A provision within the 2017 Tax Cuts and Job Act (TCJA) created incentive to invest in special low income geographic districts known as Opportunity Zones. Investments made through designated funds created specifically for economic development of these zones allow for the deferment and potential elimination of capital gains taxes. Key components of the provision are:

- Investors must invest through Qualified Opportunity Funds that purchase and improve real estate and business located within a designated Opportunity Zone.

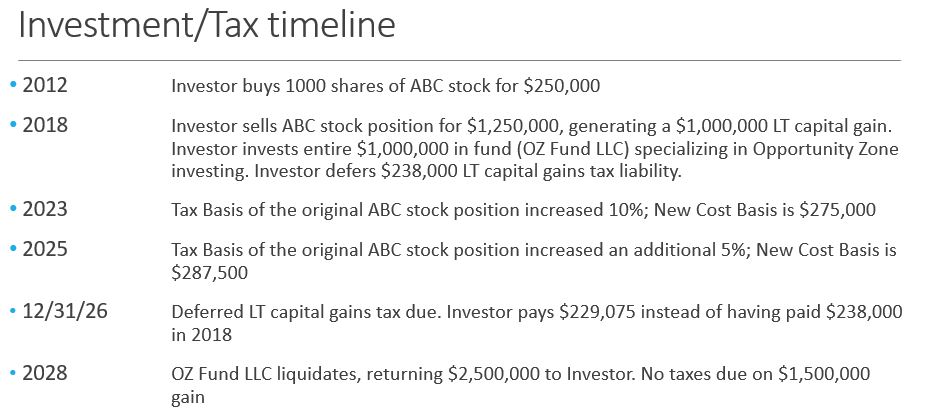

- Investors can reinvest, within 180 days of recognizing capital gains on existing investments, into a Qualified Opportunity Fund thereby deferring and, potentially, reducing taxes on those capital gains.

- Investors can defer capital gains tax on capital invested in the Qualified Opportunity Fund until the earlier of the date the fund investment is sold or December 31, 2026

- After the investment in the Qualified Opportunity Fund is held for 5 years, the tax basis on the original investment is increased by 10%. If held for 7 years, the tax basis is increased an additional 5%.

- If the investor holds the Qualified Opportunity Fund investment for 10 years, the basis can be written up to Fair Market Value, effectively eliminating capital gains if sold.

Here’s an example of how the provision is designed to work:

An individual simply buying real estate within a US Treasury designated Opportunity Zone does not qualify for the tax benefit; investment must be made through a Qualified Opportunity Fund. Investors should consult with their tax accountant prior to making such investment. Additionally, Treasury and the IRS each have resources available to assist those interested in taking advantage of this TCJA provision