Alternative Investment Reality Check Part 4

What’s Discussed

This paper on private real estate investing is the fourth of a series on alternative investments.[1] The alternatives industry is making a concerted effort to gather more assets from individuals due to declining appetite from institutional investors. The purpose of the series is to help individual investors recognize the drawbacks of alternative investments before plunging in. If you are considering private real estate for your portfolio, you should be aware of the following issues:

- Even as reported, private real estate returns have not been better than the outcomes of similar equity REIT[2] portfolios.

- The high fee burden, particularly for funds of funds, detracts from private real estate outcomes.

- The volatility of private real estate and the correlation to public equities are much higher than believed.

- Private real estate faces similar challenges as the other alternatives asset classes, with a plunge in fundraising and deal activity.

- Success in private real estate investment requires organizational capabilities and access that, for the most part, are not available to individuals or their representatives and advisors.

Why Private Real Estate?

The apparent advantages of investing in private real estate include:

- A greater opportunity set. More than 90% of US commercial real estate is privately owned.

- Greater flexibility. A private real estate operator has more flexibility in managing investments and cash flow than a REIT operator.

- Perception of “illiquidity premium.” It is generally believed that illiquid investments inherently offer an “illiquidity premium,” and therefore on average the returns for illiquid investments will be better than liquid investments.

- Perception of low volatility and correlation. The reported returns of private real estate appear to have low volatility and low correlation to other investment types.

However, as discussed below, the perceived advantages 1, 2 and 3 on this list have not led to better investment outcomes and advantage 4 is illusory.

Returns as Reported Can Be Misleading

Private real estate performance can be challenging to decipher, with reported returns generally skewed upwards. Reported investment results are based on the Internal Rate of Return (IRR), a deeply flawed metric which typically exaggerates true performance. Valuations, as reported by the private real estate firms, can flatter performance as well, particularly when real estate prices are under pressure.

Returns Lower Than REITs

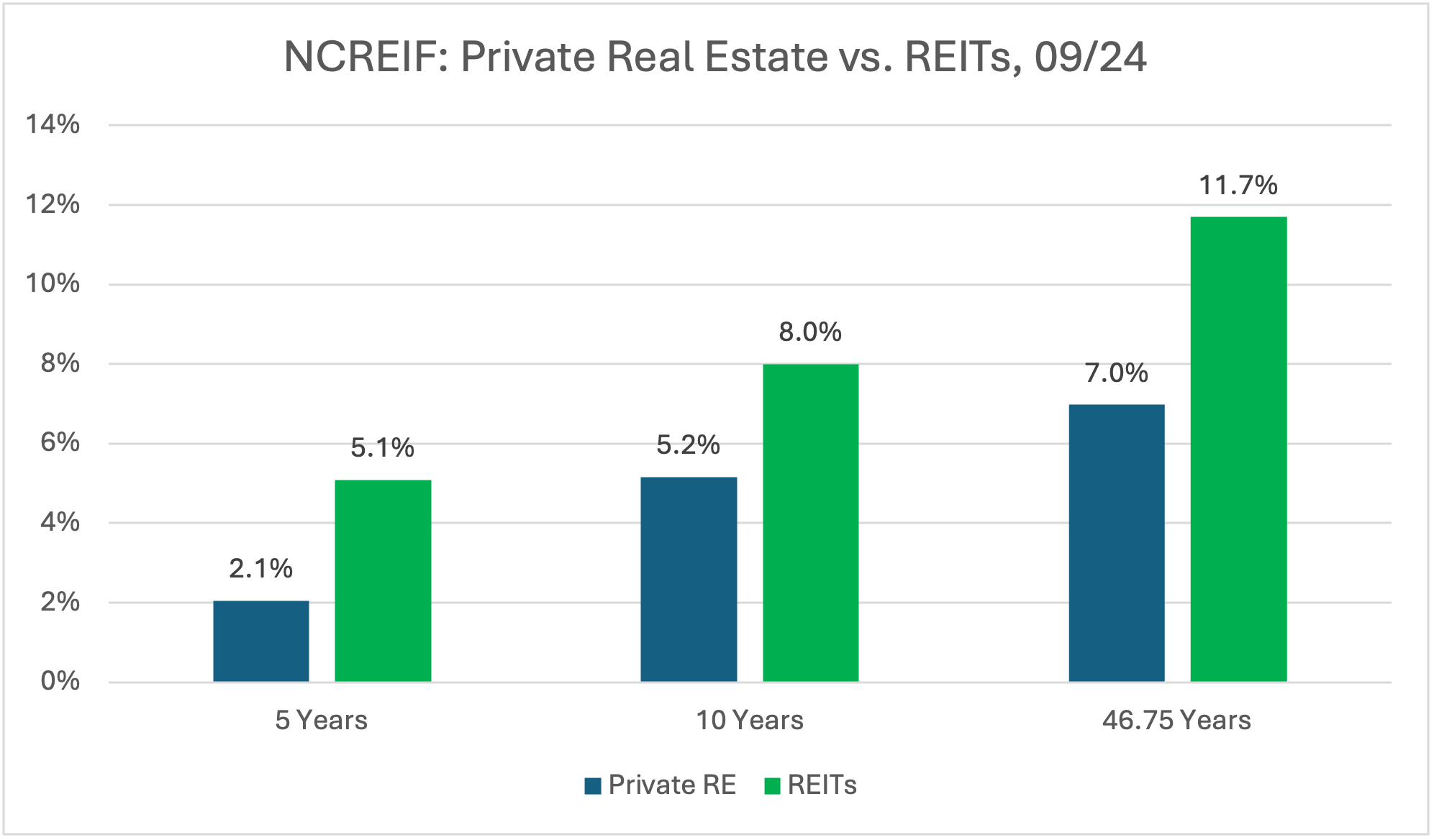

Even as reported, private real estate fund returns have lagged the returns of REITs. NCREIF (National Council of Real Estate Investment Fiduciaries) maintains an extensive database of historical returns of private real estate and of REITs. The following chart compares the performance of the NCREIF OCDE[3] private real estate index to equity REITs. REITs have trounced the private real estate funds over all trailing periods, including the full 46.75 years since the inception of these indices.

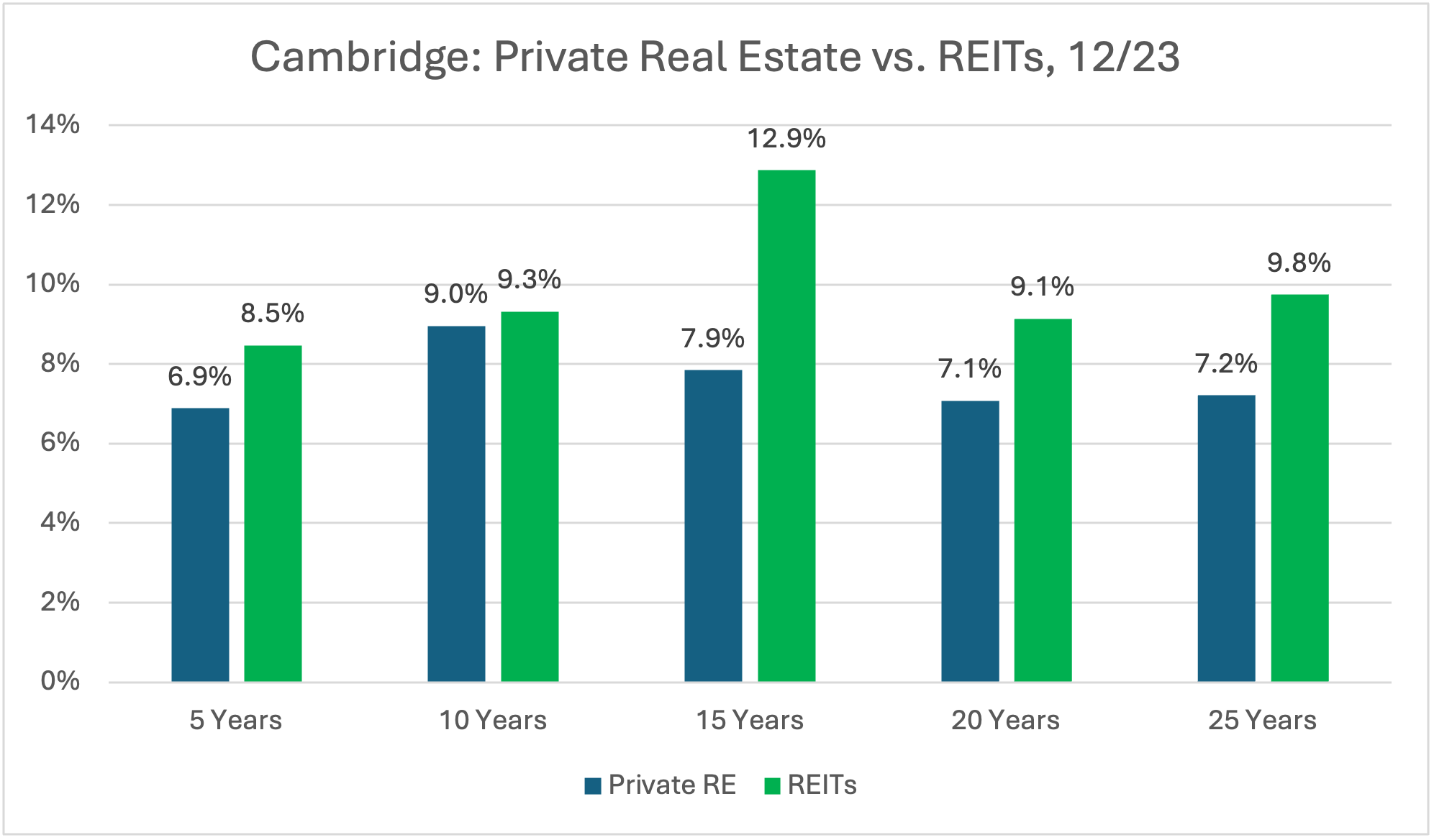

The investment consulting firm Cambridge Associates also maintains a long history of the performance of private real estate funds versus REITs. Their data reaches the same conclusion: REITs have been the better investment over all trailing time periods. [4]

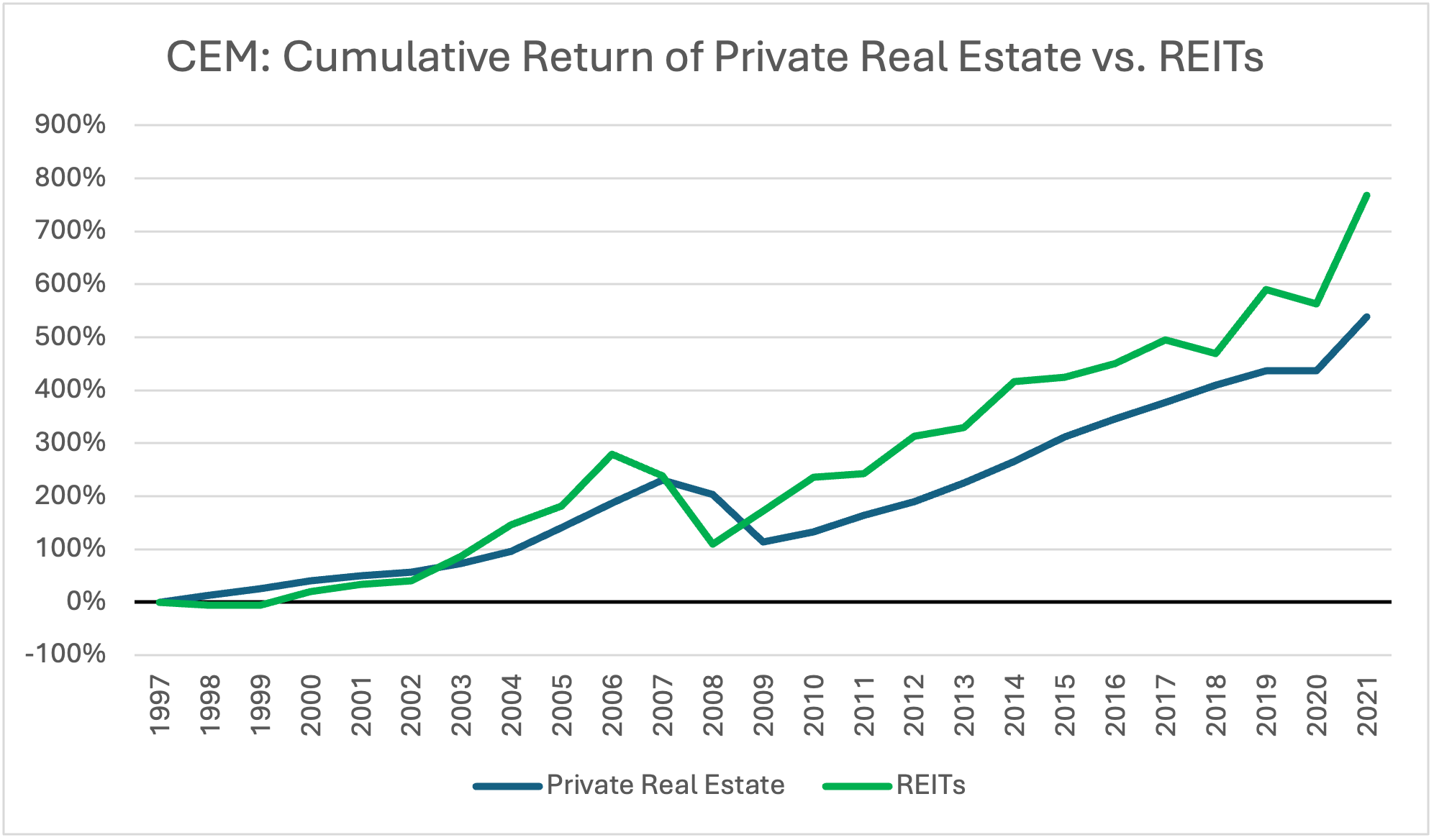

CEM Benchmarking compared the private real estate versus listed real estate returns in US pension fund portfolios over the period 1998 to 2021.[5] Over this 24-year period REITs returned 9.4% per year, versus 8.0% for private real estate.

Correlations and Volatility Higher Than Believed

Since private real estate returns are reported with smoothing and a lag, it can appear that the asset class has low volatility and attractive diversification characteristics. As an example of reaching the wrong conclusion, the Q3 2024 “Guide to Alternatives” from JP Morgan Asset Management indicates that private real estate has recently had a negative correlation to the S&P 500.[6] Unfortunately, that correlation calculation is quite misleading.

Reported private real estate returns were positive in 2022, when stocks went down, and negative in 2023, when stocks went up, so it looks like the correlation between the asset classes has been negative. But that is an artifact of the lagged recognition of true market values by private real estate fund managers. Private real estate fund managers did not mark down the value of their holdings in 2022 (as they should have, since REIT values were plunging as interest rates jumped) and finally started to reflect some of those 2022 losses in 2023 (when REIT values had already started to recover).

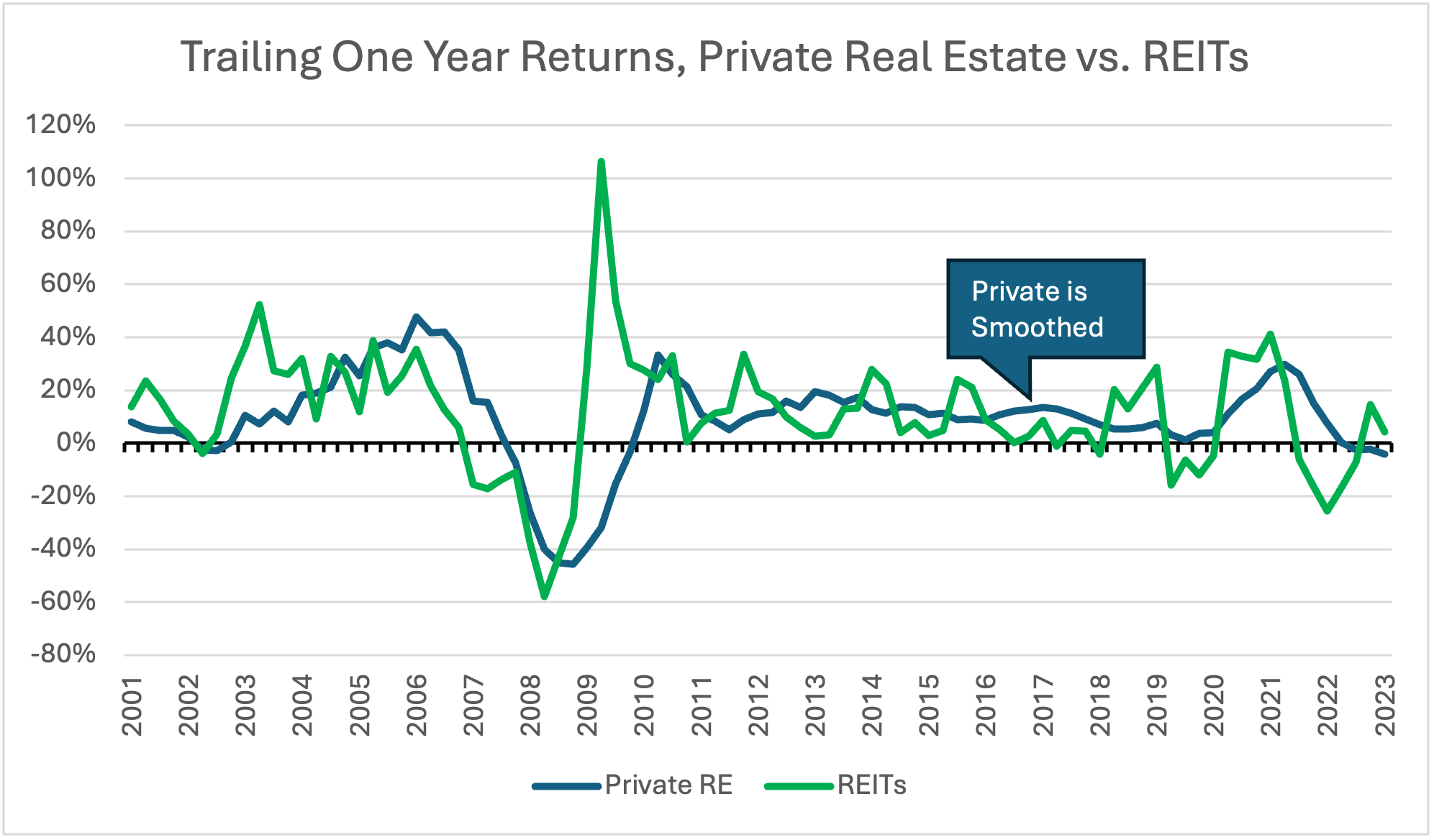

The chart below shows trailing one year returns for REITs and private real estate.[7] It is evident that private real estate returns eventually align with the REIT returns, with a lag. The chart also shows that reported returns of private real estate have been less volatile than the reported returns of REITs. That volatility is not representative of the actual volatility of the underlying assets.

For the past 20 years, the correlation between the returns of REITs and the S&P 500 has been 0.76. Moreover, the volatility of the REIT index has been about 50% higher than the volatility of the US stock market. These metrics are much more indicative of the true volatility and risk of private real estate investing than the returns as reported by the fund managers.

Manager Fees Impact Performance

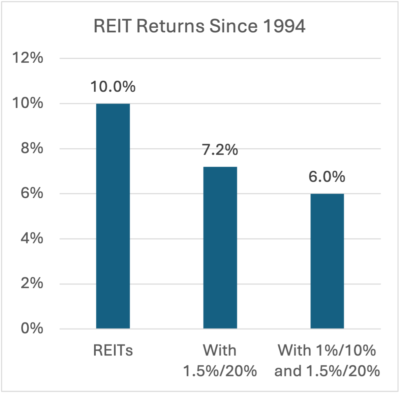

High fees are the most important explanation for the disappointing performance of private real estate funds relative to REITs. A private real estate partnership might charge a fee of 1.5% of assets invested plus 20% of the investment income. As the chart indicates, if a 1.5%/20% fee structure had been applied to the 10% annual return of REITs since 1994 the net of fee return would fall to 7.2% per year. That 2.8% gap is fairly close to the 25-year REIT return advantage as reported by Cambridge Associates.

Often an individual investor in private real estate will invest via a “fund of funds” vehicle. Relative to selecting managers one at a time, a fund of funds can provide better diversification across managers and vintage years. The drawback is that the manager of the fund of funds will charge their own fees on top of the fees already being collected by the underlying private real estate managers. These fees can be as high as 1%/10%. The chart illustrates how the return of the REIT Index since 1994 would have been impacted if 1%/10% fees were paid to the fund of funds manager in addition to 1.5%/20% to the real estate fund managers. An investor in REITS who paid both layers of fees would have paid 40% of their investment return in fees, ending up with 6%/year instead of 10%.

Private Real Estate Has Challenges

At present, private real estate shares the challenges faced by private equity. Extraordinarily low interest rates inflated property values in 2021 (and private equity valuations). Like private equity fund managers, real estate fund managers have been reluctant to mark down asset values to reflect the current reality or sell assets for what they are currently worth. Deal activity is falling considerably. According to McKinsey & Company, in 2023 there was the largest net outflow from private real estate of any year on record.[8] Global deal volume in 2023 was the lowest in ten years, about half what it was in 2022.

Who Should Invest in Private Real Estate?

There is significant dispersion in outcomes from private real estate investing. Investors with the best chance to benefit from private real estate funds are institutions that have experienced specialists to identify the best funds and who are perceived as being a desirable limited partner.

Well-resourced and sophisticated institutional investors such as the large university endowment funds have had the means to participate successfully as private real estate investors. Such an investor will have direct access to the manager, visit the manager’s premises frequently, and spend many months undertaking an in-depth analysis of the people, investment strategy, prior performance, and business operations of a private real estate manager before making a choice to invest. If your private real estate manager selection process is done with this exceptional level of resources, access, and diligence, you might have reason to participate. Otherwise, there is a good chance of ending up with an average private real estate fund portfolio or worse, with the drawbacks discussed here.

Summary

Private real estate investment provides exposure to an asset category which may also be accessed through REITs. On average, REITs have had much better net investment returns than private real estate, in addition to superior liquidity and transparency. David Swenson, the masterful Chief Investment Officer of the Yale University endowment, long argued that for individual investors, the emphasis should be on well-constructed portfolios of liquid asset classes at the lowest possible implementation cost. We support this approach wholeheartedly. As discussed in this paper, the average outcomes obtained by private real estate investors are disappointing, and individuals are more likely to succeed as real estate investors if they invest in REITs instead.

Explore the Full Alternative Investments Reality Check Series

In case you missed our earlier posts, we’ve been diving into the nuances of alternative investments, particularly as private equity, venture capital, and hedge funds increasingly look to individual investors to bolster their capital amid waning interest from institutions. This series—featuring topics on Private Equity Investing, Venture Capital Investing: Good Ideas, Disappointing Returns, and 7 Reasons Why Individual Investors Should Avoid Hedge Funds —is designed to help you weigh the potential drawbacks before making any commitments. Each post unpacks the realities and risks of these high-profile investment options, offering a grounded perspective to help you make informed choices in the world of alternatives.

[1] See our recent commentaries about alternative investments and additional research on alternatives at https://ocio.atlasca.com.

[2] An equity REIT (Real Estate Investment Trust) is a public company traded on a stock exchange which owns or operates income-producing real estate for the purpose of providing dividend income to the shareholders.

[3] Source: NCREIF. September 30, 2024. “NFI-ODCE Preliminary Snapshot Report.” ODCE (Open-End Diversified Core Equity) is an index of open-ended private real estate funds, often used as a benchmark. Results reflect the fund managers positions and financing strategy. NAREIT All Equity REIT Index is a capitalization weighted index reflecting all tax-qualified REITs listed on NYSE, AMEX and NASDAQ.

[4] Source: Cambridge Associates. December 31, 2024. “Real Estate Index and Selected Benchmark Statistics.”

[5] Source: Beath, A., Flynn, C. December 2022. “Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States.”

[6] Source: JP Morgan Asset Management. 3Q 2024. “Guide to Alternatives.”

[7] Source: PitchBook. H1 2024. “Global Real Estate Report.”

[8] Source: McKinsey & Company. March 28, 2024. “McKinsey Global Private Markets Review 2024: Private markets in a slower era.”

Disclaimer

The information and opinions contained in this presentation are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information or opinions contained herein. Atlas does not give any representation, warranty or undertaking, or accept any liability, as to the accuracy or the completeness of the information or opinions contained herein. This presentation does not constitute an offer or solicitation to any person in any jurisdiction. Any such offering will only be made in accordance with the terms and conditions set forth in a private placement memorandum or other offering document. Recipients should not rely on this material in making any future investment decision. We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Atlas and its affiliates do not assume any responsibility for the accuracy or completeness of such information. Atlas does not undertake any obligation to update the information contained herein as of any future date. Any views or opinions expressed may not reflect those of the firm as a whole. Any illustrative models or investments presented in this document are based on a number of assumptions and are presented only for the limited purpose of providing a sample illustration. Any hypothetical performance information contained herein does not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model. Any sample illustration is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Atlas’s control. One of the limitations of hypothetical performance results is that they are prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. This document may include projections or other forward-looking statements regarding future events, targets, intentions or expectations. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is no guarantee of future results. Investments are subject to risk, including the possible loss of principal. There is no guarantee that projected returns or risk assumptions will be realized or that an investment strategy will be successful. No representation, warranty or undertaking is made as to the reasonableness of the assumptions made herein or that all assumptions made herein have been stated. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. The information contained in this document is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date and Atlas does not undertake any obligation to update the information contained herein as of any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for background purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make its own evaluation of the information described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her/its specific portfolio or situation, it is encouraged to consult with the professional advisor of his/her/its choosing. Investment advisory and management services are provided by Atlas Capital Advisors, Inc. Atlas is registered as an investment advisor with the Securities and Exchange Commission.