In 1997, Mark Carhart expanded on the Fama-French three-factor model by adding momentum as a fourth factor. Stock momentum is the empirically observed phenomenon that a stock that has performed well recently will continue to perform well, and a stock that has performed poorly will continue to perform poorly. Behaviorally, people tend to become increasingly optimistic about stocks that have consistently appreciated. Similarly, a stock that continues to plummet tends to cause investors to become more averse to it, resulting in a self-reinforcing downward spiral. Momentum signals are transient – outperformance eventually turns to underperformance. But momentum is still a valuable indicator, especially when used in conjunction with factors.

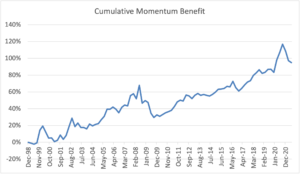

As an example of the potential benefit of Momentum investing, the chart shows the cumulative difference in return between the MSCI ACWI momentum index and the MSCI ACWI (capitalization-weighted) index.

Investors in the momentum index would have earned about double the total return of the capitalization-weighted index in the period from December 1998 to June 2021. Moreover, since 2010, which has been a poor period for Value investing, it has been a strong period for Momentum, indicating the benefit of combining factors.

Source: Bloomberg, M1WD000$ Index for ACWI (All-Country World Index, an index of global equities) momentum and NDUEACWF for ACWI cap-weighted. The ratio of the cumulative return of ACWI momentum to the cumulative return of ACWI capitalization-weighted.