increase US budget deficits. Should that happen, trade deficits would be needed more than ever to generate the funds for the budget deficits.

Objectives In doubt

It is doubtful that the Trump tariffs, if implemented, would generate the intended surge in US manufacturing employment. Consider shoes, for instance. Nearly every shoe sold in the United States is imported, primarily from China, Vietnam and Indonesia.[4] The April 2 announcement proposed tariffs of 34% for China, 46% for Vietnam and 32% for Indonesia. If those tariffs were implemented, US citizens would pay more for their shoes. Would it then become viable to build a shoe factory in the US?

As noted above, regimes of very high tariffs have been hard to sustain. Potential investors in US shoe factories who understand this history would reasonably judge that any competitive advantage arising from tariffs would be temporary. Eventually, the tariffs would be reduced, and the US factory would be exposed to foreign competition. That makes it much less likely that US factories for shoes, or for any other industry temporarily protected by tariffs, would be built at all.

Economic consequences

The April 2 tariff announcement caused most economists to reduce their projections of US economic growth, and increase their projections of inflation. For instance, Torston Slok, the respected economist of Apollo Global Management, estimated a -1.5% impact on US GDP growth along with a +1.5% impact on inflation.

Announcements of changes in tariffs for specific countries, products and industries are ongoing. Given that no one knows the end state for tariffs, uncertainty has soared. As of April 16, the US Economic Uncertainty Index is four times the long-term average, at levels only previously seen during the Global Financial Crisis and the COVID Crisis. The US Trade Policy Uncertainty Index is vastly higher than any level seen before – forty times the long-term average.[5]

The “soft” economic measurements of US consumer confidence and corporate outlook are deteriorating. For instance, the latest monthly reading from the University of Michigan Consumer Sentiment Survey is the second lowest of the past fifty years. But so far, the “hard” economic measurements of activity have held up.

It seems likely that the tariff uncertainty will become a deterrent to corporate hiring and investment. Moreover, the US is a consumer economy, and these tariffs will affect consumption. For instance, it is estimated that more than 70% of the non-grocery products sold at any Walmart come from China. Prohibitive tariffs on Chinese imports will make these products unavailable or less affordable, leading to negative impacts on retail sales and inflation.

Investment consequences

What comes next for investment markets is going to be heavily influenced by what comes next for tariffs. And that is anybody’s guess. But “stagflation” – declining growth with rising inflation – is about as bad as it gets for most investors. In a stagflation regime, all the mainstream asset classes suffer.

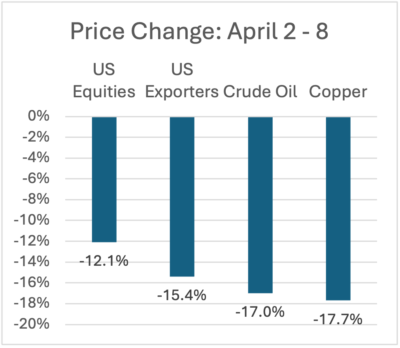

The investment market reaction between the April 2 tariff announcement and the April 9 postponement announcement showed that investors believed the tariffs would raise the probability of a global recession. In the four trading days following April 2, the S&P 500 index slumped 12%, while export-oriented US companies and economically sensitive commodities dropped even more.[6] Credit spreads jumped, reflecting increased probabilities of default on corporate loans.

Perhaps the most surprising and disturbing development was the jump in US interest rates. Typically, interest rates fall when the odds of a recession rise. But US rates began to rise sharply on April 7. Possible explanations for this include: (1) foreign holders of US treasuries selling positions in response to the tariff threat, (2) adjustments in yields to reflect likely increases in inflation, and (3) de-leveraging by hedge funds and other levered investors.

While the tariff uncertainty is unresolved, it seems likely that markets will remain volatile. Moreover, since a meaningful share of US investment assets are owned by foreigners, a tariff program which alienates the rest of the world could reduce demand by foreigners for US investment assets, raising borrowing costs and lowering US stock prices.

Summary

It does not appear that the Trump administration’s tariff plans are informed by an understanding of negative economic consequences experienced in prior periods of high tariffs. As Republican Senator Ron Johnson of Wisconsin, normally a staunch Trump supporter, recently said “I don’t quite understand the strategy, and I’m not sure anybody else does.”[7]

In an essay in 1930 (the year of Smoot-Hawley), the great economist John Maynard Keynes wrote:

“But today we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time – perhaps for a long time.”[8]

Keynes’ prescient words seem apt today. The longer the US blunders along with an ever-changing program of large tariffs, the greater the threat to the global economy and stock market. Fortunately, the April 9 announcement shows that the tariff programs can be influenced by business leaders close to the president and by investment markets. It is not too late to step back from the brink, and we should all hope that trade policies that are better for markets and the economy will prevail.

[1] Source: https://www.msn.com/en-us/politics/government/sweeping-tariffs-why-does-trump-keep-pointing-to-william-mckinley/

[1] Source for chart: Fisher Investments, Macro Insights Q1 2025

[3] Source: Torston Slok, Apollo Global Management

[4] Source: State of American Footwear Manufacturing Report [2023] – AllAmericahttps://allamerican.org/research/shoe-manufacturing-report/n.org

[5] Source: Bloomberg, EPUCNUSD and EPUCTRAD indices

[6] Source: Bloomberg, SPX, MLUXPORT, BCOMCLTR and BCOMHGTR indices

[7] Source: https://www.msn.com/en-us/politics/government/hill-republicans-worry-about-trump-s-tariffs-and-nudge-him-to-negotiate/ar-AA1CxUnt

[8] Source: https://www.economicsnetwork.ac.uk/archive/keynes_persuasion/The_Great_Slump_of_1930.htm

Disclaimer

The information and opinions contained in this presentation are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information or opinions contained herein. Atlas does not give any representation, warranty or undertaking, or accept any liability, as to the accuracy or the completeness of the information or opinions contained herein. This presentation does not constitute an offer or solicitation to any person in any jurisdiction. Any such offering will only be made in accordance with the terms and conditions set forth in a private placement memorandum or other offering document. Recipients should not rely on this material in making any future investment decision. We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Atlas and its affiliates do not assume any responsibility for the accuracy or completeness of such information. Atlas does not undertake any obligation to update the information contained herein as of any future date. Any views or opinions expressed may not reflect those of the firm as a whole. Any illustrative models or investments presented in this document are based on a number of assumptions and are presented only for the limited purpose of providing a sample illustration. Any hypothetical performance information contained herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. Any sample illustration is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Atlas’s control. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. This document may include projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. Investments are subject to risk, including the possible loss of principal. There is no guarantee that projected returns or risk assumptions will be realized or that an investment strategy will be successful. No representation, warranty or undertaking is made as to the reasonableness of the assumptions made herein or that all assumptions made herein have been stated. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable, equal to any corresponding indicated performance level(s), or be suitable for your portfolio. The information contained in this document is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date and Atlas does not undertake any obligation to update the information contained herein as of any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for background purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make its own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her/its specific portfolio or situation, it is encouraged to consult with the professional advisor of his/her/its choosing. Investment advisory and management services are provided by Atlas Capital Advisors, Inc. Atlas is registered as an investment advisor with the Securities and Exchange Commission.

What’s discussed

The tariff plans which the Trump administration announced on April 2, and has been revising since, have roiled investment markets. If a regime of much higher tariffs continues, it is likely to test the resilience of investment markets and the global economy. The main points made below about the US tariffs being considered are:

High US tariffs have been unsustainable

Tariffs as a means to protect domestic producers and raise government revenue have a history going back at least to Ancient Greece. While not all tariffs have been destructive, the general view among economists is that tariffs have a negative impact on economic growth and often disproportionately harm the country that imposes the tariff. That view is consistent with the US experience with tariffs.

William McKinley was a keen protectionist who is greatly admired by Donald Trump. When McKinley ran for president in 1896, he said, “I am a tariff man, standing on a tariff platform,”[1] words which sound familiar today. The tariff regimes under consideration by the Trump administration, both the initial April 2 plan and the plan as of April 16 with punitive tariffs on China, raises average taxes on imports to near 20%, levels that McKinley would have appreciated.[2]

As a cautionary tale for the Trump tariffs, the 20%+ tariffs of the McKinley administration proved to be unsustainable. Before being assassinated in 1901, McKinley gave a speech which recognized that the high US tariffs were limiting export markets for US producers and proposing the mutual lowering of trade barriers. The US experienced three recessions from 1899 to 1907, and tariffs were revised to lower levels in 1909.

Another notorious increase in US tariffs was the Smoot-Hawley Tariff Act of 1930. Those tariffs, which led to retaliatory tariffs by other countries, are now considered to be a grave policy error, which deepened and prolonged the Great Depression. The US unemployment rate was 8% when the bill passed, 16% a year later and 25% after two years. The S&P 500 index lost 80% of its value from the 1930 high to the low in 1932.

The political consequences of Smoot-Hawley for the Republican party were also profound. The public blamed the Republican party for its counterproductive economic policies in 1929 – 1932. Both Smoot and Hawley were defeated in the 1932 election. Thereafter, Republicans languished in the political wilderness for decades, attaining majorities in both the US House and Senate in only four of the next sixty years.

The math doesn’t work

Much has been said about the problems with the formula used by the Trump administration to derive “reciprocal” tariffs on more than 200 countries. Less discussed is the relationship between federal budget deficits and trade deficits, and how it is hard for the US to have one without the other.

Students of economics learn this formula for the relationship between federal budget deficits and the trade balance:

(SP – IP) + SG = (X – M)

Private savings less private investment (SP – IP) plus government savings (SG) equals the trade surplus, exports minus imports (X – M). If the private sector pays its own way, with private savings being close to private investment, then for the government to run a budget deficit (if SG is negative), the country must also have a trade deficit to gather savings from outside its borders. In 2024, the negative $1 trillion trade balance (X – M) helped make it possible for federal government savings (SG) to be negative $2 trillion.

The US is a net importer of goods from the rest of the world and in exchange we provide the world with US securities. At present, foreigners hold 30% of the outstanding US government debt, 30% of US corporate debt and 20% of the US stock market.[3] This arrangement has allowed the US to spend beyond its means at a reasonable cost, year after year, and promoted economic growth in both the US and our trading partners.

As the equation indicates, if the US achieves a lower trade deficit, but does not reduce government deficits by a like amount, then the adjustment would need to be higher saving or lower investment by the private sector. Neither of those adjustments would be good for US economic growth. Moreover, if the tariff regime leads to a US recession, the recession would increase US budget deficits. Should that happen, trade deficits would be needed more than ever to generate the funds for the budget deficits.

Objectives In doubt

It is doubtful that the Trump tariffs, if implemented, would generate the intended surge in US manufacturing employment. Consider shoes, for instance. Nearly every shoe sold in the United States is imported, primarily from China, Vietnam and Indonesia.[4] The April 2 announcement proposed tariffs of 34% for China, 46% for Vietnam and 32% for Indonesia. If those tariffs were implemented, US citizens would pay more for their shoes. Would it then become viable to build a shoe factory in the US?

As noted above, regimes of very high tariffs have been hard to sustain. Potential investors in US shoe factories who understand this history would reasonably judge that any competitive advantage arising from tariffs would be temporary. Eventually, the tariffs would be reduced, and the US factory would be exposed to foreign competition. That makes it much less likely that US factories for shoes, or for any other industry temporarily protected by tariffs, would be built at all.

Economic consequences

The April 2 tariff announcement caused most economists to reduce their projections of US economic growth, and increase their projections of inflation. For instance, Torston Slok, the respected economist of Apollo Global Management, estimated a -1.5% impact on US GDP growth along with a +1.5% impact on inflation.

Announcements of changes in tariffs for specific countries, products and industries are ongoing. Given that no one knows the end state for tariffs, uncertainty has soared. As of April 16, the US Economic Uncertainty Index is four times the long-term average, at levels only previously seen during the Global Financial Crisis and the COVID Crisis. The US Trade Policy Uncertainty Index is vastly higher than any level seen before – forty times the long-term average.[5]

The “soft” economic measurements of US consumer confidence and corporate outlook are deteriorating. For instance, the latest monthly reading from the University of Michigan Consumer Sentiment Survey is the second lowest of the past fifty years. But so far, the “hard” economic measurements of activity have held up.

It seems likely that the tariff uncertainty will become a deterrent to corporate hiring and investment. Moreover, the US is a consumer economy, and these tariffs will affect consumption. For instance, it is estimated that more than 70% of the non-grocery products sold at any Walmart come from China. Prohibitive tariffs on Chinese imports will make these products unavailable or less affordable, leading to negative impacts on retail sales and inflation.

Investment consequences

What comes next for investment markets is going to be heavily influenced by what comes next for tariffs. And that is anybody’s guess. But “stagflation” – declining growth with rising inflation – is about as bad as it gets for most investors. In a stagflation regime, all the mainstream asset classes suffer.

The investment market reaction between the April 2 tariff announcement and the April 9 postponement announcement showed that investors believed the tariffs would raise the probability of a global recession. In the four trading days following April 2, the S&P 500 index slumped 12%, while export-oriented US companies and economically sensitive commodities dropped even more.[6] Credit spreads jumped, reflecting increased probabilities of default on corporate loans.

Perhaps the most surprising and disturbing development was the jump in US interest rates. Typically, interest rates fall when the odds of a recession rise. But US rates began to rise sharply on April 7. Possible explanations for this include: (1) foreign holders of US treasuries selling positions in response to the tariff threat, (2) adjustments in yields to reflect likely increases in inflation, and (3) de-leveraging by hedge funds and other levered investors.

While the tariff uncertainty is unresolved, it seems likely that markets will remain volatile. Moreover, since a meaningful share of US investment assets are owned by foreigners, a tariff program which alienates the rest of the world could reduce demand by foreigners for US investment assets, raising borrowing costs and lowering US stock prices.

Summary

It does not appear that the Trump administration’s tariff plans are informed by an understanding of negative economic consequences experienced in prior periods of high tariffs. As Republican Senator Ron Johnson of Wisconsin, normally a staunch Trump supporter, recently said “I don’t quite understand the strategy, and I’m not sure anybody else does.”[7]

In an essay in 1930 (the year of Smoot-Hawley), the great economist John Maynard Keynes wrote:

Keynes’ prescient words seem apt today. The longer the US blunders along with an ever-changing program of large tariffs, the greater the threat to the global economy and stock market. Fortunately, the April 9 announcement shows that the tariff programs can be influenced by business leaders close to the president and by investment markets. It is not too late to step back from the brink, and we should all hope that trade policies that are better for markets and the economy will prevail.

[1] Source: https://www.msn.com/en-us/politics/government/sweeping-tariffs-why-does-trump-keep-pointing-to-william-mckinley/

[1] Source for chart: Fisher Investments, Macro Insights Q1 2025

[3] Source: Torston Slok, Apollo Global Management

[4] Source: State of American Footwear Manufacturing Report [2023] – AllAmericahttps://allamerican.org/research/shoe-manufacturing-report/n.org

[5] Source: Bloomberg, EPUCNUSD and EPUCTRAD indices

[6] Source: Bloomberg, SPX, MLUXPORT, BCOMCLTR and BCOMHGTR indices

[7] Source: https://www.msn.com/en-us/politics/government/hill-republicans-worry-about-trump-s-tariffs-and-nudge-him-to-negotiate/ar-AA1CxUnt

[8] Source: https://www.economicsnetwork.ac.uk/archive/keynes_persuasion/The_Great_Slump_of_1930.htm

Disclaimer

The information and opinions contained in this presentation are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information or opinions contained herein. Atlas does not give any representation, warranty or undertaking, or accept any liability, as to the accuracy or the completeness of the information or opinions contained herein. This presentation does not constitute an offer or solicitation to any person in any jurisdiction. Any such offering will only be made in accordance with the terms and conditions set forth in a private placement memorandum or other offering document. Recipients should not rely on this material in making any future investment decision. We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Atlas and its affiliates do not assume any responsibility for the accuracy or completeness of such information. Atlas does not undertake any obligation to update the information contained herein as of any future date. Any views or opinions expressed may not reflect those of the firm as a whole. Any illustrative models or investments presented in this document are based on a number of assumptions and are presented only for the limited purpose of providing a sample illustration. Any hypothetical performance information contained herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. Any sample illustration is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Atlas’s control. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. This document may include projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. Investments are subject to risk, including the possible loss of principal. There is no guarantee that projected returns or risk assumptions will be realized or that an investment strategy will be successful. No representation, warranty or undertaking is made as to the reasonableness of the assumptions made herein or that all assumptions made herein have been stated. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable, equal to any corresponding indicated performance level(s), or be suitable for your portfolio. The information contained in this document is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date and Atlas does not undertake any obligation to update the information contained herein as of any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for background purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make its own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her/its specific portfolio or situation, it is encouraged to consult with the professional advisor of his/her/its choosing. Investment advisory and management services are provided by Atlas Capital Advisors, Inc. Atlas is registered as an investment advisor with the Securities and Exchange Commission.

Share to Social Media!

Subscribe To Receive The Latest News

Related Posts

Inflation risks are back on the radar

The implications of concentration on the future of the S&P 500

Credit spreads and the stock market

Should you sell your stocks?